Bitcoins, Banking and the Blockchain

Throughout history, money has taken on many different forms, such as gold and other precious metals, salt, cattle, slaves, cocoa beans, alcohol, cigarettes, coins, paper notes, and certificates of deposit. Money derives its value purely from the confidence and trust that everyone else places in it. The recent innovation of bitcoins has pushed the boundaries by allowing money to evolve into the ethereal form of digital 0s and 1s.

At a recent Sydney Financial Mathematics Workshop, Sean Carmody (Head of Credit Risk at Westpac) delivered a seminar on the history, mechanics and implications of bitcoin technology on the banking industry and society.

Why bitcoins?

Ever since the internet has formed a global marketplace, the desire for a universal decentralised currency arose to facilitate international payments, reduce transaction costs and provide anonymity and privacy. But the simple idea of digital money, free from the control of governments and printing-press-happy central bankers, requires a mechanism to stop fraudsters from counterfeiting or “double-spending” the currency, which might appear to be as easily duplicated as movies and music are pirated online. Early efforts in the 1990s, such as Ecash, bit gold and b-money, failed because they depended on the existing infrastructures of banks and credit card companies.[1]

The eureka moment came on 31 October 2008 when a mysterious person(s) known as Satoshi Nakamoto published an ingenious system that proposed a Peer-to-Peer network to maintain the “blockchain” which is a publicly distributed encrypted ledger of every bitcoin transaction.[2] Such a system would no longer rely on a centralised authority to verify each transaction, but instead uses innovative cryptographic protocols to protect both the integrity of the currency and the anonymity of every party. Strangely enough, the true identity of the inventor is yet to be uncovered, but many have speculated it may be Julian Assange or even possibly a team of researchers at Google or the National Security Agency. [3]

The aftermath of the 2007/08 Global Financial Crisis catalysed a libertarian movement which lost faith in Wall Street bankers and politicians to rescue the banking system with “quantitative easing”, essentially printing money to jump-start the economy. Nakamoto argued that “The root problem with conventional currency is all the trust that’s required to make it work. The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

How does it work?

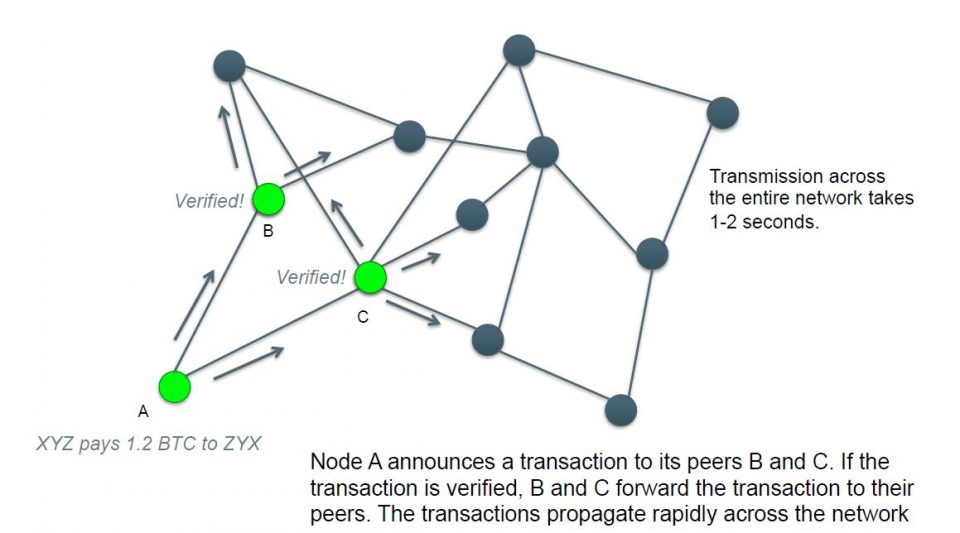

Bitcoins are stored in virtual wallets, which are protected with a private key known only to the owner. Transactions allow bitcoins to be transferred from one wallet to another (e.g. “payer X sends Y bitcoins to payee Z”), which are validated and broadcast into the network. Bitcoin miners bundle transactions into blocks through a computational brute force process, rewarding the lucky miner with newly created bitcoins, which acts as an incentive to support the network. The chronological history of all blocks is linked together into the blockchain (currently over 30GB and growing). Figure 1 provides an illustration of the bitcoin payment process.

