Climate Change at the 20/20 All-Actuaries Virtual Summit

This edition of the Climate Change Blog looks at the topic of Climate Change in the 20/20 All-Actuaries Virtual Summit, providing a summary of five presentations on this topic across the Summit.

Sessions about Climate Change

There were five sessions related to the environment and climate at this year’s summit, demonstrating a high level of engagement with the topic among the membership. The topics, presenters and the links to the recording are tabled below.

|

Title |

Presenters |

|

Considerations in Understanding Climate Change Effects on Insurance Risk |

Rade Muslin |

| Red Hot Issue – Climate Change and the Financial Sector – Part 1: Frameworks |

Jennifer Lang |

|

Red Hot Issue: Climate Change and the Financial Sector – Part 2: Disclosure in practice |

Kate Lyons, |

|

When the Air Becomes Toxic: The Health Costs of Bushfire Smoke and Poor Air Quality |

Michelle Dong |

|

Timothy Lam |

Considerations in Understanding Climate Change Effects on Insurance Risk

Rade Musulin provided a whirlwind tour of the ways in which Actuaries can think about climate change and how Actuaries can best apply their skillsets to the looming issue. Some of the key takeaways from this session are:

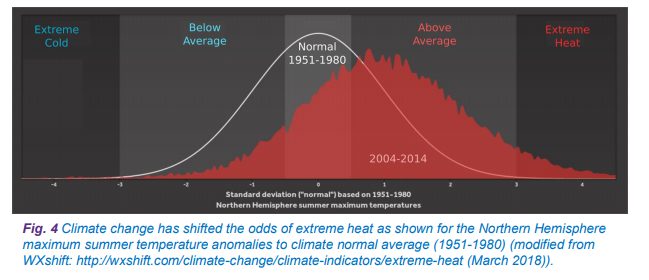

Climate Risk is real, growing and persistent. A key concern is the movement in the tail distribution. An example of this is shown in the figure below, sourced from the 2019 IAG and NCAR (US National Center for Atmospheric Research) Report Severe weather in a changing climate, which shows that the shift in temperatures causes a huge increase in the rate of extreme heat events.

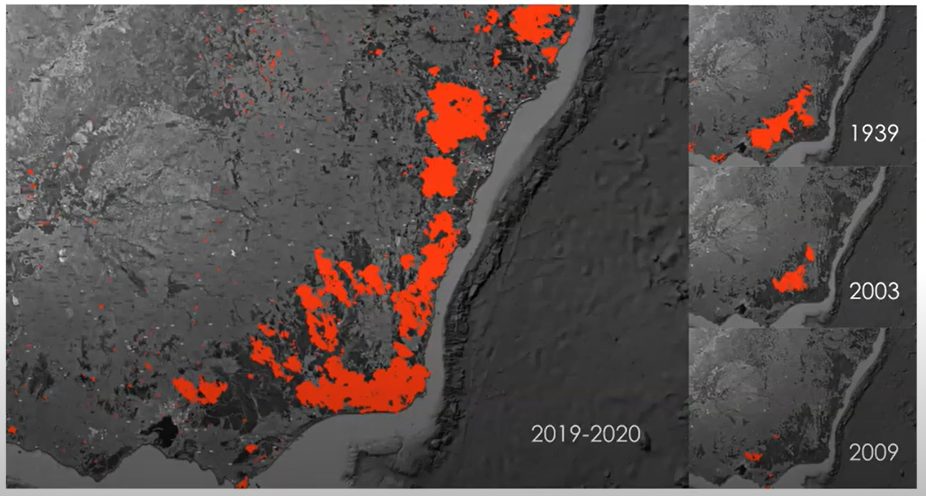

Climate Risk may not be readily apparent in insurance loss data, as it is driven by many factors such as population, wealth, mitigation and weather, resulting in a high degree of noise in the data. An illustration that may help this hit home is the recent bushfires, compared to past bushfire catastrophes. Geographically, the 2019-2020 bushfires covered much more area than these other events, but the normalised insured losses were actually similar.

