Pandemic Briefing – Morbidity and Macroeconomic Q4 Update

This article was written during the fourth quarter of 2020 and includes updates using latest data at the time of writing.

For most of this year, COVID-19 has been changing the way we live. Some changes have been dramatic, while others have had less impact than anticipated. In June, the initial Pandemic Briefing on morbidity and macroeconomic considerations presented a view of impacts on claim costs through direct and indirect (economic and others) drivers. Broadly, the direct impact of COVID-19 on morbidity is expected to be outweighed by the indirect impact, largely driven by the economy. The economy is affected by both mandatory and voluntary measures to limit the spread of COVID-19, thus impacting overall growth.

An economic downturn affects mental health and the general propensity to claim (or to stay on claim). In addition, other changes to limit COVID-19 (such as isolation and lockdown) also impact people’s mental health. Psychological stress generally has a delayed impact, so mental health related claims are largely yet to emerge.

This article reflects on some key changes in the economy and consequences on morbidity: how unemployment and interest rates have shifted, the impacts on industries, and finally whether this all leads to any considerations for underlying morbidity claim cause drivers.

Considerations raised in this update are not intended as guidance or advice. Rather, this is a discussion around and reflection of some of the impacts driven by changes in the broader economy.

Employment

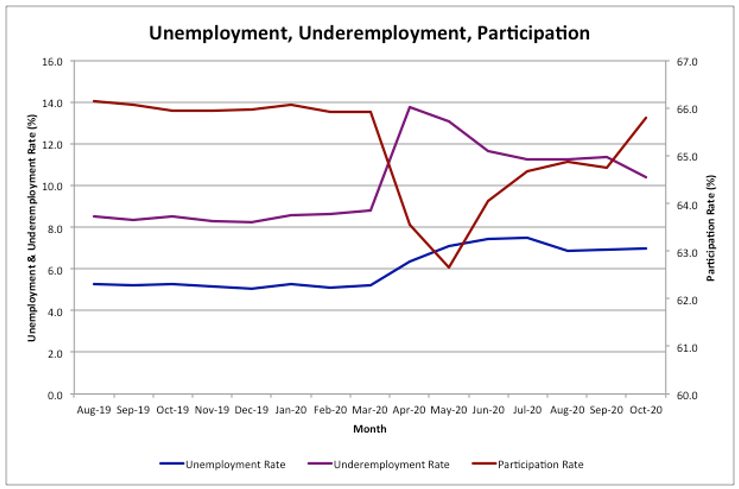

In the morbidity and macroeconomic pandemic briefing article, we note the association between reduced economic activity and higher morbidity claims costs, where measures of employment can be considered a proxy for the state of the economy. Measures of employment (or unemployment) are often more complex than comparing the headline unemployment rate, particularly in relation to morbidity impacts. We consider movements in the unemployment rate, underemployment rate, and hours worked.

Unemployment Rate

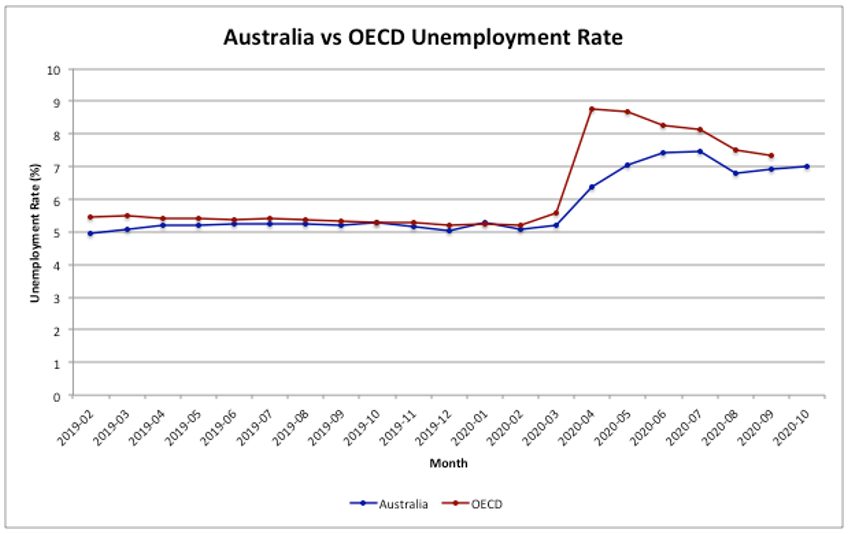

The labour force statistics published by the ABS show that the unemployment rate has fluctuated materially since March 2020, reaching a high of 7.48% in July. This reported rate includes the impact of JobKeeper, without which the actual rate would have been even higher. The changes in unemployment rate between February 2019 and October 2020 for Australia (relative to OECD countries) is shown in Figure 1.

