An introduction to energy markets and some of the actuaries working within the sector

In the first of a series of articles on an actuarial perspective of the energy sector, Peter Eben, Azhar Khan, Matthew Legg and Daniel Teng introduce the National Electricity Market and its main participants.

Energy is an essential part of modern life that has recently been the focus of several political and ideological debates. Actuaries are well reputed as astute financial problem solvers where uncertainty and long timeframes exist. The energy industry presents both these key characteristics and is a fascinating example of where the traditional actuarial skill set can be applied to navigate new problems.

The energy industry attracts interest for various reasons:

- it is an essential service;

- rapid technology advances mean there is significant transformation ahead;

- electricity and gas costs have been unpredictable and volatile over the past five years;

- the sector is a major contributor to greenhouse gas emissions and climate change is at the forefront of social and business decision making; and

- Australia’s economic reliance on energy continues to grow from both exports like coal and gas, as well as the raw input cost to industries like manufacturing and smelting.

The industry is faced with several challenges. This includes an ageing fleet of coal power stations that need to be replaced over time, disruption and opportunities from new technologies like renewables, batteries and other assets which are competing in an outdated market structure not designed for these new technologies, intermittency, and political and regulatory uncertainty that inhibit investment and longer-term planning. As a recent example, average daytime electricity prices have fallen considerably over the past year due to increased grid and rooftop solar generation, in some cases up to 70%, which puts immediate pressure on coal power providers.

|

To give you an understanding of the ecosystem that the electricity market operates in, did you know:

|

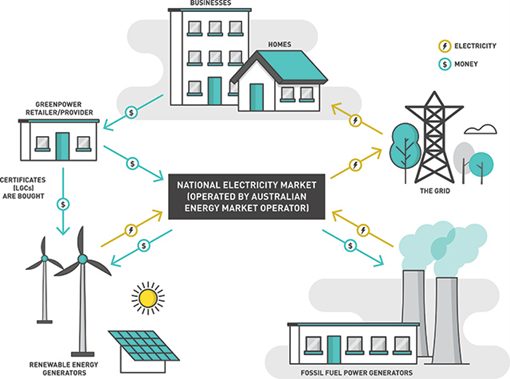

A typical household consumes 5-10 MWh of electricity a year1 and spends, on average, $2,000 on this consumption2. This bill is paid to the retailer which in turn covers a range of costs including wholesale costs for the value of the energy, the network charges associated with delivering the energy, renewable energy compliance costs and other charges levied by the electricity retailer.

|

Traditional electricity system participants include:

|

Actuaries are well-placed to work in the energy sector as we are adept at modelling uncertainty, contingent cashflows and long-term projections. There are several examples of actuaries tackling problems in the energy sector:

- Modelling demand, supply, and spot prices which is becoming increasingly challenging with growing intermittent renewable generation

- Valuing financial contracts (eg. a Power Purchase Agreement) which are based on unknown future spot prices and intermittent renewable generation

- Retail pricing of electricity contracts including the calculation of embedded risk premiums

- Reviewing market rules changes and reforms to predict unintended consequences.

- Energy portfolio optimisation across physical and financial assets

- Insurance pricing for generators and transmission providers who are susceptible to climate change risks.

Over the next few articles, the Energy Practice Working Group will be covering some of these topics. And for any other actuaries working in the sector, we encourage you to reach out for inclusion in the taskforce or even just to meet fellow actuaries working in the space.

[1] – https://www.energymadeeasy.gov.au/benchmark

[2] – https://www.energymadeeasy.gov.au/plan?id=ORI25194MRE&postcode=2000

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.