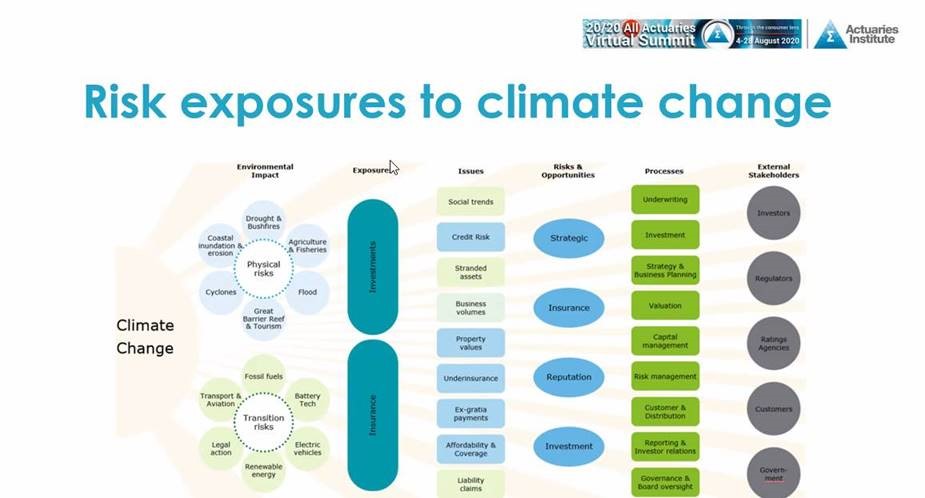

Climate risk extends beyond physical risk to transition risk. The ways individual countries and the world collectively approach climate change can affect the insurer through their investment and ESG policies, impacts on the supply chain, demand for their products, thus introducing new risks. The uncertainty about government action and the possibility of rapid policy changes implies that insurers (and others) need a high level of agility and adaptability.

Affordability issues arise, as seen in Northern Australia, where a combination of decades old construction codes, more granular pricing, and more recent weather events have strongly affected local insurance affordability. Climate risk is likely to create pockets of affordability issues in other parts of Australia.

Adaptation and investment in mitigation is critical to maintain affordable insurance, a strong insurance system and a resilient economy.

Actuaries are involved, through our relationships with financial institutions that need to respond to climate risk (e.g. TCFD disclosure, ERM, responding to public policy).

More than traditional actuarial knowledge is needed. This includes the need to understand of natural hazards, climate and macroeconomics. Actuaries need to work with multidisciplinary teams, and other Actuarial organisations around the globe, to address Climate Change.

Red Hot Issue – Climate Change and the Financial Sector – Part 1 Frameworks

Peter Kohlhagen of APRA first outlined APRA’s recognition that climate change gives rise to substantial financial risk that can impact financial institutions and customers. From APRA’s survey of 38 financial institutions in 2019, APRA saw pleasing levels of awareness and inclusion of climate change in risk management frameworks, but also saw the need for more analysis on impact and more disclosure. APRA has looked at the quality of climate change commentary in FCRs and Peter described it as “mixed”. After presenting an overview of international regulatory developments, Peter expanded on APRA’s forward looking strategy on climate risk, moving from awareness to education phrase to embed climate risk into supervision, looking to play back international best practice to assist the 38 largest regulated entities. APRA is also planning to do a deep dive review on vulnerability of these entities.

Sharanjit Paddam of QBE Insurance Group gave an update on Climate Measurement Standards Initiative (CMSI). Its focus is how to ‘drive confidence and comparability’ between different entities’ disclosures, with the objective of improving confidence in these disclosures, initially on physical risks. Key recommendations from CMSI were regarding financial disclosure, for example disclosures should focus on selected IPCC pathways, specifically the scenarios of climate warming 2 degrees or lower (RCP 2.6) and the more extreme scenario greater than 2 degrees (RCP 8.5). Setting out recommendations on key items to disclose is intended to improve consistency of information.

CMSI found that climate change impacts in short-term (e.g., 2030) are relatively minor compared to the projections for 2050. The most difficult areas to define are uncertainty and confidence in scenario analysis, with the most uncertainty arising from future greenhouse gas emission levels and their impact on extreme climate tail events. CSIRO and BOM’s predictions show a range of event changes, including predictions that by 2050 the frequency of Tropical Cyclones may decrease by around 4% to 8% under the RCP 2.6 scenario, while the frequency and severity of bushfire events may increase sharply. These CMSI papers were published after the Summit on 14 September 2020 and are discussion documents rather than formal standards. CMSI is already thinking about “CMSI 2.0” to look at vulnerability assessments.

Jennifer Lang (representing the Climate Change Working Group) spoke about the recently released Information Note for Appointed Actuaries. The note is intended to provide a framework for Appointed Actuaries preparing FCRs, but also benefit other actuaries reviewing financial institutions, with particular focus on physical and transition risk for general insurance companies. Naomi Edwards felt it should be of considerable assistance for Appointed Actuaries currently preparing FCRs, even though APRA has not yet released its formal guidance on this area.

Red Hot Issue: Climate Change and the Financial Sector – Part 2: Disclosure in Practice

The session opened with a poll asking the audience when their employers plan to respond to the recommendations from the Taskforce on Climate-related Financial Disclosures (TCFD). The results of the poll showed that, of the people surveyed, 14% are already implementing TCFD recommendations; 8% will do it within a year; 4% have no plans on doing TCFD, and 71% answered “do not know”.

Sharanjit Paddam of QBE provided a brief background on TCFD and its beginnings originating from the Financial Stability Board as part of the G20. The final report was produced in 2017 to recommend a single international cross-industry framework for disclosing climate risk in financial reporting of companies.

