COVID-19 and Mental Health

While the direct health implications of COVID-19 has been widely analysed and discussed, the more hidden and potentially more profound impact on mental health is often overlooked. This blog article discusses the impact of COVID-19 on mental health, as well as some of the implications for life insurers.

As Australia finds its way through the COVID-19 pandemic, we are now warned by experts to embrace a historic wave of mental health crisis.

New modelling conducted by Orygen research institute predicts a potential 30% increase in new cases of common mental disorders a year due to COVID-19, with the curve peaking at mid 20231. Separate modelling revealed that an increase in suicide of 25% per year may be expected if unemployment rate increases to 11%2.

What have we seen so far?

Limited statistics are available at the moment given we are still in early stages of the pandemic and mental health conditions often develop gradually over time. However many lead indicators are already showing mental issues are on the rise.

Contacts to Beyond Blue are up 60% compared to last year3, Lifeline recorded an increase of 25% in March4 while Kids Helpline experienced a 40% increase5. Interestingly the overall use of mental health services in Australia has declined6. Experts suspect this is due to people not willing to physically attend doctor visits hence many are living in “pressure cooker” as they try to cope with stress themselves. The situation is much starker in USA, with a federal emergency hotline for people in emotional distress registering a more than 1000% increase in April compared with the same time last year.

How does COVID-19 impact mental health?

Uncertainty

COVID-19 is an unprecedented event and the resulting uncertainty causes stress and anxiety. Some people cope well, others less so and may develop mental health issues that are long lasting. We are right now in a live psychological experiment of coping with uncertainty induced fear and anxiety – fear of contracting the virus, fear of losing job, fear of losing money in investment market, fear of running low on basic household goods. This can lead to irrational behaviour in the short term (as we have seen on panic buy/ hoarding), and may also have long term implications on people’s mental wellbeing.

The King’s College London has recently published an interesting analysis which clusters the UK population into three groups according to how they are responding to the coronavirus crisis and lockdown measures. The three groups have very distinct characteristics and are dubbed as “the accepting” (people who accept the situation), “the suffering” (people who suffer mentally from the crisis) and “the resisting” (rule breakers). The study shows the mental health impact on each group is vastly different, with 93% of the “the suffering” feeling more anxious and depressed, 52% for “the resisting” and only 8% for “the accepting”.

Back home, preliminary results from a recent survey conducted by Monash University which tracks the mental health effects of COVID-19 crisis showed a majority of participants registered mild levels of anxiety and depression and 30% of people showed moderate to high levels7.This is well above the widely quoted mental illness prevalence rate of 1 in 5 during normal times.

People who experienced COVID-19

On top of the anxiety and stress experienced by general population, people who have close experience of COVID-19 are particularly at risk of mental health issues. This can include health care workers, patients, other frontline workers and their families.

There have been reported suicide incidences by medical professions around the globe. We have also seen heartbreaking reports from countries where the health system was under enormous pressure of patients dying in corridors and doctors forced to make life-and-death decisions relating to who should receive treatment.

Through this traumatic experience, people can develop mental health issues (including depression and PTSD) even many years after the trauma. A study of 1,257 doctors and nurses in China during the coronavirus peak found that half reported depression, 45% anxiety and 34% insomnia and 71% distress. From the 2003 SARS epidemic experience we know that around 50% of recovered patients and their family remained anxious; and 29% of health-care workers experienced probable emotional distress8.

These numbers probably don’t look too surprising for life actuaries as there can be a much higher proportion of mental claims for emergency workers (paramedics, police etc) when compared to the broader insured population, with PTSD often identified as one of the common claims causes.

In Australia we are really quite lucky this hasn’t been a big issue so far, with our pandemic response working relatively well compared to many other countries.

Economic impact

COVID-19 is far more than a health crisis. The latest figures from the ABS show the employment underutilisation rate has risen by 5.9% to 19.9% (comprising of unemployment rate of 6.2% and underemployement of 13.7%) while the workforce participation rate has reduced by 2.4%. Despite the massive economic rescue package most experts agree the economic impact will be profound.

Mental health is closely linked to economic conditions. Loss of employment, financial stress and housing stress can put significant strain on mental health. ANU research shows that someone who is unemployed is up to twice as likely to experience depression9. Closer to our heart in the life insurance industry it’s widely accepted that disability claims costs are positively correlated to unemployment rate. While the claims cost increase from a rise in unemployment is not necessarily wholly related to mental health conditions, these are thought to be making up a substantial proportion. There are various industry studies on this, although some will argue the conclusions from these may understate the current impact given they do not necessarily take into account of the effect of underemployment which has also spiked during the current crisis.

There may also be strong correlation between suicide and economic conditions. A US study of GFC that began in 2007 found that for every percentage point increase in the unemployment rate, there was about a 1.6 percent increase in the suicide rate10. Based on this an unemployment rate increase of 5% say this would translate into an 8% increase in suicide every year (note this is lower than predictions from some Australian experts).

Social distancing

No more travelling holiday. No more big celebrations. Dine in arrangement now involves people sitting 1.5m apart from each other, with laminated menus and no salt and pepper shakers. UBER Eats while bingeing Netflix becomes the new norm. How do all these impact peoples’ mental wellbeing?

