Harnessing value from ‘digital ecosystems’

Exponential transactional volumes in the digital world mean insurers have a lot to gain from partnering with the right players to fulfil customer needs and create value. A recent Oliver Wyman event shared learnings from its work with global insurers to do just this.

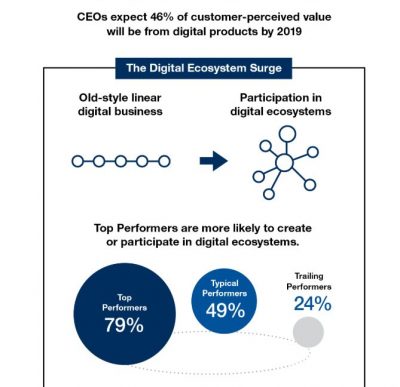

From ride sharing to buy-swap-and-sell groups to meal delivery apps, customers are living out their mobility, entertainment, lifestyle and even financial needs in digital ‘ecosystems’.

‘Black Friday’ a couple of weeks ago was the biggest shopping day in Amazon Australia’s history according to the company – the US mega-sale day online is gaining traction in Australia.

This year’s Cyber Monday was the first day to see sales via smartphones break the $3 billion mark (double the dollars shoppers spent on smartphones on Cyber Monday one year ago) – evidence we’re increasingly comfortable shopping on the go.

‘Digital ecosystems’ is a buzzword used by tech influencers around the world.

Digital ecosystems not only allow businesses to grow digitally, they create a more connected, efficient digital society.

“The inherent benefits multiply with every partner organisation sharing applications, information and bandwidth through mutual use of the ecosystem,” writes Andrew Zangre in G2.

Insurers have been trying to leverage digital ecosystems to capture value and meet customer needs but not many have experienced success.

“Challenges like misalignment of different parties’ incentives, and huge gaps in technology required, have resulted in investments abandoned,” said Angat Sandhu, Actuary and a Partner at Oliver Wyman.

Angat opened the event in Barangaroo, Sydney on 21 November, to an audience of professionals, including actuaries, at major insurers, consulting firms and start-ups.

The main speaker was Shashwat Sharma, Partner at Oliver Wyman, who started with an outline of the differences in Business to Business (B2B) vs Business to Business to Consumer (B2B2C).

In B2C, insurers seek full control of their customer journeys and the entire customer experience. The claim experience is often the ‘moment of truth’. Whereas in B2B2C, the journey is controlled by the digital partner and ‘insurance happens’ as a result of the overall online customer experience, Shashwat explained. Very often, the insurance proposition is co-created between the digital partner and the insurer from the end-customer’s pain point.

“When it comes to meal delivery apps, insurance can address things like order cancellation, order delay or failure to deliver after pick-up, incomplete order, food quality/sickness, tampered or incorrect packaging and cumbersome refund processes. All of this goes beyond traditional insurance offerings” said Shashwat.

With consumers increasingly trusting tech brands rather than traditional brands they perceive to be ‘old and clunky’, insurers must reimagine their propositions, find digital ecosystem partners and integrate with their customer journeys.

The difficulty is in knowing how to find the right partners, develop the necessary capabilities and manage the risks associated with these processes.

Short sprint MVPs key to success

In its experience, most of the digital partners work in ‘short sprint’ cycles, looking to launch minimum viable propositions (MVPs) within a 90-day period. This is quite different from the traditional cycles adopted by most mainstream insurers.

“Getting to the first MVP is always a challenge. Some hard decisions upfront are critical for success” said Shashwat.

Shashwat reflected that insurers must keep an eye on what could be ‘the next big thing’ with their digital partners in 2-3 years while at the same time being focused on the immediate rollout of MVPs almost in a factory mode.

“They had to build internal teams in a less formal structure and get ‘left and right brain’ people working together,” he said.

One key question from the audience was: where do you cede control to a third-party player to keep pace with tech enabled player?

Shashwat reflected that it requires a leap of faith with the partners and design of innovative propositions. The role of the reinsurers also should not be underestimated as some of them have experience across different markets and some learning on the propositions.

A number of insurers have setup the B2B2C/ ‘digital partnerships’ business in a separate entity. In this case, the focus has to be on capabilities being developed in the separate entity and how much is leveraged from the ‘mothership organisation’.

The capabilities of the mothership also may need a significant upgrade in the context of the B2B2C business. This adds to further complexity as there is always the risk of duplicating capabilities in both the mothership and the separate B2B2C entity.

Fostering entrepreneurship

Cherry picking entrepreneurial people from the mothership to bring the ideas into mothership and make them accountable was a method touted by an audience member.

One way to develop entrepreneurial people, including actuaries, is through programs like those run by Insurtech Gateway Australia, a branch of the successful London based insurtech incubator. The organisation allows founders to retain more equity in their business whilst acquiring support to progress through the highest risk phases of commercialisation.

Simon O’Dell from Insurtech Gateway, who was also in the audience, knows that tech startups have found success by embedding themselves between the customer and the rest of the value chain.

This is thanks to a ‘build-measure-learn’, iterative approach to developing products and services which ensures complete alignment with consumers’ needs and values, explained Simon.

“The greatest collaborations we’ve seen to-date play to this strength and embrace the strengths of the (re)insurer i.e issuing insurance paper and technical insurance know-how,” said Simon.

“These partnerships have manifested in B2B2C and MGA models with great success. Think ByMiles, Guardhog, Trov, Cover Genius.”

“We are seeing healthy numbers of entrepreneurs coming into our deal flow pipeline and its pleasing to see incumbents exploring different models for capturing value from this cohort of innovators.

The Oliver Wyman event was a valuable discussion that allowed insurance professionals to better understand the size opportunity and takeaway practical ideas to accelerate their partnership journey.

Infographic source: Gartner’s 2017 CIO Agenda report

Related content:

Podcast: ‘Open Sesame’ The online insurance treasure trove in China

Event Report: Reverse-pitching the future of life insurance

Q&A Series: Fast five with Fintechs

Podcast: Insurtech Australia Co-Founder Simon O’Dell in conversation with Angat Sandhu

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.