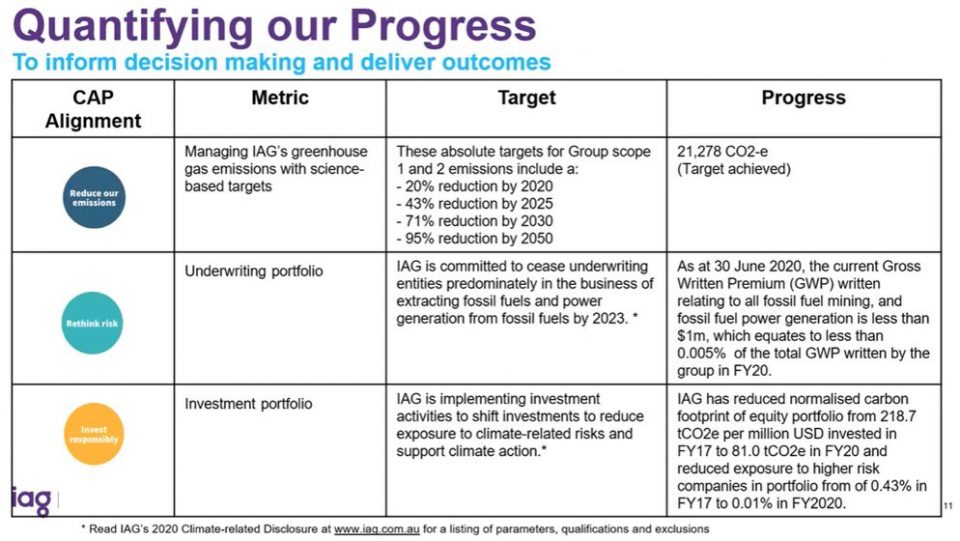

Brooke Petitt, Executive Manager Responsible Business at IAG, gave an overview of how IAG puts TCFD into practice. IAG’s Climate Action Plan (CAP) is informed by the TCFD report, Sustainable Development Goals (SDGs), and the SENDAI framework. IAG partnered with National Center for Atmospheric Research (NCAR) to consider impacts of changing climate on severe weather and released their first report in November 2019. These results are used to inform reinsurance approaches and the short- and medium-term risks to IAG.

Brooke explained how the Board considers climate change through the enterprise risk profile and its disclosures, overseen by the Safer Communities Steering Committee. IAG manages risks using scenario analysis and tools relating to physical and litigation risks. The results inform how IAG needs to manage reinsurance, capital, customers, supply chains, and investments. IAG releases a scorecard every half year to track updates against the CAP, and this is updated on their website.

Kate Lyons, Executive Manager Reinsurance & ESG Strategy at Suncorp, introduced Suncorp’s CAP and commitments to responsible banking, insurance, investments, and support for a transition to a low-carbon economy. The issues identified by the TCFD are important – investors are asking for disclosures, and the TCFD report provides a framework on how to do this. There is also a push from regulators for organisations to move ‘from awareness to action’ on climate risk.

Suncorp looked into physical risks via scenario analysis with warming pathways to 2030 and 2060. For the insurance business, risk was measured using the change in Average Annual Loss (AAL) to see the impacts of natural perils overtime. Analysis showed that AAL is increasing over the next 10 years as storm-related hazards pose the greatest natural perils risk to Suncorp. For the banking business, scenario analysis showed that coastal erosion and expanding soils will become more prevalent for residential customers.

Kate talked about how the topic of climate-related financial disclosures is a very interesting space for actuaries to get involved in since actuaries have experience measuring and quantifying risks. There is a huge diversity of teams that get involved in the process so actuaries can learn more about their business. Kate then talked about how Suncorp and other actuaries can advocate for better disclosure of climate risks.

In Q&A, Brooke and Kate talked about the main challenges they faced in getting to this point for TCFD. Brooke thought that the main challenges were about managing multiple stakeholder inputs, making sure they are kept up-to-date and getting people comfortable with the level of disclosure based on the strategic focus. Kate agreed and also thought that another challenge was communicating the scientific process and information with levels of confidence around different aspects, and how to convert these complex meteorological information into simple messaging. It was also about making stakeholders not only aware, but also bringing about action.

IAG’s and Suncorp’s latest TCFD reports can be found at their websites.

When the Air Becomes Toxic: The Health Costs of Bushfire Smoke and Poor Air Quality

Climate change exacerbates air pollution in two main ways – more days with high concentrations of ozone due to hotter temperatures, and higher bushfire risk. In the future, bushfires such as those over the ‘Black Summer’ of 2019-2020 are 80% more likely because of climate change[1]. This session discussed the estimation of health risks and costs of “typical” air pollution in 2019/2020 and compared that to the ‘Black Summer’ bushfire.

Michelle Dong of Pacific Life Re gave an overview on Australia’s air quality. While Australia’s air quality is good compared to OECD, there are poor air quality “hotspots” in the Upper Hunter and Liverpool, Sydney regions. Air pollution is a major health risk and a persistent concern in Australian capital cities. It causes illness, premature death, reduced quality of life, lost productivity, and leads to significant economic costs. In 2006, the NSW Government advised that air pollution caused 643 to 1,446 deaths annually in the Sydney region and cost $706m to $5,994m per annum[2].

