Launch of new Green Paper: Mind the Gap – Australian Actuaries Intergenerational Equity Index

Monday 17 August 2020 saw the launch of the Australian Actuaries Intergenerational Equity Index (AAIEI), commissioned by the Actuaries Institute and written by three Taylor Fry staff (Ramona Meyricke, Laura Dixie and me).

The Green Paper, Mind the Gap – The Australian Actuaries Intergenerational Equity Index, and the interactive index are both available on the Actuaries Institute website. They represent an important contribution to the debate about how to treat generations ‘fairly’ by examining structural factors that have been changing over time.

Listen to the summary podcast below:

Listen to Launch of the Australian Actuaries Intergenerational Equity Index on Spreaker.

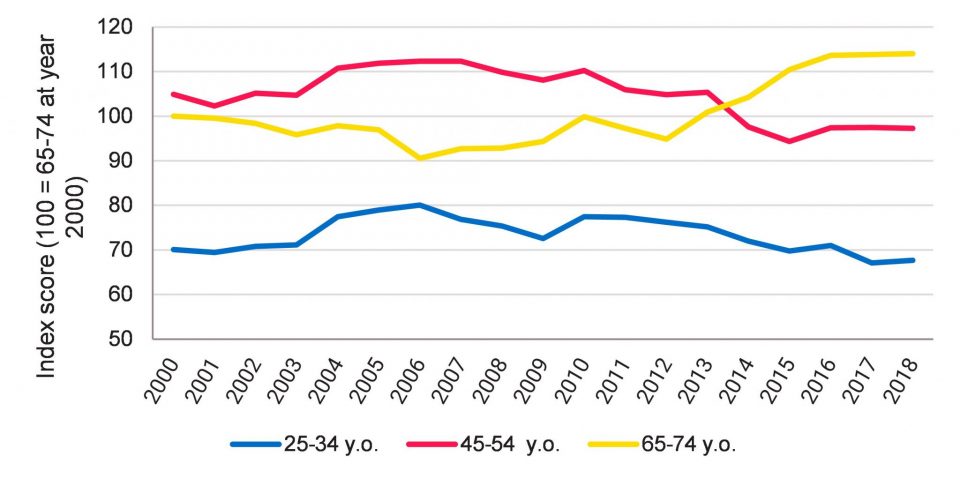

The index itself tracks a wealth and wellbeing score of three distinct age groups over time, using over 20 indicators drawn from six domains (economic & fiscal, housing, health & disability, social, education and environment) with the overall absolute index results shown below.

While some gaps between age groups should be considered normal considering natural life stages (for example, older people have had more time to accumulate wealth or buy a house), the striking result is that the gap between the youngest age group (25-34, currently Millennials) and the oldest (65-74, currently Baby Boomers) has never been larger. This suggests we’re experiencing growing intergenerational tensions, as exemplified by the ‘OK Boomer’ meme seen in 2019.

The paper itself is well worth a read for full details of how the index is constructed and what drives it, but we highlight a few items.

- Real household net wealth has grown about 90% for the 65-74 age group over the past 15 years, compared to 20% for the 25-34 group. The gains from large increases in asset prices, including housing, has advantaged older generations most.

- The proportion of 25-34-year-olds owning a home has fallen from 51% to 37% in the 17 years to 2018. This compares to a seven percentage point drop for the 45-54 age group and a one percentage point drop for the 65-74 age group. Housing affordability has worsened significantly, despite record low interest rates. It now takes longer to save for a deposit and house prices, particularly in the bigger cities, has grown far faster than incomes.

- Environmental issues, a commonly cited intergenerational issue, have dragged down the index for younger people. Higher temperatures, more CO2 in the atmosphere and lower rainfall are all issues that are likely to continue to worsen.

The COVID-19 pandemic also brought some intergenerational issues into sharp relief. Rates of unemployment, and underemployment, are almost always higher for younger people but the spike seen has disproportionately affected younger people. Increased government debt will take many years of fiscal restraint to manage down as a proportion of GDP. And many people, particularly younger people, have drawn down on their superannuation early, which will have longer-term consequences for wealth accumulation and standards of living in retirement.

Intergenerational issues are not solely about problems facing younger Australians. The aged care royal commission has highlighted the failure of society to allow the elderly to live with dignity in their final years. And poverty rates are high for subgroups across different ages, including pensioners who do not own their own home.

Government policy can have implications for intergenerational issues. The paper points to several policy proposals that have already been developed across each of the domains.

Further highlights are provided in the media release.

This article is also published on the Taylor Fry website.

CPD: Actuaries Institute Members can claim two CPD points for every podcast listened to.