Source: OECD (2020), Unemployment rate (indicator). doi: 10.1787/52570002-en (Accessed on 6 December 2020). OECD Unemployment rate not available for October 2020 at time of writing.

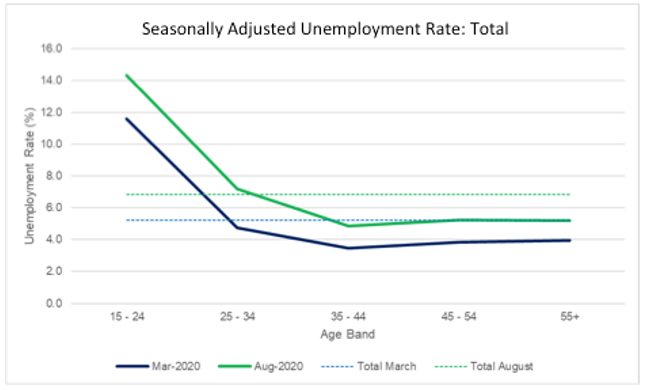

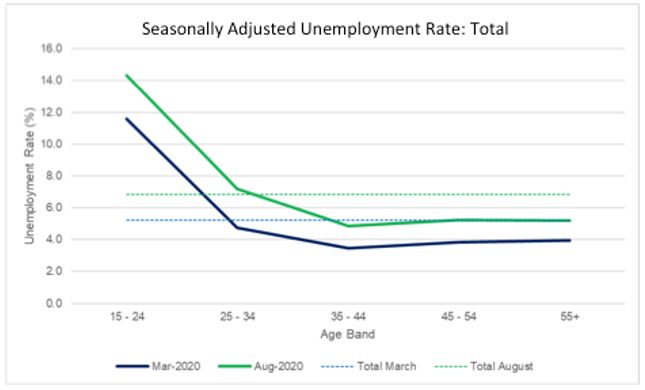

By age, the distribution of the increase in unemployment is not uniform. The most impacted cohort is the 25 – 34 age band in terms of percentage change. Most of the fluctuation by age is observed for males in the 25 – 34 age band, whereas on females the variability by age is less stark. Some of this is driven by labour force participation rate changes by age and gender.

There appears to be signs of recovery in this quarter, though the unemployment rate remains higher than pre-pandemic levels. Movements in the unemployment rate are partially attributable to easing lockdown restrictions and changes in the participation rate. For example, there has been an increase in part-time jobs, offset by a decrease in full-time work. Further, JobKeeper has helped ease the effect of people losing jobs, with an estimated 165,000 people in July working zero hours but counted as employed (EY chief economist).

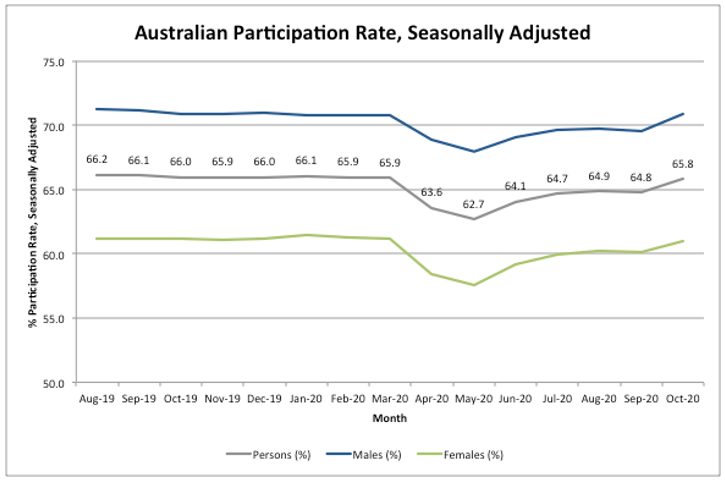

Source: Australian Bureau of Statistics

Whilst more recent data this year shows an increase in the participation rate back to ‘normal’ levels in the range of 65% – 66%, in months immediately following lockdown measures there was an observed decrease in the participation rate. Thus, the fall in participation rate also contributes to an overall lower level of unemployment rate, due to the shrinking of the labour force.