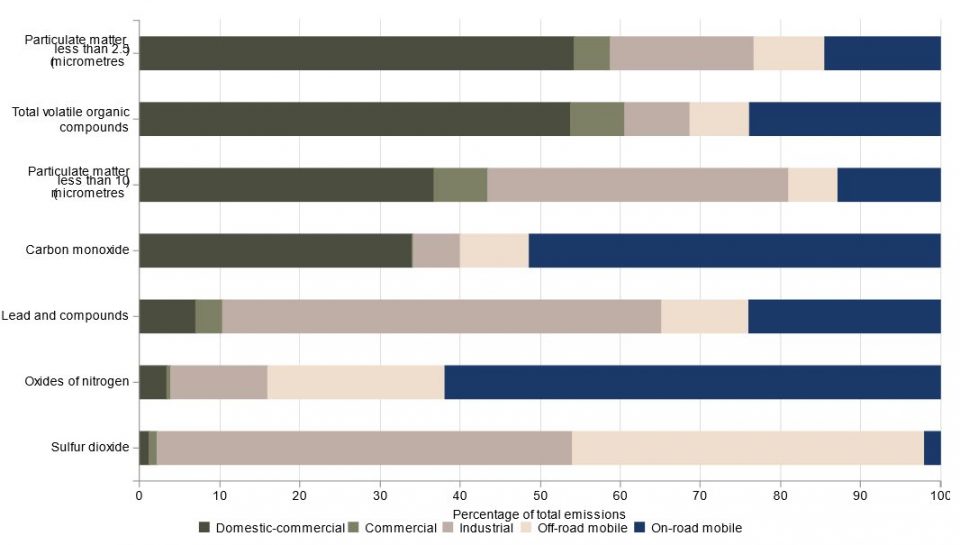

In cities, typically anthropogenic emissions – from industry, residential wood heating, power stations, and vehicle emissions – are the main contributors to air pollution; however natural sources such as bushfires are also a major contributor.

Ramona Meyricke of Taylor Fry talked about the health impacts from air pollution. Air pollution adversely affects respiratory, immune and cardiovascular health. Chronic exposure (including exposure to smoke) increases the risk of cardiovascular disease, respiratory disease and lung cancer, and affects reproductive, urological and neurological systems[3]. The health effects of extreme exposures to air pollution are much less well understood due to a lack of scientific evidence.

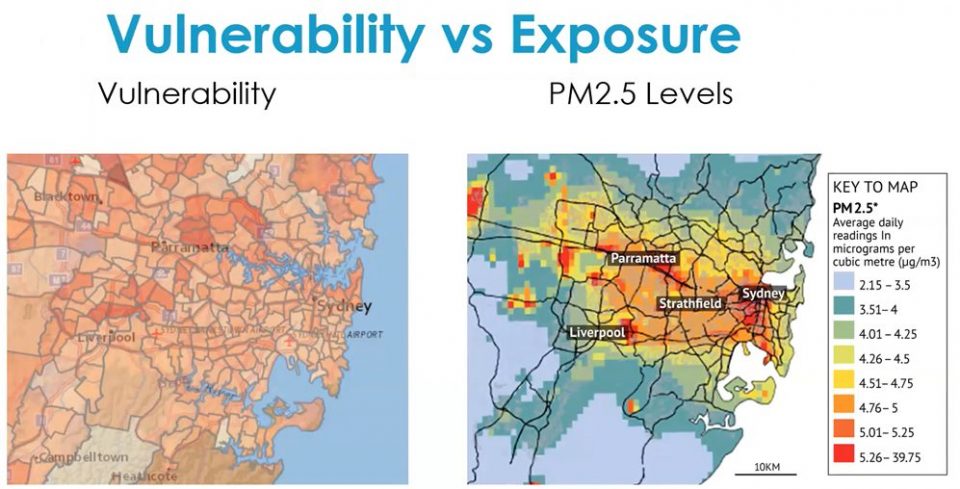

A wide body of research exists that identifies these risk factors that increase vulnerability to air pollution – pregnant women, children, elderly people, socioeconomic status, comorbidities, gender, and neighbourhood walkability and road density. These factors were combined to form an Air Pollution Vulnerability Index, results shown in the diagram below. The areas with the highest vulnerability tend to be inland in Western Sydney. Unfortunately, this vulnerability intersects with the higher exposure. Furthermore, the population of Western Sydney is estimated to grow to 3 million by 2036. This will increase emissions and further impact air quality across this region.

