Falling Profits for Australian Life Insurers

Jennifer Lang is Chief Actuary at NAB Wealth. The views expressed in this article are her own personal views, and do not necessarily reflect the views of her employer. This article was originally published in her blog, actuarial eye; www.actuarialeye.com.

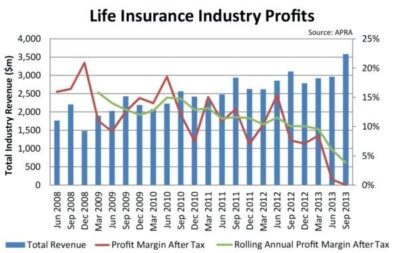

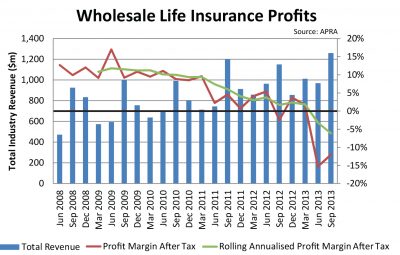

The life insurance industry has had a particularly poor few years, particularly in the disability classes of business. Recent reports from Swiss Re and Munich Re – two of Australia’s major life reinsurers – have continued the bad news. More recently, APRA released their quarterly statistics for the quarter ending September 2013, and commented on them in their quarterly update. Overall, the life insurance risk part of the life insurance industry has made 4% profit after tax, as a percentage of revenue, in the 12 months to September 2013. Group Insurance, which generally insures corporate and industry superannuation funds, made a 6% loss after tax, over the same 12 months, as a percentage of revenue.

The life insurance industry is not making sustainable profits, and the news seems to be getting worse not better, as insurer after insurer strengthens their reserves.

This hasn’t gone unnoticed in the actuarial profession, with much of the life insurance part of the recent risk and regulation seminar discussing the sustainability of the industry, and a whole Insights session recently devoted to Group Insurance. The slides are worth reading in their entirety. The Insights session pointed out that there are a number of different issues affecting the group market at the same time.

The average insurance product within the group market as a whole has gradually made the definitions of disability less stringent at the same time as making it easier to qualify for insurance with little or no underwriting. Members have become increasingly aware that they have insurance, which is often driven by increased benefits. Lawyers have become more involved, as the benefits have become higher, and higher unemployment in some areas of the economy makes it much harder for disabled people to return to work.

Another speaker in the Insights session pointed to the major reduction in capacity affecting the group market: in 2011, five to six insurers participated in tenders; in 2013, for medium or large plans, two to three insurers were often participating.

Anyone who has been involved in long tail classes will recognise some of the symptoms of a classic insurance cycle. As profits increase, insurers relax terms and conditions and reduce prices. Then as claims start coming in, insurers realise they have given too much away, and tighten terms and conditions, increasing prices and reducing capacity. In my view, one of the major preconditions for the creation of insurance cycles is that there needs to be a reasonably long tail between the incidence of the claim and the payment, so that insurers cannot be definitive about the cost or profitability of the insurance cover they are selling for several years. That creates a feedback loop that takes some time to work its way through the system.

So what is the answer? Back in 2006, Lloyd’s recommended seven steps for managing insurance cycles.

1. DON’T FOLLOW THE HERD

Insurers need to be prepared to walk away from markets when prices fall below a prudent, risk-based premium.

2. INVEST IN THE LATEST RISK MANAGEMENT TOOLS

Insurers must push for continuous improvement of these tools based on the latest science around issues such as climate change, and make full use of them to communicate their pricing and coverage decisions.

3. DON’T LET SURPLUS CAPITAL DICTATE YOUR UNDERWRITING

An excess of capital available for underwriting can easily push an insurer to deploy the capital in unsustainable ways, rather than having that capital migrate to other uses such as hedge funds and equities, or returning it to shareholders.

4. DON’T BE DAZZLED BY HIGHER INVESTMENT RETURNS

Don’t let higher investment returns replace disciplined underwriting as base rates creep up on both sides of the Atlantic. Notionally, splitting the business into insurance and asset management operations, and monitoring each separately, is one way to achieve this.

5. DON’T RELY ON ‘THE BIG ONE’ TO PUSH PRICES UPWARDS

The spectacular insured loss should not be used as an excuse to raise prices in unrelated lines of business. Regulators, rating agencies, and analysts – not to mention insurance buyers – are increasingly resisting such behaviour.

6. REDEPLOY CAPITAL FROM LINES WHERE MARGINS ARE UNSUSTAINABLE

There is little that individual insurers can do to alter overall supply-and-demand conditions. But insurers can set up internal monitoring systems to ensure that they scale back in lines in which margins have become unsustainable and migrate to other lines.

7. GET SMARTER WITH UNDERWRITER AND MANAGER INCENTIVES

Incentives for key staff should be structured to reward efficient deployment of capital, linking such rewards to target shareholder returns rather than volume growth.

In some ways, none of the suggestions above are anything other than recommendations for sensible management. At their heart, these are recommendations to analyse risk carefully, price for it, make sure all of your internal incentives encourage sensible behaviour, and do as much as you can to set up a contract that pays out in the event of genuine loss. There isn’t a magic bullet that will create profitability. Each lever of profitability is important, and they all need to be used appropriately. Sometimes it is good to take a step back, in the midst of continuing bad news, and look at the fundamentals.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.