Never Smile at a Crocodile – The Group Risk Story

Peter Pan, for those of us who remember or have watched the movie with our kids, opens with the line: “All of this has happened before and all of it will happen again.” You couldn’t script the Australian Group Risk story any better.

Around the middle of 2013, the Life Industry had a surprise visit at the window, one night, as we started to notice a worsening trend in our Total and Permanent Disability (TPD) portfolios. More than AUD$1 billion of reserve strengthening across the industry later, and the effective shutting down of reinsurance capacity for larger superannuation schemes, the market is beginning to learn to fly again, with some hard lessons learned and more clarity on how to move forward.

WHO IS HOOK?

Every consultant will have a different view on the cause, but to understand the drivers that led to this situation, we should reflect on the market three to five years ago when intense competition, excess capacity and new business sales incentives all contributed to very soft market conditions. Default cover was introduced and later increased as prices kept falling, underwriting controls were gradually relaxed and available data allowed actuaries to conclude that rates were sustainable. Very little attention was paid to the operational controls, opportunities for anti-selection, strength of claims definitions, potential trends or the levels of consumer awareness inherent in the system.

SO WHAT CAUSED THE BLOWOUT?

In my opinion, one of the key drivers of the market experience shift related to the levels of inertia or lack of awareness priced into the rates. There was an implicit assumption that not every member was aware of their cover given that Superannuation is compulsory, and for many members, the retirement savings component was the main focus. Over an eight year period, the levels of advertising spend, member communication and market noise around insurance benefits radically shifted. For example, ASIC reported in 2005 that there were only 23 Industry Fund TV advertisements over a 16 month period1. Today, you might see that many TV adverts in a few days. The GFC also encouraged Funds to focus on the good news story around insurance within Super, as opposed to poor performing investment returns.

Contributing to this awareness, plaintiff lawyers have become more prevalent, in part due to a change in workers compensation legislation, driving these lawyers to expand their business model to target life insurance. In 2013, nearly 40% of claims involved a lawyer2 (including nearly all long tail claims). Arguably, these lawyers provide a service that the industry doesn’t need but that can impact the outcome of a claim.

One of the key drivers of the market experience shift related to the levels of inertia or lack of awareness priced into the rates.

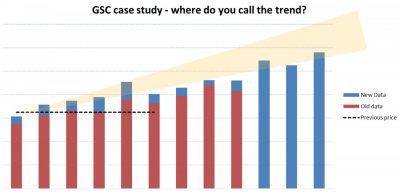

Equally, actuaries aren’t directly to blame for getting the pricing wrong. Of some small measure of comfort, when global colleagues attempted to re-price the historical renewals based on the data available at the time, they drew similar conclusions around setting the price at the levels suggested by the local actuaries. Very few would have seen this trend coming from the data alone. In hindsight, more time should have been spent on considering the trends and scenarios where money could be lost, along with how risk management could feed into the ultimate terms offered.

Finally, as the market softened, rather than pass on price discounts to members, the default sum assured levels increased instead, further contributing to the real villain of awareness being higher than expected.

TINKERBELL HAS ALL THIS MAGIC BUT JUST ISN’T VALUED BY PETER

It’s easy to overlook this, but for the actuaries that were involved, it’s been an emotional rollercoaster. The inevitable cycle quickly took shape once the first rein

surance numbers came out – disbelief at first, then disagreement that the numbers were correct, then fear, acceptance, and finally, action. When you can’t pinpoint the exact problem, it’s very challenging to address only the key issues rather than change the whole model. Even focusing on the main driver, it’s been an impossible call to make about whether there is more awareness to come that still needs to be factored into pricing (noting this affects TPD and GSC benefits).

The GFC encouraged Funds to focus on the good news story around insurance within Super, as opposed to poor performing investment returns.

The other byproduct of this journey relates to the potential for lack of confidence to creep into the actuaries’ mindset. Along with the underwriters, risk managers and management, there may be a tendency to lurch so far to the conservative end of the spectrum that this could impose a significant short-term cost on members and reduce the industry’s aim of closing the protection gap. In Peter Pan, Hook continually remained fearful that the crocodile was coming back for the rest of him.

THE CLOCK INSIDE THE CROCODILE IS TICKING

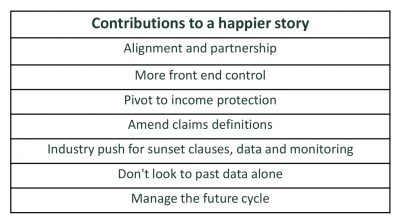

We don’t have to change everything to move forward but rather focus on those areas that are critical to ensuring the long-term sustainability of this segment of the market.

1. THE LOST BOYS WALKING TOGETHER IN UNISON

In the past, high reinsurance commissions buffered insurer results and funds not having any stake in the experience outcomes led to the situations whereby insurance became a purely transactional purchase at the lowest possible cost.