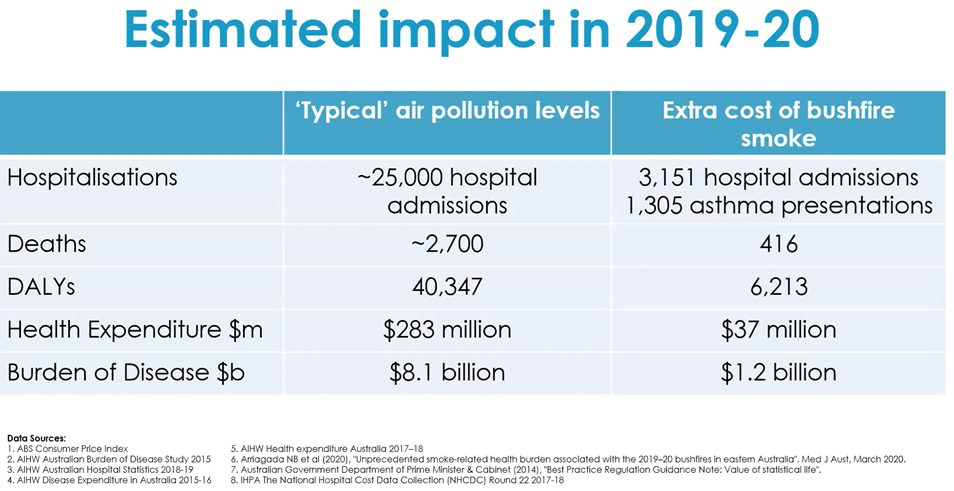

Kirsten Armstrong of Three Rivers Consulting explained how data from the Burden of Disease Study 2015 and other sources were used to estimate health expenditure and burden of disease cost (based on Years of Lives Lost and Years Lived with a Disability) in a typical year. She then compared that to the additional costs arising from the 2019-2020 bushfire smoke.

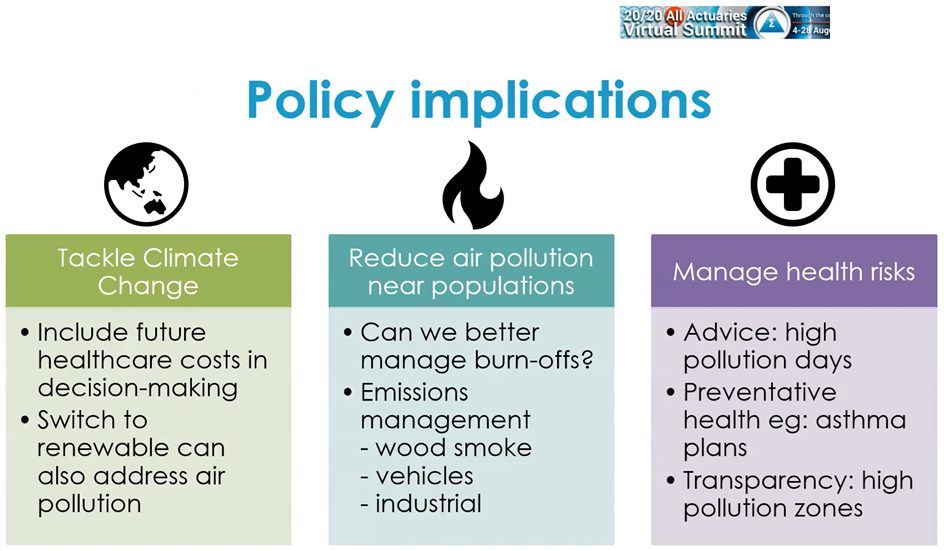

Kirsten then closed the session with policy. Air pollution is often described as a “silent killer” as many of the costs of poor air quality are “external” to the production and consumption processes and fall on the wider community and society rather than the polluter, meaning that these costs are not priced and often ignored. The health risks and costs of air pollution are large, and need to be better understood by actuaries and policy makers, particularly in forming adaptation solutions.

Integrating ESG-Related Risks into ERM – A Risk Network Enhanced Analysis of Systemic Risks in the Food and Agriculture Sector

The session was presented by Dr. Andries Terblanche, Dr. Mike Ashley, and Tim Lam, from KPMG Global Centre of Excellence for Dynamic Risk Assessment. KPMG was requested by the World Business Council for Sustainable Development (WBCSD) to “identify the risks and their mitigants towards not being able to feed a projected population of nine billion people”.

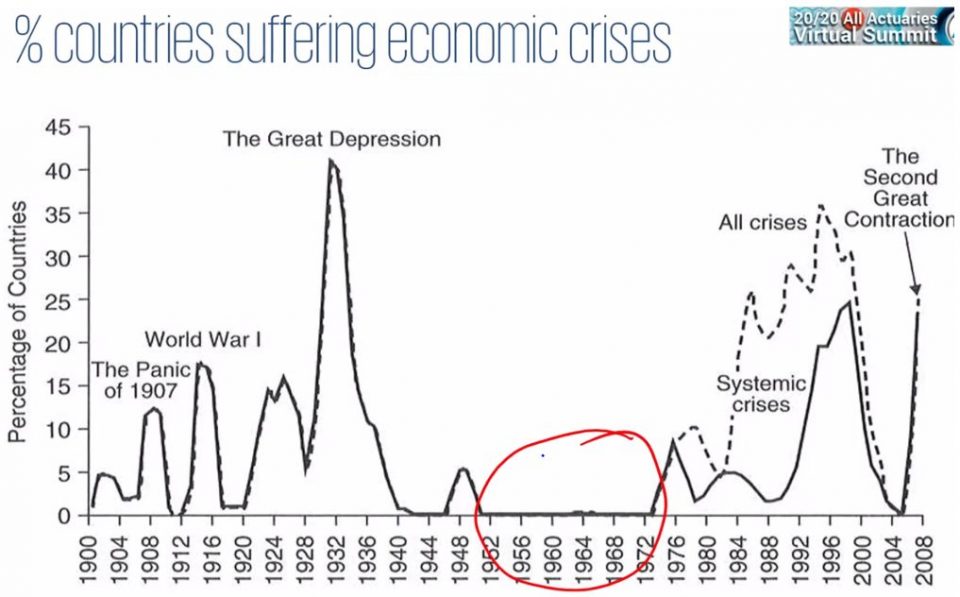

Andries talked about the historical events of economic crises and how literature during the flat period (in the diagram below) did not predict volatility in the future, which is unusual given that there were other periods of upheaval before that flat period. Most of the initial work on quantitative risks actually originated from 1950s and 1960s when the world was in a period of abnormal calm.

