Risk, Uncertainty and Opportunity Learning from the COVID-19 Crisis

COVID-19 brings a ‘new normal’ with lots of new issues and more volatility to come in future – societal concerns on the wealth gap, global warming, geo-political uncertainty, digitalisation and changes in how we work. If our most important work is figuring out and addressing problems, then the challenge amidst risk, uncertainty and opportunity is to figure out the question, ‘How can we become a problem-solving company?’

This article is for leaders of businesses and focuses on key risks, uncertainties and opportunities to think about. Not just for now when organisations have been forced to act quickly by necessity but to prepare for the future and be better placed to act quickly by design.

Each of the areas is addressed in turn: Risk, Uncertainty and Opportunity.

Risk and Good Governance

In conditions of stress and uncertainty, such as COVID has given us, risks change – some significantly. So too do correlations between risks – e.g. financial stresses can lead to operational issues and vice versa. A small issue in normal times can blow up under stress.

What are some of the key risks Directors should now be thinking about?

Two lead indicators stand out: Firstly, a key risk is that of stakeholder imbalance. Stakeholders include: customers, employees, suppliers, regulators and community. All require some exchange of value though not always a money dividend. Failing to ensure this balance is in place eventually leads to the decline and possible destruction of the organisation’s culture and business system. A question to ask is:

Are we in balance between employees, customers, investors, regulators, suppliers and community?

Secondly, the recent experience is giving us indicators to managing good governance. So often the focus is on a process and pre-meetings, caucusing and PowerPoints such that when the decisions comes to be made it is not controversial. Be alert to decisions that are presented as self-evidently true.

Good governance is decision making based on risk. What we’ve learned in COVID-19 is that good governance is making a decision when it needs to be made based on evidence available. Managing the risk might mean a test and learn approach to determine how to act in the evolving environment.

In COVID-19, we have learned that amidst risk good governance is:

- Practices that give clear intent (so be alert to lack of clear intent).

- Auditable and makes decisions based on known risks (so be alert to processes that don’t allow scrutiny and being presented with only one option that is self-evidently true).

The crisis has shown us that when it comes to risk management the old adage is true: ‘Planning is everything. The plan (or budget) is nothing’. We can move to more agile risk management by design not just necessity.

Uncertainty and Competing Demands

The outlook for businesses in times of stress and uncertainty becomes clouded quickly – from both strategic and operational perspectives. Boards have to operate at present with much higher levels of uncertainty. This is very challenging for a board – the path forward is not clear. With uncertainty plaguing us, what should leaders be alert to?

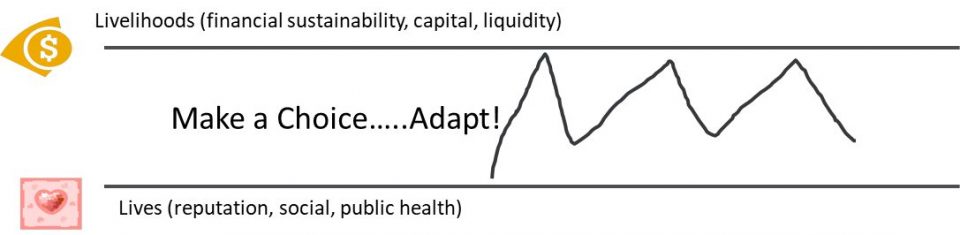

In uncertainty there is a challenge of competing demands. At the big picture level, we hear: “Safeguarding lives AND livelihoods” and “Solving for the virus AND the economy”. What we need to be alert to is forced positions of “either/or” rather than “both/and” thinking. Examples include:

- A choice to damage livelihoods (through lockdowns) OR sacrifice lives

- short or long term;

- customer need or financial need

There are potentially thousands of these…we can’t talk about each one. The key is to be alert to and surface the assumptions underlying decisions in times of uncertainty and competing demands.

Simple rules help best navigate uncertainty rather than complicated rules to try and deal with everything. For example, in uncertainty and with competing demands:

- Principle 1 – Surface Your Assumptions – Apply “Both/And” {avoid either / or}.

- Principle 2 – Know your ‘Guardrails’ – Advice on ‘where are my Guardrails you can operate between? – Options come from knowing where the guardrails are {avoid going too far to financial or too far to customer}.

- Principle 3 – Make a choice – need to be agile; recognise can’t be perfect in uncertainty so if act within guardrails can then adapt {avoid paralysis by uncertainty}.

Setting guardrails has a strong link to risk appetite and setting a clear intent. Being clear on the guardrails means freedom within boundaries. There are financial consequences you can’t breach and, at the same time, customer principles to keep.

Recently, I heard a story about decision making taught in the military:

- Rapidly identify three options available.

- Make a choice but assume you will need to…

- Adapt once underway

Having a clear risk appetite helps establish and communicate clear guardrails. Does your organisation have a clear intent and risk appetite (‘guardrails’) that helps teams make decisions? Did you use it in recent months?

Opportunities and Readiness for the Future

Risks and opportunities are sometimes flip sides of the same coin. In a crisis, we often speak about risks and uncertainties and managing all that can go wrong in a crisis, what about opportunities?

Under stress opportunities are there – the twin of risk. We can be over focussed on survival but not ask: “what are we surviving for?”. We can fail to appreciate some of the extra-ordinary achievements and to imagine what may be possible. We can be alert to:

- What was done that is not normally done?

- What would improve us without a crisis? (Best by design not by necessity)

- What are some new ways our products and services are being used during this crisis?

An example is in health where we have seen reforms in virtual health and tele-medicine. Some of this would have taken years to negotiate. Yet in a crisis, we got it in and working. So how can we use digital and virtual delivery for better health services in future?

Conclusion

The COVID-19 crisis has forced us to look at risk and uncertainty. The opportunity is to emerge stronger and to do that consider:

- What have we learned in this crisis? What worked and should be built on?

- What major capabilities do we invest in and develop that may help us with future challenges such as climate change?

- Who is our support network? (If ‘rugged individualism’ doesn’t work how do we make new friends before we need them?)

Finally, the pandemic is a human issue – When we look back in 10 years what do you want to say when asked – What were you doing in COVID-19?

Acknowledgement

This article was prompted by the webinar for Insurance company directors Ian Laughlin championed and the small team where we workshopped these ideas (Greg Martin and Win-Li Toh).

I also had input on the questions we face from Joseph Bentley, PhD and emeritus professor of management and organizational behaviour at the University of Utah who recently published a book titled, “Exploring Wicked Problems”.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.