Climate Change Blog – February 2019

Welcome to the sixth instalment of the Climate Change Blog, an article series that aims to cover news and events related to climate change and relevant to actuaries and the industries they advise.

Welcome to the first Climate Change Blog of 2019. This month’s edition summarises the latest climate change news over the last two months. The focus of this issue will be an introduction of UN Sustainable Development Goals and an overview of the progress made at the most recent Global Climate Change Conference in the Polish coal mining town of Katowice.

Sustainable Development Goals (SDGs)

In an earlier blog post, we talked about the Principles of Responsible Investment (PRI) and its most recent event that covered climate change, social and governance issues, policy reform, ESG integration and Sustainable Development Goals (SDGs). The next few paragraphs describe the SDGs and focus on the ones relating to climate change.

In September 2015, 193 world leaders gathered at the United Nations to ratify the Sustainable Development Goals, also known as “the Global Goals”. The 17 goals with 169 targets address increasing health outcomes, environmental impact, access to education and economic growth for all countries. The aim of the SDGs is to serve as a blueprint for the world’s development efforts from 2016 – 2030.

Goals that resonate with the climate change theme are:

- Goal 7: Affordable and clean energy

- Goal 11: Sustainable cities and communities

- Goal 13: Climate action

The full description of all 17 goals can be found here.

Access to affordable and clean energy is crucial for jobs, security, climate change, food production, increasing incomes, and more. Energy is the dominant contributor to climate change, but progress has been made in the past decade regarding the use of renewable electricity from water, solar and wind power. The ratio of energy used per unit of GDP is also declining.

However, more progress needs to be made regarding integrating renewable energy into end-use applications in buildings, transport and industry. There needs to be more investments in sustainable energy services, and more focus on regulatory frameworks and innovative business models to transform the world’s energy systems. Countries, businesses, employers, investors and you have a big part to play in fixing these issues. For tips on how to do so, see this link.

Sustainable cities and communities are important as half of humanity (3.5 billion people) live in cities today, and this number will continue to grow. The city life must be able to provide solutions to some of the greatest issues facing humans, including climate change, healthcare, and poverty.

Many cities are vulnerable to climate change and natural disasters due to their high concentration of people and location. Building urban resilience is, therefore, crucial to avoid human, social and economic losses. In addition, the cost of poorly planned organisation can be seen in green-house gas emissions, tangled traffic, and sprawling suburbs.

To help achieve this goal, take active interest in the governance and management of your city and advocate for the type of city you believe you need. Help contribute to the development of a vision for your building, street, and neighbourhood.

Taking urgent action to combat climate change and its impacts has never been more important. Severe weather and rising sea levels are affecting people and their property in developed and developing countries. If left unchecked, climate change will cause average global temperatures to increase beyond 3°C, which will adversely affect every ecosystem.

One of the most significant climate actions taken was the Paris Agreement in 2015, which was agreed at the COP21. As of April 2018, 175 parties had ratified the Paris Agreement and 10 developing countries had submitted their first iteration of their national adaptation plans for responding to climate change.

How does PRI support the SDGs?

Since the launch in 2015, discussions tend to focus on how investors can contribute directly to the SDGs or align their portfolios with SDG outcomes. The SDG Investment Case paper authored by the PRI and PwC looks at the reasons the SDGs are relevant to institutional investors.

Firstly, the SDGs provide the first generally agreed framework that defines the “broader objectives of society” that investors wish to align with. Achieving the SDGs will be a key driver to global economic growth, which is important to any long-term investor.

Participants in pension funds, clients of insurance companies are increasingly demanding that all parties in the investment chain take their broader long-term interests, and those of future generations, into account.

Secondly, companies moving towards more sustainable business practices, products and services provide new investment opportunities. This can include refining and growing existing products like green bonds, or insurance and banking products.

Lastly, the challenges put forward by the SDGs expose asset classes and portfolios that can be financially material across industries, companies, regions, and countries.