The very first block of 50 bitcoins, known as the genesis block, was mined by Nakatomo himself on 3 January 2009, in which he permanently embedded the Times of London newspaper headline “Chancellor on brink of a second bailout for banks”[4]. The supply of bitcoins has been designed to increase steadily at 25 bitcoins per block mined (about every 10 minutes), then halving to 12.5 bitcoins per block and so on halving every 4 years. This will continue until the ultimate limit of 21 million bitcoins is reached by 2140 and miners will be rewarded for their computationally intensive record keeping services solely through transaction fees.

Figure 1: Operation of the P2P network in keeping the blockchain up to date with the latest transactions

Bitcoins are able to be transferred in almost any amount, with one bitcoin able to be divided into 100 million satoshis, the smallest unit. As at April 2015, there are 14 million bitcoins in circulation worth about $US3.6 billion, with increasingly formidable computing power needed to stand any chance at mining new bitcoins. Proponents argue that such a fixed money supply will eliminate inflation and provide a competitive alternative to the typical 2-3% credit card payment processing fees.[5]

Why does it work?

The bitcoin scheme is based on the mathematics of public key cryptography, a pioneering invention from the 1970s, which allows two parties to communicate securely over an insecure channel, allowing for the fact that a malicious eavesdropper may intercept and deliberately alter messages to mislead either party. This technology is critical to the functioning of e-commerce and the secure operation of the internet. Such a cryptographic scheme requires a pair of mathematically linked keys for each user: a public key published for everyone to see and a private key to keep secret, analogous to a padlock and key, which are used together for:

- Confidentiality through encryption / decryption (to stop an eavesdropper from reading your messages) and

- Authentication with a digital signature (to prove that the messages actually come from the sender)

Security is ensured through the use of cryptographic hash functions, which are easy to compute for a given input, but are very difficult to reverse engineer for a given output (also known as a type of trapdoor function). As a simple analogy, adding up the letters in the name of an animal (assuming A=1, B=2, C=3 etc.) might give HORSE as 8+15+18+19+5=65. This function is easy to compute for any given animal, but it is very time-consuming to find out the animal for a given sum.

Figure 3: The chain of ownership of a bitcoin. A bitcoin can be represented as a series of transactions between successive owners such that only the current owner can “spend” it by digitally signing the next transaction and anyone can verify who the coin currently belongs to.

The bitcoin protocol uses the current state-of-the-art algorithms, such as SHA-256 (Secure Hash Algorithm) and the Elliptic Curve Digital Signature Algorithm known as secp256k1. In a similar fashion, bitcoin miners use dedicated computer hardware to solve these complex hash functions, generating a “proof-of-work” for each block that verifies the authenticity and irreversibility of each transaction.

Attacking the system

Can bitcoins be stolen by modifying the blockchain? Many currencies are protected by advanced security measures such as Australian polymer banknotes with microprinting and clear plastic windows. In contrast, the integrity of the blockchain is demonstrated with a simple probabilistic argument. As the consensus rule for the network is to always accept the longest blockchain starting with the genesis block as the official one, it is proven that the only way for an attacker (counterfeiter) to publish an alternate longer blockchain of fake transactions is to control more than 50% of the total CPU processing power of the entire network (known as the 51% attack).

As Nakamoto explains, “If a majority of CPU power is controlled by honest nodes, the honest chain will grow the fastest and outpace any competing chains. To modify a past block, an attacker would have to redo the proof-of-work of the block and all blocks after it and then catch up with and surpass the work of the honest nodes. We will show that the probability of a slower attacker catching up diminishes exponentially as subsequent blocks are added.” Thus, the system is designed to take advantage of the fact that information is easy to spread, but hard to stifle.