Reinsurers, insurers, funds and other suppliers in the value chain should be strongly aligned in the member outcomes. This principle leads to structures whereby reinsurers and insurers lose money at approximately the same point, funds take some risk and third party providers are strongly aligned in the delivery of better quality data and timeliness of that provision. It also changes the way we might all work together – closer engagement by all parties to develop the proposition and more exclusivity arrangements to ensure complete transparency between the parties. This latter part, like Wendy walking the plank, will require a good dose of trust.

2. HOOK NEEDS A HAND

Years of the softening cycle led to relaxation of the product design controls, many of which had unintended consequences.

It’s hard to argue the case for a product that offers more than $1 million cover for disability with no underwriting; no aggregate cover limitations, so you can buy more than one policy; pays a big lump sum for disability, which is an all or nothing decision; and ignores high risk occupations or sets of claims definitions that are open to lawyer or doctor abuse.

It might feel like it’s all broken, but at the heart of amending the design, only a few key principles need to be considered:

– More front end control: This includes reducing automatic acceptance levels; addressing the disproportionate incentives given the fixed cover levels for part time workers or high risk occupations; and removing the ability to increase cover without some form of underwriting or pre-existing condition clause.

– Consider more efficient delivery mechanisms for TPD: Here we should explore shifting the lump sum mentality into more of an income based approach. This has multiple benefits including encouraging members to engage with

the insurer around rehabilitation; limiting plaintiff lawyer involvement; and ensuring a better member experience away from an all or nothing decision.

– Changing claims definitions: A more robust definition for both TPD and Income Protection (IP) is needed. The aim here is to ensure that the right members benefit where disability cover is required and subjectivities are removed as far as possible. Encouraging retraining is a core goal in helping members back to work rather than staying on benefits.

One approach is to go back to the basics of writing insurance cover. In one investigation into the drivers of experience, around 20% of claimants were found to have had some form of pre-existing condition prior to taking up cover. Surely this was never the intention around the design of group risk covers.

3. THE PROBLEMS WITH NEVERLAND

While product and mindset are largely in our control, there remain a few industry challenges which require significant momentum.

Better quality data should be a non-negotiable requirement for all actuaries. While it is expected to take time to work through the system, and supported strongly by APRA, Super funds should see data as an opportunity for competitive advantage.

The impact of plaintiff lawyers should be managed to ensure that member benefits aren’t unnecessarily eroded. The Super funds are, perhaps, in the best position to provide this service to members, but shifting product design to an income stream or making the policy terms and claims process easier to understand for members will equally reduce the unnecessary cost of these lawyers in the system. A big push for a change to the Insurance Act around introducing a sunset clause for notification of claims will add some measure of pricing certainty for actuaries around the length of a claim’s tail.

Lastly, the industry joining together to manage the opportunity for multiple covers across a number of funds (aggregation of covers) is an area needing change. There appears to be strong commitment to an industry-wide database being set up that allows monitoring of these multiple covers, so a continued push to deliver on this model is gathering momentum.

4. HOOK WAS ONCE A BOY, TOO

One clear lesson from the past 12 months relates to the fact that these events have happened before, but corporate memory is always short. From a reinsurer’s point of view, and being honest about where we’ve got it wrong, the soft cycle was not managed very well – increasing cession rates, falling price, weakening of entry controls and introducing new benefits should have all set off a ticking clock in hindsight. The Group Risk model will reset but ensuring that the cycle is managed five to 10 years from now remains one of the biggest challenges to avoid déjà vu.

Addressing this through initiatives, such as the requirement for a Chief Risk Officer to exist; setting up committees to monitor trends and early warning signs; sharing information between stakeholders (and generations); and defining the walk away position in advance of a tender, are perhaps some of the ways that we can ensure we don’t forget the timeless story.

5. ONLY CHILDREN CAN SEE A FAIRY

We should, lastly, also consider areas that we can’t obviously see coming. This ranges from legislative changes in other markets that might impact insurance (workers compensation and auto-consolidation being two known examples) all the way through to the broader impact of the economy (unemployment or interest rates) on disability experience. Not looking at past experience as a guide to the future (one of our biggest lessons around the inertia implied in historic data) has perhaps never been so true.

To conclude, it’s an unprecedented time in our industry, perhaps even a once-in-a-career set of circumstances to learn and grow. The changes expected over the next few years will take a collective effort from all the stakeholders in the market and it is an exciting opportunity for all of us to work closer together to deliver a better proposition for Super fund members.

There are no quick fixes, but we all need to maintain our perspective and not forget to enjoy working through this challenging time. With a sprinkle of fairy dust and a bit of faith, we’ll have a better ending.

It’s an unprecedented time in our industry, perhaps even a once-in-a-career set of circumstances to learn and grow.the changes expected over the next few years will take a collective effort from all the stakeholders in the market and it is an exciting opportunity for all of us.

1 ASIC Report – Monitoring advertising in Super 2004-2005

2 Swiss Re Life and Health claims research 2014

Ilan Leas is a Director at Swiss Re Life & Health Australia and New Zealand.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.