Personalised pricing of annuities in the UK

The knowledge imparted to Australian Diploma of Financial Planning students around 2002[1] when revising the section titled ‘annuities’ was that lifetime annuities represented good value only for those with good health and a long-life expectancy. Developments since show that the benefits can be extended to those in poorer health and with shorter life expectancies.

Value of annuities

First, it seems appropriate to comment on the value of annuities, which is often referenced in economic terms, of which there are many approaches, namely the money’s worth ratio, internal rate of return, and many others. An issue with the economic assessment of value is that it requires an assumption of duration in calculations and ratios, which will align more with pricing assumptions than the lifetime of the customer and product. It also ignores the value customers place on certainty of retirement income, a critical component to retirement lifestyle. This intrinsic value is possibly the reason annuity markets across many regions have been surprisingly stable through a sustained low interest rate environment.

The UK market

The United Kingdom (UK) is a market where annuities were commonplace. This changed in 2013 when the Chancellor of the Exchequer made a public statement that “nobody will have to buy an annuity”. While the then Chancellor might say that these comments were intended as a statement of fact, others would suggest its ripples had far greater effects and demonised the product. That being said, of the £40bn (AUD$72.26bn) of assets that transition from accumulation to retirement products each year, just over £4bn (AUD$7.23bn) is used to purchase lifetime annuities. Half of all annuity customers take up the convenience of an offer to purchase an annuity from their existing providers, while the other half shop around on the open market for a competitive annuity rate.

Some features of the market worth mentioning include:

- A universal state pension provides no incentive or disincentive for annuities relative to drawdown products. The guarantee offered by prudently managed insurance assets is underpinned by a commitment from the UK’s Financial Services Compensation Scheme, which offers 100% coverage for contracts of long-term insurance with UK-regulated insurers.

- UK Insurers often securitise lifetime mortgages (equity release) as a backing-asset that matches the duration of annuity liabilities – hence, the UK equity release market is underpinned by insurers offering annuities and defined benefit arrangements

The market for annuities has reduced following 2013, however, the approach to pricing and underwriting has continued to evolve.

Evolution of annuity pricing in the UK

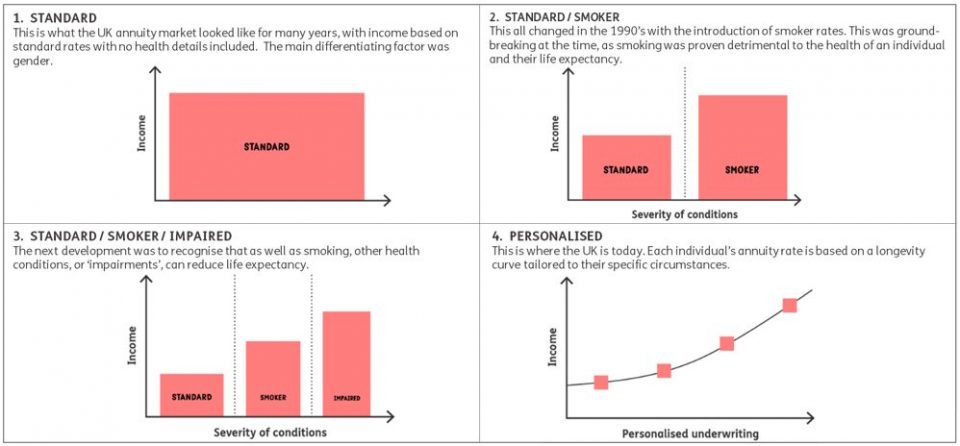

While UK insurers are not permitted to use gender as a factor to determine pricing (EU Directive 2004/113/EC), the market has evolved to incorporate a range of other factors to price annuities. A quick tour through time would define these stages as:

- Introduction of Smoker rates as an additional factor, similar to life insurance;

- Broadening of the standard and impaired/enhanced markets where customers with serious health conditions qualified for higher rates; and

- Development of sophisticated underwriting models incorporating socio-demographic, health, lifestyle and medical factors which deliver personalised rates, and the disappearance of any distinction between ‘standard’ and ‘impaired/enhanced’ terms.

Customer perspective

From a customer perspective, there are advantages from more sophisticated pricing approaches, such as:

- Fairness of an individual price and reduction of the degree to which mortality cross-subsidies favour those in better health (as suggested by the Diploma of Financial Planning education received by one of the authors in 2002); and

- Ability for customers across all levels of health to benefit from certainty and simplicity of a guaranteed income for life, not necessarily having to be on the losing side of a distribution.

On the former point, the impact of socio-demographic factors on underwriting is high enough to suggest that the use of these factors also reduces the degree to which poorer customers subsidise wealthier customers.