Human beings are herd animals. With social distancing rules that are likely to be embedded in our life for the foreseeable future, a lack of social connectedness can drive loneliness and anxiety. This is more likely to impact vulnerable groups including the elderly, people who live alone, people with existing mental health conditions and other medical conditions (who might be in a heightened state of distress resulting from deferring treatment).

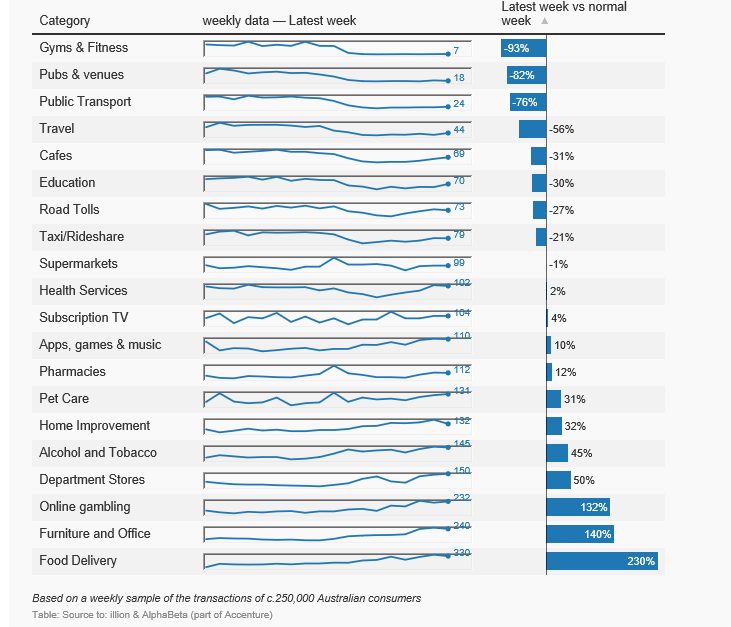

Lifestyles are also changing rapidly, with more home time and less external activities and exercising. This interesting dashboard shows how our spending habits have shifted during the pandemic.

Online gambling and alcohol/ tobacco spending has increased significantly compared to a normal week, both of which can have negative impact on people’s mental wellbeing (other spending increases like online delivery, furniture and office expenditure are not surprising).

In addition there’s increase in family stress. How to manage home schooling while working from home with the same expectations from work? A national survey of 1000 parents found one in five families are struggling to cope with the stress of COVID-19, the lockdown measures and the economic downturn, while 27 per cent of parents are worried about their family’s mental health11.

Then there’s over consumption of media which is thought to amplify public anxiety. There are children and young people whose mental health may be impacted by education disruption. There is an increasing trend of domestic violence incidence. There are more racial attacks.The list just goes on.

The impact of social distancing can be extremely complex as it penetrates into all parts of our lives, and the mental health cost associated with this is likely to be the biggest unknown of all.

Impact on life insurance

For life insurers the impact of COVID-19 on mental health is going to be primarily observed in disability products (IP and TPD), as well as death products (through higher suicides).

The discussion notes produced by COVID-19 working group – life insurance stream set out considerations for life actuaries when assessing various impact of COVID-19. Some of the considerations that are particularly relevant for mental health are highlighted below

- Insurer/ reinsurer’s specific portfolio mix. As noted above, mental health issues impact different pockets of population differently. For example, for group insurance the industry and employment type profile is crucial in forming views of the likely impact from economic downturn and the corresponding government stimulus program. For individual insurance it’s worth considering underwriting outcome (e.g. pre existing condition) and the insured demographics

- Product design. IP sustainability has been a particular challenge in life insurance industry even in the pre COVD-19 world. The soundness of product design is going to be heavily tested in the new environment – what’s the benefit period, is the definition of disability appropriate, is the replacement ratio too high. Due to the long term nature of many mental health claims, this is going to disproportionally impact the claims costs

- How well the product/claims rules are going to be executed during pandemic.Will early intervention still work? How about rehab/ retraining? Are there any changes in claims philosophy? How do reasonable community expectations (and potential government intervention) impact claims handling given the current unique circumstances?

- The timing of the impact will be heavily dependent on the length/ shape of economic recession, when/ how the health crisis is going to end, and whether there are any meaningful government policies to counteract the impact (the federal government has announced $48m spend on pandemic mental health recently but most experts say it’s far from enough)

It’s sobering to think how a tiny and invisible virus has so far turned everyone’s life upside down in just a few months time. Amid the gloomy outlook in the mental health space, there is silver lining – less daily commute frustrations, more family bonding time and some proof of improved work/ life balance. After all, the crisis has taught us how to appreciate small and trivial things in life.

Human beings have lived through many crises in our long history – wars, plagues and natural disasters, and have proven to be quite good at adapting into new environment (and sadly forgetting about what happened). Are we going to survive the mental crisis relatively unscathed this time, or is it going to be a game changer?

The author would like to thank COVID-19 working group members Daniel Longden and Richard Lyon for their peer review.

References:

-

Suicide and the Great Recession of 2007-2009: The role of economic factors in the 50 US states. Phillips JA, Nugent CN. https://www.washingtonpost.com/health/2020/05/04/mental-health-coronavirus/

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.