The unemployment rate changes are largely driven by the participation rate, and any job, including people working zero hours on JobKeeper, is treated as employment. To better understand the impact holistically, the underemployment rate and changes in this should also be analysed.

Underemployment Rate

From a morbidity perspective, it is also important to consider underemployment, its implications on the economy, and the flow on mental health consequences. Relative to a year ago, the underemployment rate increased by 1.9%, and the latest reported figures show underemployment at 10.4% of the labour force (October, seasonally adjusted). Over the year, underemployment rate increased earlier than the unemployment rate, and has been similarly showing signs of decrease in more recent months. By gender, the increase in underemployment has been higher for males than for females, though in terms of absolute value, female underemployment has historically been and continues to be higher overall.

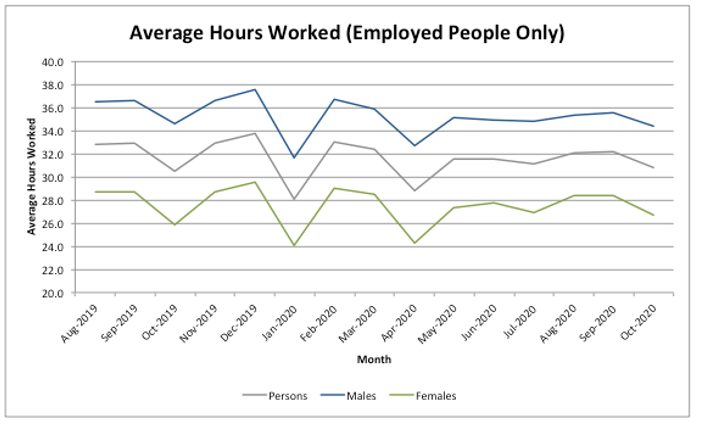

Hours Worked

To get a view of the movement in hours worked and the impact of increases in part-time work as well as employed people working zero hours, the following chart looks at average hours worked over the period August 2019 to October 2020. Note the average hours worked relates to employed people only.

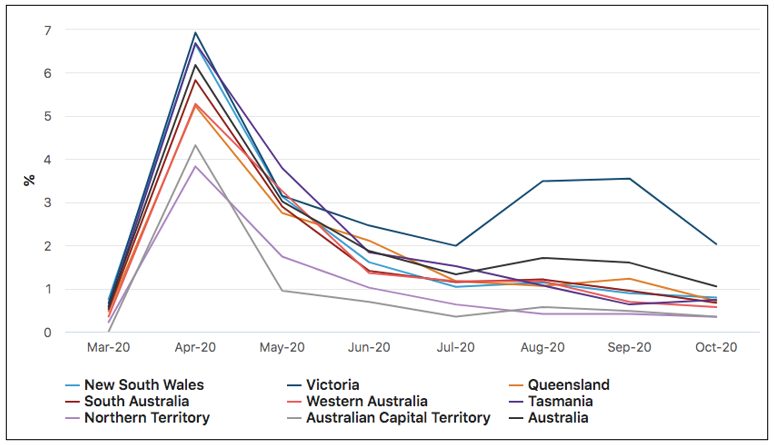

By State/Territory

Whilst the average hours worked has decreased since March, there appears to be a recovery to pre-COVID levels. The impact of the prolonged lockdown in Victoria can be seen through the fluctuation in proportion of employed people working zero hours per week.