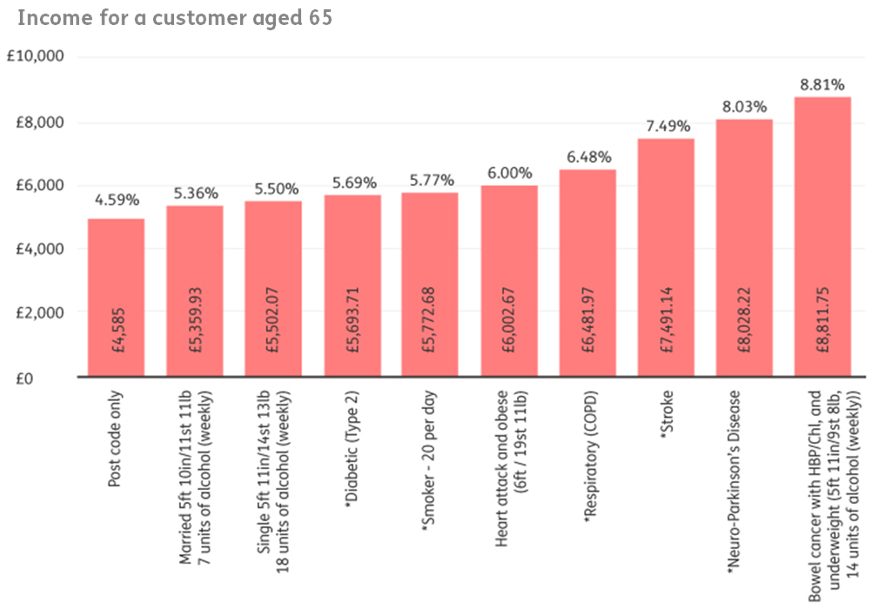

The latter point is demonstrated in the following chart, which shows the higher annuity amounts typically available to those who are likely to be subject to heavier mortality. We estimate 40% of the UK population would be eligible for some uplift, and 10% for an uplift of 20% or more.

Competition perspective

As annuities are often sold based on price, the ability to price at more granular levels than competitors can allow an insurer to acquire new business with acceptable commercial margins and offer terms to some clients who may fall outside the underwriting range of competitors.

An advantage for one insurer can translate to a disadvantage for others. Say there are two insurers in a market: Insurer A offers standard rates while Insurer B offers personally underwritten rates. In a price-driven market, Insurer B will acquire new business where it can out-price Insurer A. Using the UK as an example, this is estimated to be 40% of the market. In this scenario, Insurer A loses more than just market share. It will also see worsening mortality experience, as its business mix shifts towards annuitants with longer than average life expectancy.

This occurred in the UK’s early days of impaired annuities, the learning being that it is in nobody’s interest for insurers to discover and need to meet the cost of substantial shortfalls in assets required to back liabilities.

If we now consider the balance sheet, there are further advantages of having greater confidence in annuitant mortality. Insurers in the UK are encouraged to match assets and liability cashflows (Solvency II: Matching adjustment | Bank of England). Having a greater confidence in the profile of liability cashflows provides insurers the ability to select better matching assets. In a mature market, like many other factors, an enhanced investment experience is often passed to the customer via a more competitive rate.

Lifetime annuities in Australia

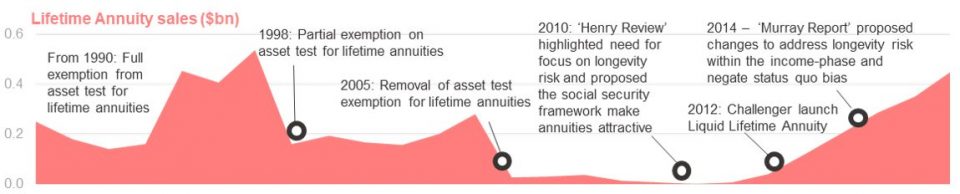

In 2005, the removal of an asset test exemption for lifetime annuities coincided with a period of substantial inflows followed by a sharp descent. While the market for lifetime annuities in Australia all but evaporated for almost a decade, there were examples of alternatives. Variable annuities and guaranteed funds came and went.

Today, it is clear that the Australian retirement income sector would benefit from innovation. It is also clear that sales of lifetime annuities (and most other retirement products) are heavily dependent on their impacts on the Age Pension benefits and hence the overall value provided to customers.

A discussion on the Age Pension system and suggested changes is out of reach for the mere mortal authors…

As a comparison, APRA’s Annual fund-level superannuation statistics[1] show that members between the ages of 55 and 64 have about $540bn in their accounts. If 10% retire each year, and 10% flowed into life annuities, the market could be over $5bn annually.

Summary

As underwriting models have evolved, several factors have been included. Sociodemographic factors, for which postcode is a proxy, are important to the annuity rates offered by insurers. Beyond sociodemographic status, lifestyle factors, medical conditions and treatments, even marital status are all typically factored into annuity pricing bases. Insurers have gained underwriting capability as part of reinsurance arrangements, or by investing in proprietary capability. Those who invested in technical pricing capability have accumulated sufficient experience to leverage pricing skill as an asset that can be used to create value for the insurer and customers.

[1] Around the time Mark Johnson studied the course

[2] APRA Annual Fund-Level Superannuation Statistics June 2020

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.