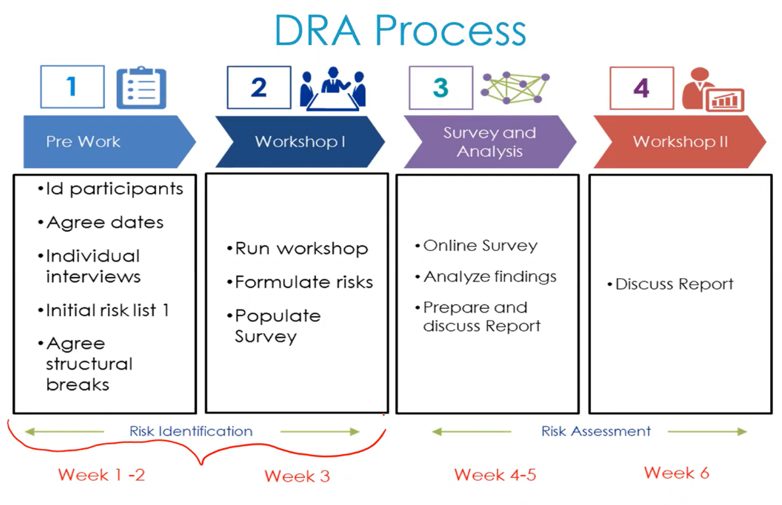

Tim emphasised that using purely historical data to predict the future is not realistic nor reasonable when there is a structural change. Tim reminded the audience that they are currently living in a moment like this during COVID, where things have changed and there is a structural break, so historical experience cannot be relied upon to estimate what can continue into the future. Risks are actually non-stationary, but in the absence of data, academia showed that expert elicitation (i.e. relying on expert opinion) is the most useful resource. Tim then talked through the DRA process shown below.