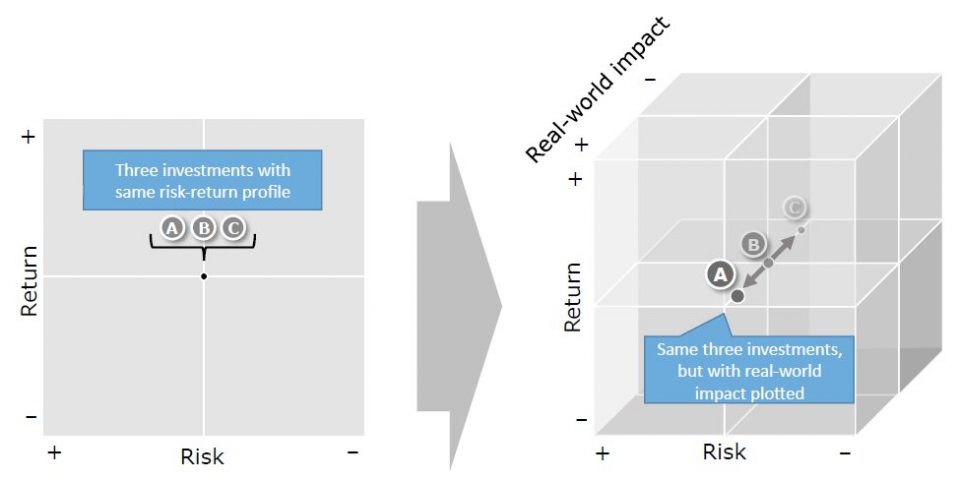

The paper also introduces a shift towards including a third dimension of “real-world impact” alongside risk and return. This helps an investor look at how a responsible investment portfolio affects those broader objectives of society. The diagram below illustrates this third dimension.

This transition is as important for the 21st century as the addition of risk to return was in the 20th.

Asset owners have started to use the SDGs as a framework to guide investment decision making. To assist asset owners in the process, the PRI prepared the Impact Investing Market Map that provides a practical link between the SDGs and real world investment opportunities by mapping each of the SDGs to investible themes.

More information with illustrations about PRI and SDGs can be found in this Global Dialogue: SDGs in Action presentation.

Presentation slides from the webinar are also available on the website.

COP 24

The recent Climate Change Conference was held in Poland in December and the agenda was a bold one. Articles in the rule book for the Paris agreement were to be agreed upon ahead of implementation in 2020. The full agenda can be found here, for an in depth review of the key outcomes in Katowice click here, and for a brief overview you can read in one minute, click here.

The special report on the impacts of 1.5C global warming, published by the Intergovernmental Panel on Climate Change (IPCC) in October was to be ‘welcomed’ by the member countries but the US, Saudi Arabia, Russia and Kuwait were only prepared to ‘note’ it. The resolution was postponed until the next session in 2019.

Article 6 on Voluntary Market Mechanisms was not able to be agreed upon, largely due to Brazil not compromising on wording that would have allowed them to double count their carbon credits. This was also carried over to COP25 to be held in Chile.

Article 9 on Climate Finance Reporting was agreed upon in full. The most controversial feature of this was that countries will be allowed to report the full value of loans as climate finance, making monetary targets less meaningful.

Article 13 on transparency covers seven types of information, including emissions reporting, progress towards meeting climate pledges, adaptation, climate impacts and climate finance provided or received. It was a contentious issue between rich and poor countries. The final rulebook applies a single set of rules to all countries on biannual reporting with flexibility for developing countries.

There was more action on the sidelines of the conference with the “High Ambition Coalition” – including the EU, UK, Germany, France, Argentina, Mexico and Canada – pledging to “step up” their ambition by 2020 through enhanced climate pledges, low-emission development strategies and increased short-term action. The Powering Past Coal Alliance, launched at last year’s COP by the UK and Canada, announced a round of new members, including Scotland, Israel, Senegal, Sydney and Melbourne, bringing its total to around 80.

Would you like to know more?

Recent climate change articles published by members of the Climate Change Working Group:

- Insight Session: Peril, Pricing and Climate Change – Richard Carter

- Climate Change Blog – October 2018 by Evelyn Yong

- Climate Change Blog – September 2018 by David Hudson

- Climate Change Blog – August 2018 by David Hudson

- Climate Change Blog – July 2018 by Evelyn Yong

- Climate Change Disclosure – Financial Institutions Feel the Heat by Sharanjit Paddam and Stephanie Wong

- Climate Related Financial Disclosures: The Way Forward? by Wayne Kenafacke.

- An Overview of the Actuaries Climate Index by David Hudson

- Climate Risk Management for Financial Institutions by Sharanjit Paddam, Stephanie Wong and Alison Drill

- TCFD Webinar: Climate Leadership – How to Support the TCFD

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.