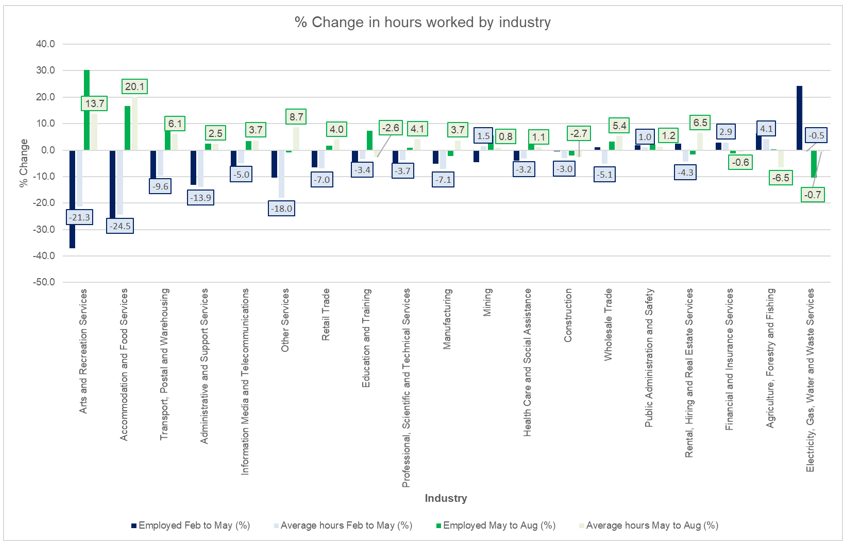

By Industry

In August, the ABS compared the changes by industry and shows the improvement in employment comparing the February to May quarter with the June to August quarter. The below chart shows a more optimistic view of hours worked by industry increasing since May in arts, accommodation, food, and transport industries. Notably, there is an observed decrease in hours worked in construction, agriculture, forestry, and utilities.

Source: Australian Bureau of Statistics – Data Labels refer to % change in average hours worked

For insurers, this gives rise to some key questions and considerations. Most importantly, whether what we have seen in morbidity experience so far aligns with the movement in unemployment. To date there has not been obvious and materially poorer morbidity experience in recent months. This suggests there is a lag between morbidity experience and reported unemployment statistics, particularly in terms of mental health impacts, which we expand on further in this article.

Putting all the pieces together, below is the historical unemployment rate, participation rate, and average hours worked since August 2019 to October 2020.

Looking at all three metrics combined, it is a bit clearer that the initial increase in unemployment rate was dampened by a combination of the lower participation rate, and higher underemployment rate. As participation increases back to pre-COVID levels, the interaction with underemployment and a lower number of hours worked will be important in understanding the overall impact on lives. Aside from looking at employment, there are also other macroeconomic factors at play impacting the morbidity experience we observe. In particular, interest rates are currently at a record low.

Interest Rates

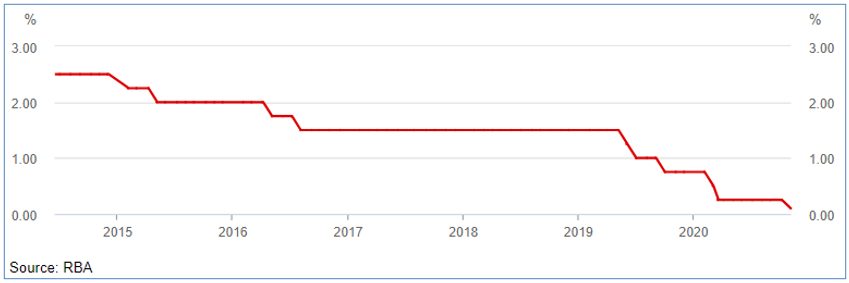

At the time of writing, interest rates are at 0.1%, after the RBA reduced the cash rate twice in March 2020, and once in October 2020. This is an historic low, and the underlying intention is to boost cashflows for businesses and households.

The RBA acknowledges that COVID-19 is having a material impact on the economy, despite being a public health issue. Social distancing measures and restrictions have led to disruptions to economic activity, and the impact is expected to continue. In the medium term, the RBA has made clear its priority to support jobs, incomes, and businesses to help the economy recover once the pandemic is contained.

Over the past five years, the RBA target cash rates have decreased, and can be seen in the following chart.

The key drivers of the low interest rate environment stems from the forecasted economic downturn and is a reaction from the RBA to the observed decrease in inflation rate (from targeted 2-3%), and the observed increase in unemployment rate. Other RBA responses include:

- Reduce cash rate target to 0.1% and keep it at this level until there is an improvement in unemployment and inflation.

- Additional target to three-year Australian Government Bond Yield of 0.1%. This is new and was targeted at 0.25% in the months prior to October 2020. The RBA typically targets the cash rate, rather than bond yields further along the yield curve.

- Reduction in the interest rate on new drawings under the Term Funding Facility to 0.1%

The government has provided ongoing support for people who have had employment impacted by COVID. The JobKeeper program has been extended to run until March 2021. This is estimated to work in alignment with other RBA strategies to reduce the economic impact from COVID.

Whilst it is complex to predict how long the economic impacts from COVID-19 will last, and even less clear how long the morbidity impacts may extend, the RBA comments that it will “take some time to reach pre-pandemic levels of output”. In addition, the RBA is not expecting to increase the official cash rate for the next three years.

Further to this, in a speech from RBA Governor, in reference to COVID-19 impacts, he reiterated that “it will take time repair that damage and it is highly likely that the recovery will be uneven and drawn out. In particular, we face the prospect of a long period of higher unemployment and underemployment than we have become used to”. This may give some broad indication of how persistent economic impacts from COVID-19 are, and potentially morbidity impacts. However, there are other factors and uncertainties that need to be considered in the context of recovery.