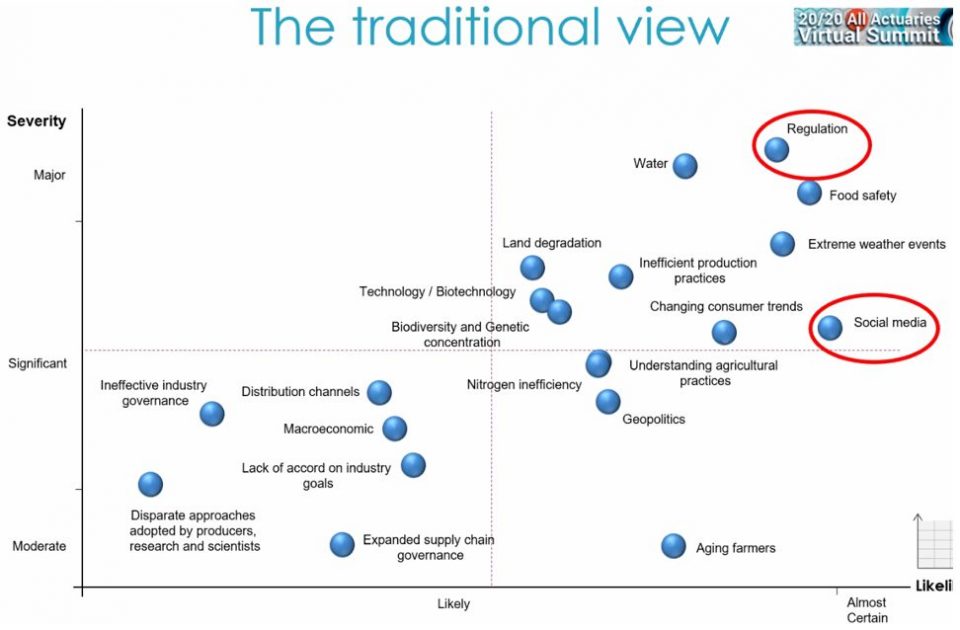

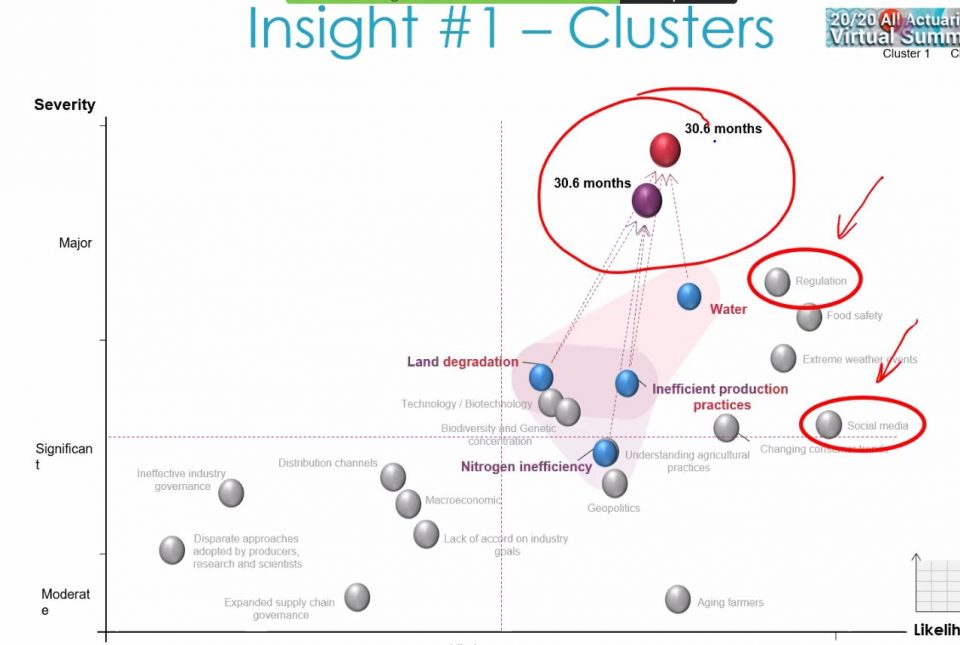

Tim explained that the traditional view for identifying the individual risks (see diagram below) shows that regulation and social media risk are almost certain and severe. The purpose of this traditional view is to set a baseline.

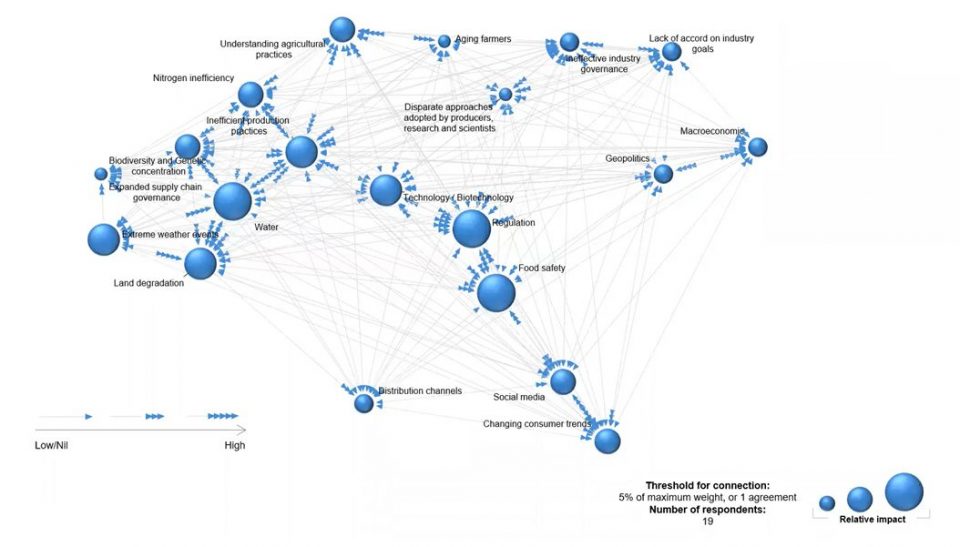

However, such an approach can suffer from ignoring the connections between risks. The diagram below shows the clusters and inter-linkages between risks. This network connections were collected from experts with over 400 years of experience collectively.

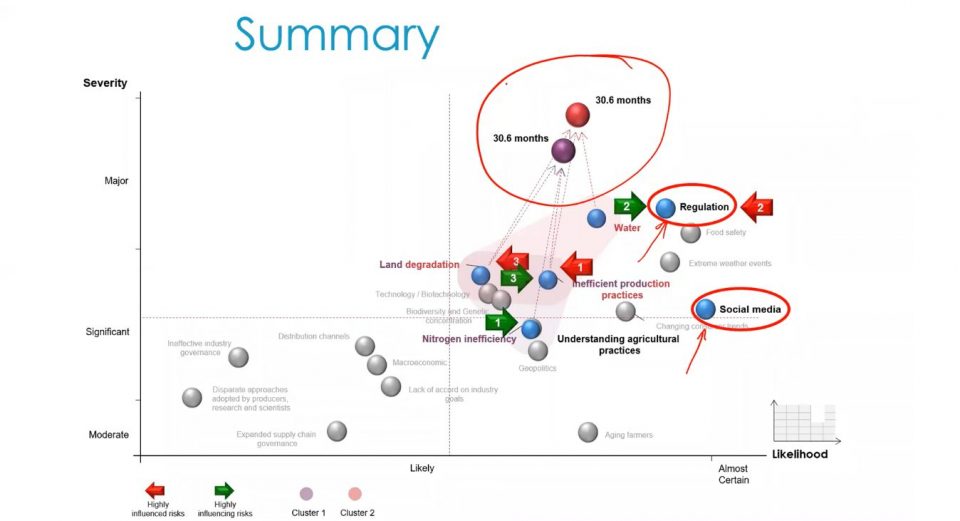

Mike explained the result of overlaying the traditional view with the network connections. The results in the diagram below showed that events fired in unison have a much larger impacts. The time shown in the diagram shows the fastest occurrence of one of the risks to happen, this means the lead time for this event to happen is 30.6 months. Regulation and social media risks were no longer the largest risks (as opposed to the traditional view).