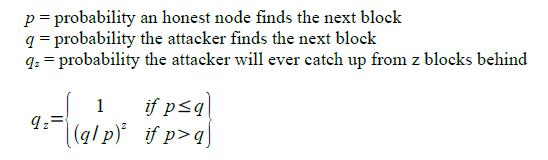

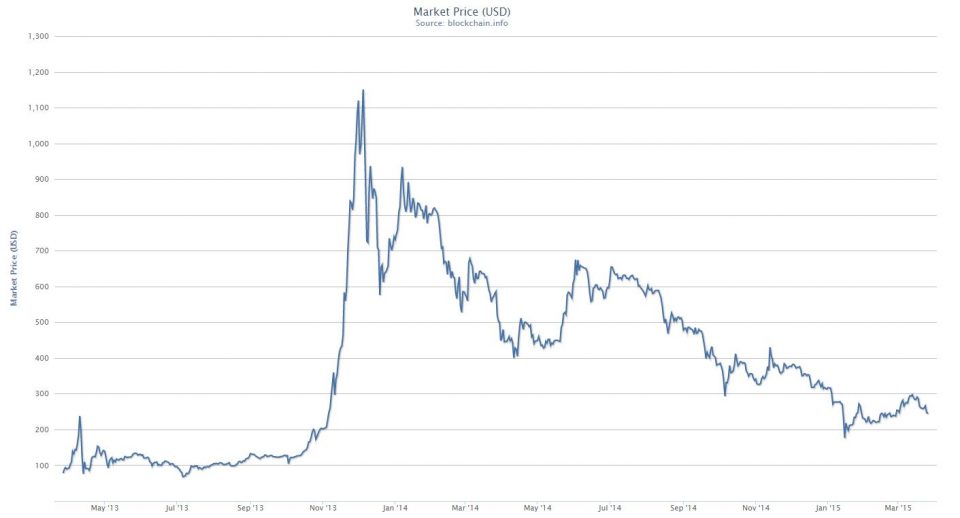

The race between the honest chain and an attacker’s chain can be modelled as a Binomial Random Walk. The probability of an attacker ever catching up from a given deficit is reminiscent of the classic actuarial problem of Gambler’s Ruin, which can be applied to give the following result:[6]

Similarly, we can determine how long the recipient of a new transaction needs to wait before being sufficiently certain the sender can’t change the transaction. As a block moves deeper into the blockchain, the probability of it being invalid shrinks exponentially. The current market convention is to wait for 6 blocks to confirm a transaction, which gives a probability of 0.02428% of fraud for an attacker with 10% of the total computing power in the network, as seen in Figure 4.

Figure 4: The probability of fraud (P) after confirmation of various numbers of blocks, assuming an attacker’s computing power (q) is 10% of the total network.

The challenges

The anonymity of bitcoin makes it the currency of choice for the online black market with websites such as The Silk Road, Black Market Reloaded and Utopia where users can purchase child pornography, illicit drugs, stolen credit cards, weapons and even murder-for-hire services. Such websites on the Dark Web can only be accessed through special anonymity software such as ToR (The Onion Router), which directs Internet traffic through a worldwide network of more than six thousand relays to conceal the user’s identity and location.

The currency has also posed challenges for authorities to monitor Anti-Money Laundering, Counter-Terrorism Financing and tax evasion, which is ironic given that all transactions are broadcast publicly in the blockchain (even though the identities of each party are kept secret). Some bitcoin startups have complained that, “banks are scared to deal with bitcoin companies, even if they really want to”[8], due to the reputational risks of being linked to illicit activities, such as NAB and HSBC in 2014 refusing to serve clients with ties to bitcoin.[9]

Some skeptics have labelled bitcoin as ‘BitCon’[10], or simply the “21st century Ponzi scheme”, with the whole mythical anonymous founder story as a sexy marketing trick. It is all the more suspicious that Nakamoto himself is believed to be in possession of about one million bitcoins ($US300 million).[11] However, as University of Chicago law professor Eric Posner pointed out “A real Ponzi scheme takes fraud; bitcoin, by contrast, seems more like a collective delusion.”[12]

However, some evangelists are much more optimistic about the role of bitcoin as a global currency. It may have the potential to help the developing world’s 2.5 billion unbanked to connect to the formal financial system, with stories like that of an Afghan woman who gets paid in bitcoin for the articles she writes for an American website.[13] Another author has suggested that bitcoin will be a “force for peace” because governments will be unable to raise money for long wars if the universal currency is widely adopted.[14]

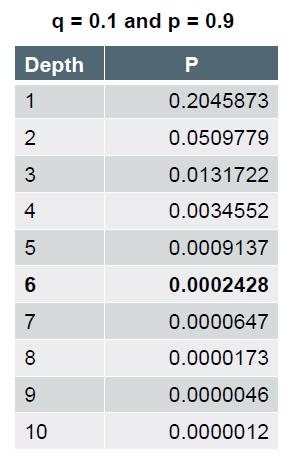

The price of the startup currency has gone through a rollercoaster ride, with annual volatility about 7 times greater than gold and 18 times greater than the US dollar[15], which reflects the uncertainty of its long-term value. Figure 5 shows the extreme price reactions to various historical events.

Figure 5: Selected events in bitcoin price history

(A) 10-Apr-2013: The 2012-13 Cypriot Financial Crisis causes the price of bitcoin to soar to over $260, before crashing to $50. Bitcoin purchases in Cyprus rise due to fears that savings accounts would be confiscated or taxed.