Industries

Having considered the broader changes in the economy, and how they impact life insurers, it is also important to appreciate the differences by industry. As discussed in the unemployment section, we have observed differences in changes in hours worked by industry over the past two quarters. For group insurance particularly, industries inherently have different risks, some of which are exacerbated by the economic changes arising from COVID-19.

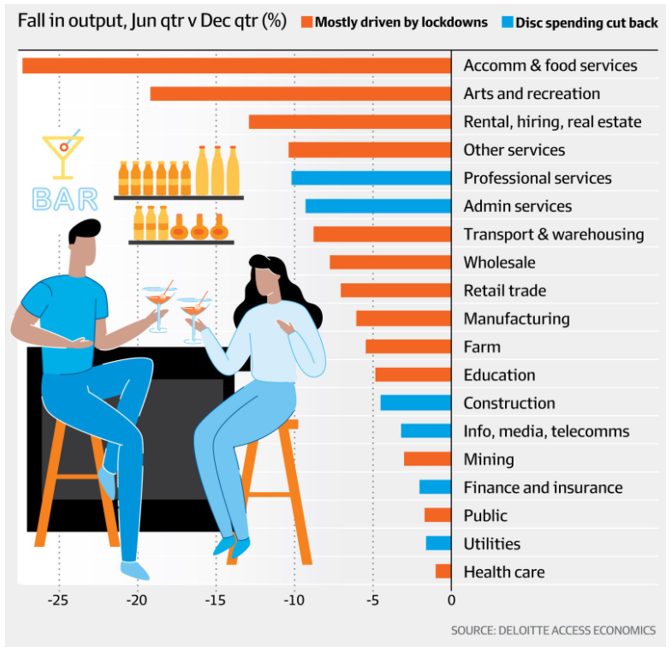

Unsurprisingly, lockdown has impacted growth in accommodation, food service, and retail industries more, and healthcare and utilities less. Nonetheless, according to the Deloitte Access Economics report, there is the expectation that some of these changes in growth are short-term fluctuations, whereas others may have longer term effects. For example, output and employment in the health services is expected to increase in the short-term due to the pandemic, and then stabilise at slightly higher levels. Conversely, arts, recreation, and retail are expected to see short-term decreases in employment and output, and a correction in the longer term.

Given the inextricable link between unemployment, interest rates, and morbidity experience, it is likely that insurers will see (or are seeing already) differences in experience by industry exposure. Below is a view of the changes in output from the June 2020 quarter to the December 2019 quarter.

Comparing with the hours worked by industry (Figure 6, February – May comparison), we see the biggest decrease in the Arts and Recreation, and accommodation and food services. This is consistent with the Deloitte Access Economics findings, which largely attribute the decrease in output to lockdowns. One inconsistency arises in the finance and insurance industry, where hours worked between February and May actually increased slightly but output decreased. However, there are likely other factors in this industry driving the decrease in output. Similarly, this behaviour is observed in agriculture, utilities, and the public sector.

Based on the above and considering the % changes observed from June to August, we may be able to infer that there is likely an increase in output for industries where employment has increased (accommodation and food services, arts and recreation), and deterioration in others. Even within industries, there is variation in output and employment levels.

Mental Health

One significant component of morbidity experience that we have yet to discuss in detail is the impact from mental health. So far, with JobKeeper and low interest rates, reported unemployment rates have not increased as drastically as initial expectations. However, there is an expected lag between changes in the economy and society driving mental health consequences, and subsequent reporting lag of mental illnesses.

Some institutions have published research exploring the impacts of psychological distress arising from COVID-19, for example the Brain and Mind centre at the University of Sydney. Generally, psychological stressors have a cumulative impact, and the full impact from COVID-19 may take some time to be revealed. Factors that are expected to drive deterioration in overall mental health include the social impact of lockdown (reductions in community connectedness, social gatherings) and increases in unemployment rates. Conversely, other factors including government employment programs, such as JobKeeper, are expected to mitigate the adverse impacts on mental health.

In terms of morbidity claims, these factors (lag in mental health presentations, lag in unemployment rate reductions, importance of employment programs in dampening the effect of mental health) all contribute to the expectation that the bulk of the morbidity impact from COVID-19 is yet to be seen.

