How can a Bear learn MoS?

It all started on a sunny weekend in 2020. Like many others, I had taken lockdown as an opportunity to revisit some old hobbies, namely my dusty watercolours. Picking up the brushes proved more enjoyable than I remembered, and before long I was thinking of ways to combine this ‘new’ hobby with something practical.

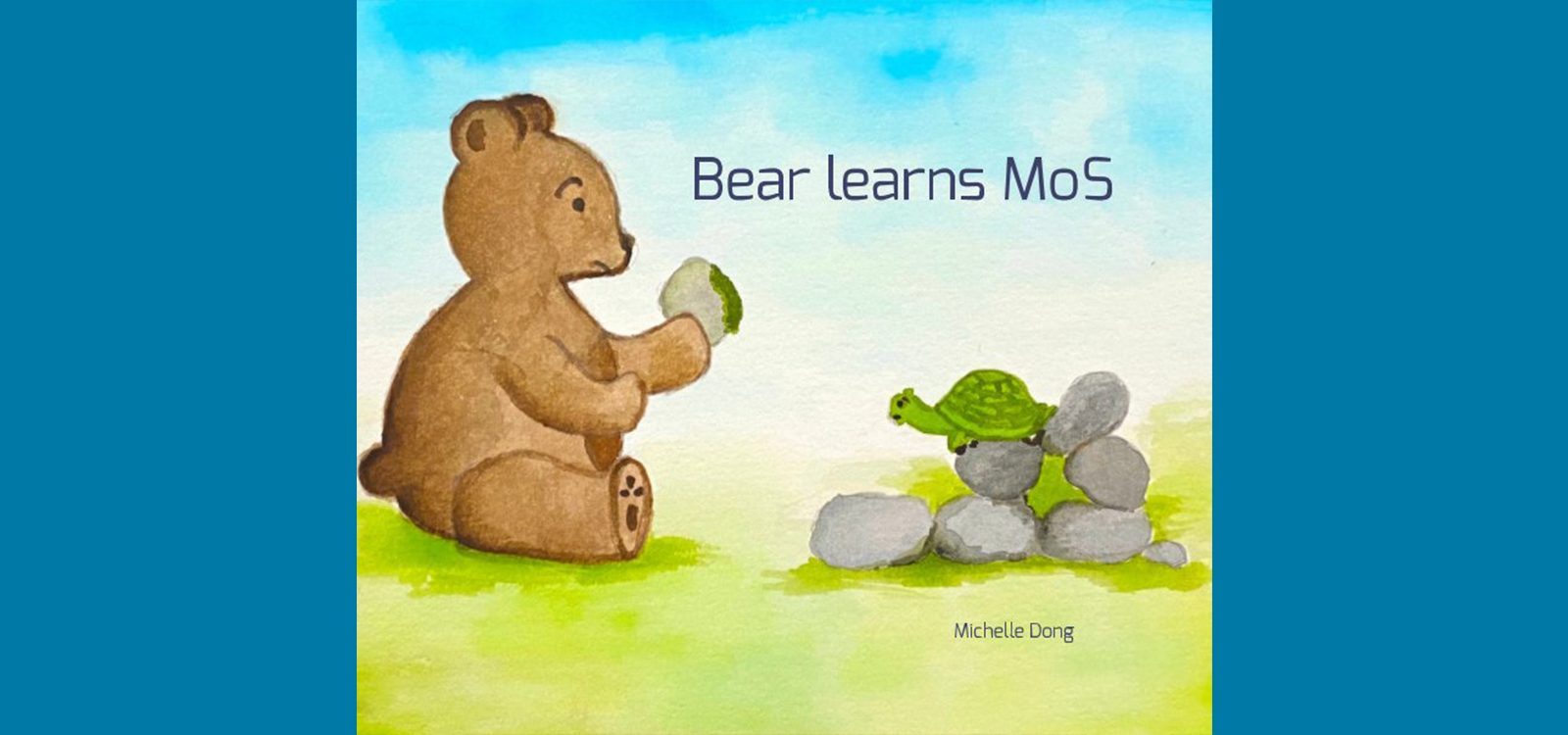

Life insurance valuation is one of the prominent areas of my actuarial working experience. Even today, I recall having long discussions in study groups and with mentors on reserving concepts, and different considerations that arise depending on the scenario. Perhaps by reimagining some of these concepts, life valuation could be made more accessible to a layman, a curious child, or as a bit of entertainment for an actuary. Thus, having found a practical application, I set to work trying to reimagine Margin on Services (MoS) – through a picture storybook.

Our protagonist, Bear, meanders through the forest with Tortoise, contemplating berries (B), present values (PV), incurred but not reported (IBNR), and profit margins (PM). He faces the problem of not knowing how many berries to collect to honour his promises to the other woodland creatures, and Tortoise suggests MoS as a method of quantification.

For a bear who has not had a lot of exposure to life insurance actuarial work, this is a big ask. Tortoise has a lot of explaining to do! As Bear and Tortoise journey on, they discuss some complex actuarial concepts through metaphors and examples. This probably goes without saying, to fully understand the depth and breadth of reserving for life insurance is certainly a much bigger task than a brief sojourn through the woods, but Bear is a curious one and asks his fair share of sticky questions.

The process of painting the pages and writing the story was really enjoyable. I must confess, it was an interesting experience to be thinking through how best to explain concepts like Best Estimate Liability (BEL) and Profit Carrier (PC) to someone who perhaps is not too familiar with life insurance. If anything, this highlighted that it’s not just the technical expertise, but also the communication and holistic view to problem solving that we as actuaries can bring!

As fun and informative as it was, I would probably not recommend having this book as your only source for knowledge on life insurance valuation. Your best bet would be to refer to the course education materials that the institute has to offer. However, I do hope that reading this book can bring some amusement to you, as it has for me in writing and illustrating it.

If you are interested, Bear Learns MoS is available for purchase here.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.