Using operational risk scenarios to calculate an internal risk based capital position

As a collaboration between the Actuaries Institute Superannuation Practice Committee (SPC) and Risk Management Practice Committee (RMPC), a small working group of actuaries (Tim Gorst, Vivian Dang, Matthew Burgess, Taleb Hassan, Bloreen Abbasi) worked together to explore the use of risk based scenario analysis in developing an internal operational risk-based capital (ORBC) position for Australian Super Funds.

Their work considered the following core question “Is there a pragmatic way that a set of operational risk scenarios can be both parameterised and then aggregated to infer an internal ORBC position for an Australian Super Fund?”

Background to ORBC management in Australian Super Funds

A key catalyst to ORBC management in Australian Super Funds was the introduction of the 2013 APRA prudential standard SPS114 (Operational Risk Financial Requirement or ORFR). The regulatory approach behind this standard followed the traditional 3 pillars style model used by regulators around the globe with respect to capital management. In summary, ensuring: (1) adequate capital is available across the industry to address the impact of operational risk events on member balances subject to a minimum of 0.25% of FUM for each Fund; (2) Trustees start to connect operational risk and capital management to help better manage operational risk exposures; and (3) an increased focus on both internal and regulatory reporting of historical operational risk events. In 2019[1], APRA provided honest reflection that points 2 and 3 above have perhaps not delivered to their original expectations.

In examining some of the challenges to driving innovation in ORBC within Australian Super Funds, the working group did discuss the possible lack of incentive for a Super Fund to invest in projects that reduce their operational risk profile as a result of the 0.25% (of FUM) minimum capital floor. More generally, the lack of Super Fund operational risk data (particularly “tail related” severe loss history), managing any management bias in relation to setting of operational risk scenarios, subjectivity in the calculation approach and challenges explaining capital related outcomes to a Super Fund Board were also discussed as challenges to driving an uplift in ORBC management in the industry.

Why bother then with calculating an internal ORBC position?

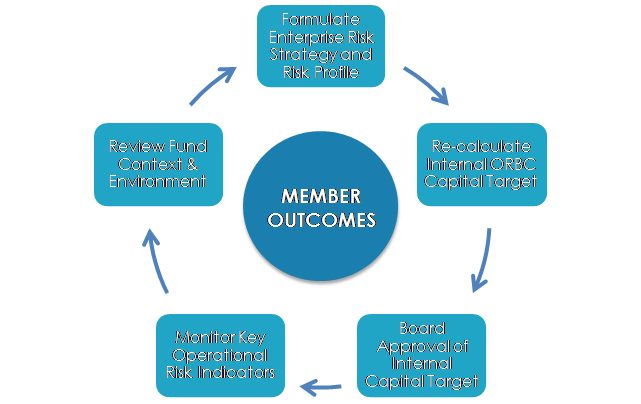

Notwithstanding the challenges above, the working group reflected that the benefits from the calculation of an internal ORBC position come not from the calculation outcome itself, but rather how it can be integrated into an overarching Trustee framework to connect operational risk, capital and strategy. This is illustrated in Figure 1 below. The ultimate goal of such a framework would be to support meaningful Board conversations about operational risk management (right conversation, right place, right time and right actions) with a clear improvement in operational risk profile and member outcomes over time. The working group noted such control cycles within the Australian superannuation industry are at present relatively immature compared to the ICAAP style frameworks adopted in other APRA regulated industries.

In addition to the more general purpose of supporting a Trustee ORBC control cycle, the working group identified several more specific reasons for calculating an internal ORBC position:

- Confirming the appropriateness of the Board’s ORFR Target;

- Identifying any opportunity to transfer free (or surplus) capital to members;

- Quantifying theoretical return (to members) on investments that reduce risk to justify capital investment; and

- Quantifying theoretical potential fund consolidation capital efficiency benefits.

An approach to determining an internal ORBC position

The working group developed a basic 4 step approach that anchored around the use of scenarios which it then demonstrated using worked examples:

Step 1 – Identify operational risks (source Trustee Risk Management Framework);

Step 2 – Identify key operational risk scenarios for each risk (for some risks industry or fund data may be available but generally not);

Step 3 – Interview executives to determine scenario impact (for a given percentage confidence interval for example 95% or 99%), taking care to ask questions properly and manage any bias; and

Step 4 – Assume statistical properties of (distribution type, Expected Loss, Unexpected Loss, percentage confidence interval), and correlations between scenarios to calculate & calibrate ORBC.

For steps 1 and 2, the working group developed a hypothetical set of operational scenarios able to be mapped back to the types of generic operational risks that would be found within the operational risk taxonomy of a typical Australian Super Fund. For step 3, each scenario was then parameterised with a notional impact, which in practice would be informed by interviews with senior management and operational risk owners. Step 3 is an important step to explore the way in which factors like Fund size and member profile might impact the potential severity of an operational risk capital scenario, with the working group seeing some evidence of operational risk scale efficiencies (i.e. larger funds potentially less exposed to particular operational risk impacts as a % of assets). Finally in relation to step 4 the working group applied the information from the previous steps to three potential statistical approaches to infer an internal ORBC position.

| ORBC Model Approach | Key Insights |

|

Basic: Deterministic. Book end target amount by simply adding the scenario impacts together assuming scenarios are fully correlated. Alternatively assume all scenarios are independent and adjust the ORBC amount down by applying a simple “square root of sum of the squares” calculation. |

Able to acknowledge some extent of independence between the scenarios without any detailed modelling. Approach limits exploration of any unique statistical characteristics (e.g. correlation) between each scenario. A good starting point for a Super Fund not wanting to embark on building a model. |

| Modelled (one distribution): Stochastic. One distribution for frequency of claims and severity. E.g. A scenario of this size will happen once in 20 years (i.e. 5%). Common distributions: log normal or half normal. Flexibility to explore different correlation characteristics between scenarios. | More complex to model but provides more flexibility to explore any unique statistical characteristics (e.g. correlation) between each scenario. Potentially workable as an approach but noting outcomes very sensitive to assumptions. |

| More Complex (two distributions): Stochastic. One distribution for frequency of incidence and another for severity. E.g. Expect ‘x’ losses each year and when a loss occurs it is ‘$y’ in size. Common distributions: Poisson for frequency and lognormal or half-normal for severity. Akin to models used in banking industry. | Difficult to calibrate, understand and in turn communicate to management. Results not as simple and intuitive. Not enough data to fit parameters, particular frequency. Most likely too complex for a Super Fund’s needs. |

Conclusion

In conclusion the working group felt that the development of scenarios using management interviews was useful both to help identify and understand operational risk (in the absence of operational risk “severe loss tail” data) but also in turn to support an internal ORBC model. With the use of scenarios developed by management, an internal ORBC position using either the simple or modelled approach was therefore a manageable exercise for any actuary asked to assist a superannuation trustee in determining an internal ORBC position.

The working group noted the sensitivity of outcomes to assumptions, making both the initial calibration and ongoing analysis of change of any model an important exercise. Whilst a more complex modelling approach was explored, akin to those historically used in advanced ORBC models in the Banking (and other) industries, the integrity of the model outcomes quickly broke down without access to better quality data to parameterise the model and confirm assumptions. In all cases the impact of correlations, confidence level and fund size were important factors in ultimate capital outcomes.

[1] “APRA Information Paper : Review of APRA’s 2013 superannuation prudential framework”30 April 2019

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.