Morbidity Observations

In light of JobKeeper, changes in interest rates, unemployment, and interactions between these, where do we stand now? How do things differ by industry, and what are some of the things we could consider?

As we noted earlier in the year: “quarantine, self-isolation and general lock-down measures remove people from the active workforce and limit economic activity. Even in the absence of such measures, economic activity would be reduced because of general fear of becoming infected”. With Victoria having a markedly different lockdown experience to the rest of Australia, it is worth considering the impact due to lockdown and social distancing. As data becomes available, it would be interesting to investigate mental health presentations by state.

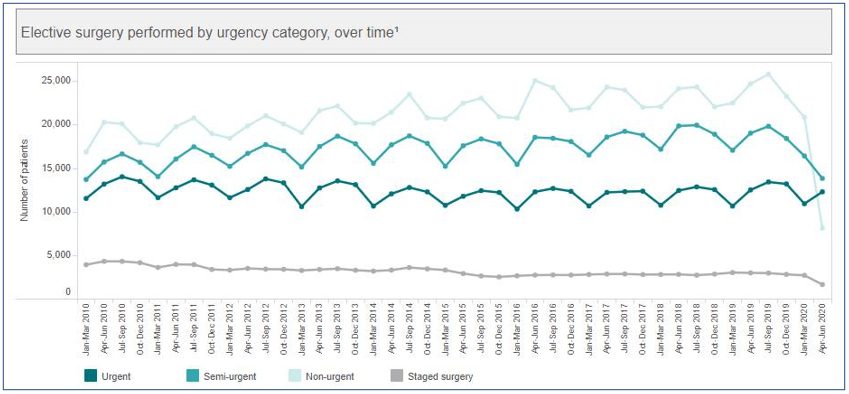

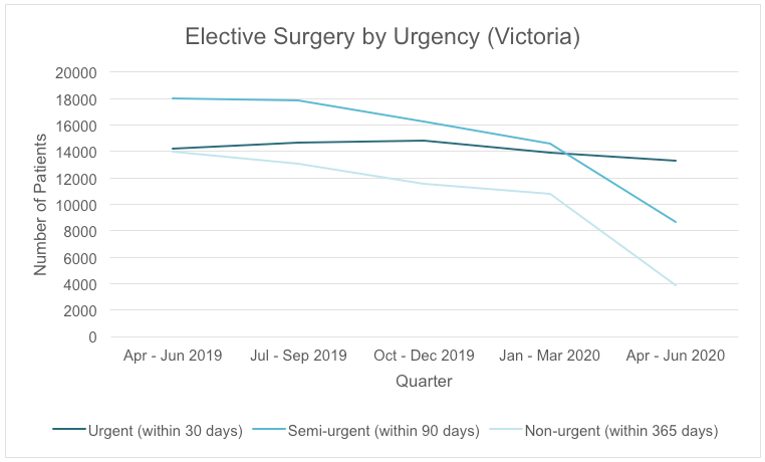

One interesting outcome is the decrease in output in the Health Care industry. Note this is not limited to COVID-19 care, but also includes elective surgeries. Both NSW and Victorian health data shows although urgent surgeries have not changed materially in volume, there has been a marked decrease in non-urgent and semi-urgent surgeries. Given the ongoing lockdown situation in Victoria, it is expected there may be a slower recovery in non-urgent elective surgeries compared to other states, but this is not clear yet. In terms of morbidity impacts, the reduction in elective surgeries has resulted in increases in backlog cases and in some circumstances may lead to adverse morbidity experience.

Source: Bureau of Health Information

Source: Victorian Agency for Health Information

It is becoming increasingly clear that the economic impact on morbidity claims costs will exceed the direct (sickness) impact for life insurance companies. In light of the changes in the economy stemming from COVID-19, we can reflect on some considerations from a morbidity perspective. One key facet we need to be aware of is the delayed response to the changes in unemployment rate. Although there has not yet been any evidence of significantly worsening experience to date, there are factors that contribute to delays, most importantly, government and central bank support is still largely in place, and there is the expected deterioration to industry and employment when JobKeeper benefits cease.

Ultimately, the indirect impact of COVID-19 on morbidity is expected to outweigh the direct impacts. In particular, the economy, including employment, interest rates, and the way we work has changed. These changes, as well as other measures to limit the spread of COVID-19 such as lock downs, have impacted mental health. Psychological stress is often delayed and cumulative, so the full impact of COVID-19 on morbidity may yet to be seen.

Additional Sources

Unemployment:

Interest Rates:

By industry:

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.