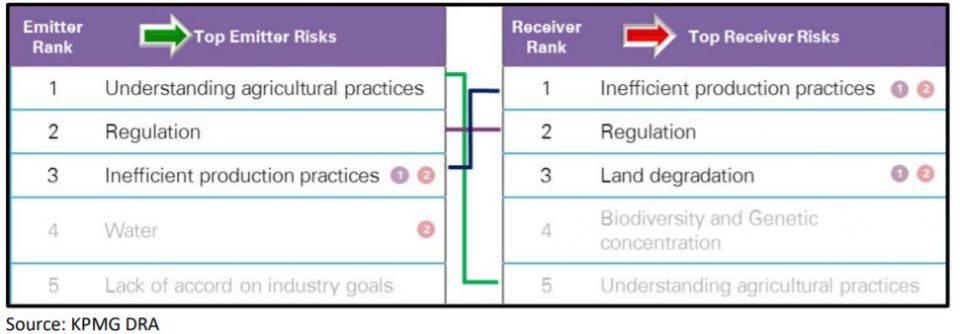

The DRA process and the network view highlighted the top 3 strategic vulnerabilities/receiver risks and systemically strongest mitigants/emitter risks. The most important risk, after allowing for network effects, is the use of inefficient production practices in farming.

Andries talked about the mitigation strategies and its interaction with system vulnerabilities. Results showed that understanding agricultural practices is important because it can influence biodiversity, inefficient production practices, regulation, and land degradation. On the other hand, inefficient production practices are systemically more vulnerable than influential. Mitigating inefficient production practices as a discrete risk would never solve the mitigation equation because as much as we try to mitigate it, it will always remain more vulnerable to other risks in the network than the proposed mitigation bestowed on it.

In summary, the traditional view of seeing risks as discrete threats, and not as a complex adaptive system, means that we would have misdirected time and mitigation strategies on these risks (regulation and social media). The grey risks in the diagram below show that we can mitigate the entire system without necessarily having to mitigate each one of the grey risks. The DRA process allows users to identify and mitigate risks in a more efficient, realistic, and targeted manner.

You can read more about DRA in the WBCSD paper and summit paper. Would you like to know more?

The climate change blog series has covered a broad range of topics over the past couple of years:

- August 2020: COVID-19, Climate Change, and the Green Recovery

- May 2020: Net-zero Emissions: What are Governments and Companies Doing?

- Jan 2020: Bushfires in Australia

- Oct 2019: Australian Sustainable Finance Initiative (ASFI) and crossword

- May 2019: International Actuarial Association (IAA) and the CRO Forum

- Mar 2019: Climate Disclosures

- Feb 2019: Sustainable Development Goals (SDGs)

- Nov 2018: Australian Actuaries Climate Index (AACI)

- Oct 2018: Global Climate Action Summit, PRI, Climate Week in NY, UNEP PSI

- Sep 2018: Physical Risk

- Aug 2018: Litigation Risk

- Jul 2018: Transition Risk

Other climate change articles published by members (past and present) of the CCWG:

- The Big Climate Change Gamble: What are the Odds? by Sarosh Batliwalla

- Insight Session: Peril, Pricing and Climate Change by Richard Carter

- Climate Change Disclosure – Financial Institutions Feel the Heat by Sharanjit Paddam and Stephanie Wong

- Climate Related Financial Disclosures: The Way Forward? by Wayne Kenafacke.

- An Overview of the Actuaries Climate Index by David Hudson

- Climate Risk Management for Financial Institutions by Sharanjit Paddam, Stephanie Wong and Alison Drill

- TCFD Webinar: Climate Leadership – How to Support the TCFD

[1] Oldenborgh et al (2020, p. 26). The lower-bound estimate was 30%. Both estimates are likely to ‘severely underestimate’ the attribution (p. 26) due to underestimations of the main heatwave inputs (p. 1).

[2] Of which $7 million – $13.5 million is for cardiovascular and respiratory admissions and ED attendances, and the majority of costs are driven by mortality impacts. See ‘Health impacts of air pollution in the Sydney Basin’ 16 November 2006.

[3] Zhao, B., Johnston, F. et al (2020) Short-term exposure to ambient fine particulate matter and out-of-hospital cardiac arrest: a nationwide case-crossover study in Japan. The Lancet Planetary Health & World Health Organisation (WHO) (2018). Ambient air pollution: Health impacts. Available at: https://www.who.int/airpollution/ambient/health-impacts/en/ & Climate and Health Alliance. (2013). Inquiry into the impacts on health of air quality in Australia. Submission to Senate Standing Committees Community Affairs (March 2018), p.2.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.