(B) 1-Oct-2013: The Silk Road is shut down by the FBI, causing a flash crash from $133 to $110. The owner Ross Ulbricht (aka Dread Pirate Roberts) is arrested with 174,000 bitcoins seized. Former administrators launch Silk Road 2.0 afterwards, but it is also eventually shut down.

(C) 20-Nov-2013: Price almost doubles to $1200 as People’s Bank of China gives bitcoin the green light. Yi Gang, deputy governor, says that “people are free to participate in the Bitcoin market”.

(D) 5-Dec-2013: Price plummets as People’s Bank of China reverses previous sentiment and decides to ban financial institutions from dealing in Bitcoin with guidelines specifying that “it is not considered a currency”. Buying real-world goods with any virtual currency is ruled illegal in China.

(E) 24-Feb-2014: A major bitcoin exchange, Mt. Gox (short for “Magic The Gathering Online eXchange”) finally closes down, losing its customers over 744,000 bitcoins ($US400 million). The exchange had suffered through previous controversies such as being hacked, being subject to seizure warrants by the US Department of Homeland Security and being the target of Denial of Service attacks.

Beyond bitcoin…?

The blockchain of bitcoins has proven its potential to be a real disruption to the financial system which will inspire further innovation. The idea of “crowd-sourced” publicly maintained record-keeping can be applied beyond the banking system and to decentralised exchanges of equities holdings, bonds, derivatives, land titles, and passports. Some more exotic examples include storing digital car keys, betting transactions, patents, copyrights, weapon unlock codes and even nuclear launch codes on the “Blockchain 2.0”. [17]

IBM has started experimenting with a blockchain for payment settlements between the world’s central banks[18], as well as applying the blockchain concept to the “Internet of Things”, which allows consumer devices to be remotely controlled and autonomously maintained e.g. self-driving self-owned taxis which are owned and repaired by the blockchain itself![19]

Regardless of whoever or wherever Satoshi Nakamoto is, at the moment only six years ago that he uploaded a nine page research paper along with 30,000 lines of open-source code, he created a billion dollar market out of thin air and an idea with a life of its own.

[1] Benjamin Wallace, “The Rise and Fall of Bitcoin” from Wired Magazine

http://www.wired.com/2011/11/mf_bitcoin/all/

[2] Satoshi Nakamoto (2008) “Bitcoin: A Peer-to-Peer Electronic Cash System” https://bitcoin.org/bitcoin.pdf

[3] Nakamoto is considered unlikely to be Japanese or living in Japan given his flawless English, the timing of his forum posts and emails imply his time zone lies in the Americas and the fact that the bitcoin system seems too well designed for one person to figure out. However, he tends to use British spellings e.g. optimise, colour

[4] https://en.bitcoin.it/wiki/Genesis_block

[5] http://www.nytimes.com/2013/10/31/technology/bitcoin-pursues-the-mainstream.html?_r=0

[6] William Feller (1957), “An introduction to probability theory and its applications”

[7] Satoshi Nakamoto (2008) “Bitcoin: A Peer-to-Peer Electronic Cash System” https://bitcoin.org/bitcoin.pdf

[8] http://www.bloomberg.com/news/articles/2013-12-05/bitcoin-skepticism-by-bankers-from-china-to-u-s-hinders-growth

[9] http://www.theguardian.com/world/2014/apr/10/bitcoin-dumped-by-national-australia-bank-as-too-risky

[10] Jeffrey Robinson, “BitCon: The naked Truth About Bitcoin”

[11] http://motherboard.vice.com/blog/bitcoin-mints-its-first-billionaire-satoshi-nakamoto

[12] http://www.slate.com/articles/news_and_politics/view_from_chicago/2013/04/bitcoin_is_a_ponzi_scheme_the_internet_currency_will_collapse.html

[13] http://www.economist.com/news/business-books-quarterly/21638093-rise-and-fall-crypto-currency-good-news-authors-least-much

[14] Dominic Frisby, “Bitcoin: The Future of Money”

[15] http://www.bu.edu/questrom/files/2014/10/Wlliams-World-Bank-10-21-2014.pdf

[16] https://bitcoinhelp.net/know/more/price-chart-history

[17] http://ledracapital.com/blog/2014/3/11/bitcoin-series-24-the-mega-master-blockchain-list

[18] http://www.reuters.com/article/2015/03/12/us-bitcoin-ibm-idUSKBN0M82KB20150312

[19] http://www.marketwatch.com/story/how-bitcoin-technology-could-power-driverless-cars-2015-03-03

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.