Discounting the future: social discounting for climate-related projects

Over $US130 trillion of capital is now committed to transforming the global economy into one with net zero emissions[1] in order to avoid catastrophic climate change. So, are robust frameworks in place to ensure this staggering amount of investment flows to the most worthy and impactful projects?

This article dives into one of the most important inputs into decisions that will direct public investment in climate change – the social discount rate. Climate-related investments often need to be evaluated over several decades – so the discount rate used is critical. When used in cost benefit analysis, high discount rates result in lower amounts of investment today to avoid costs that are decades in the future (relative to lower discount rates).

Australian government agencies routinely use a discount rate of 7% to evaluate costs and benefits of projects spanning decades. 7% might have been appropriate when interest rates and intergenerational equity were higher[2], but is much harder to justify today – with borrowing rates at historic lows and growing inequity in the average wealth and wellbeing between younger and older generations. A 7% discount rate is also out of step with many other governments who are using considerably lower hurdle rates in their decision-making process to invest in climate change adaptation and transition.

Introduction

Discount rates are used to put a present value on costs and benefits that will occur at a later date. They are one of the most important inputs in a cost-benefit analysis. For projects impacting several generations, which involve a trade-off between consumption today and consumption in the far future, a social discount rate (SDR) should be used.

A SDR is the discount rate used in cost-benefit analysis of social projects and investments by government. A high SDR effectively results in decisions that prioritise benefits to current generations over benefits to future generations. A low SDR means more importance is given to future generations’ wellbeing in cost–benefit analyses.

Climate-related projects often need to be evaluated over several decades and may involve significant investment in the short term with benefits only seen over the long term. The discount rate used is critical in determining how we invest to guard against the future costs of climate change.

What is a social discount rate vs a commercial discount rate?

In commercial applications, the discount rate is commonly derived as the opportunity cost of capital. When government agencies make investments (e.g. in infrastructure, health or the energy system) they need to reflect ‘social’ considerations, not just the opportunity cost of capital.

Social discounting is a more normative concept and needs to reflect the inter-temporal trade-offs that are acceptable to society (that is, society’s views on the importance of costs and/or benefits today versus costs and/or benefits to future generations).

There are two alternative approaches to setting a social discount rate:

- The social opportunity cost of capital approach (SOC) defines the discount rate as the rate of return that a decision-maker could earn on a hypothetical ‘next best alternative’ to a public investment.

- The social rate of time preference approach (SRTP) defines the discount rate as the rate of return that a decision-maker requires in order to divert resources from use today.

In the SRTP approach, economists break down the social discount rate into three separate components:

- rate of pure time preference (δ): For time horizons covering several decades, this can be seen as an expression of the weight given to consumption by different generations. As a result, this component of the social discount rate is the subject of much debate.

- elasticity of marginal utility (ƞ): a measure of the sensitivity of the benefit gained from incrementally more consumption relative to the change in one’s wealth. In general, the increase in utility from consuming more today generally falls as one’s wealth increases.

- rate of growth in aggregate consumption (g): a measure of the growth in the society’s wealth.

These three components are combined to calculate the social discount rate as r = δ + ƞ*g – often referred to as ‘the Ramsey formula’.

While there is considerable variation in practice in setting a SDR, a 2018 survey of about 200 international experts found that more than three-quarters agreed a SDR of 2% was acceptable. While their responses covered a wide range of median values ranging from 1% to 3.5%, the median SDR (allowing for intergenerational discounting) was 2% per annum.

Why does the SDR matter?

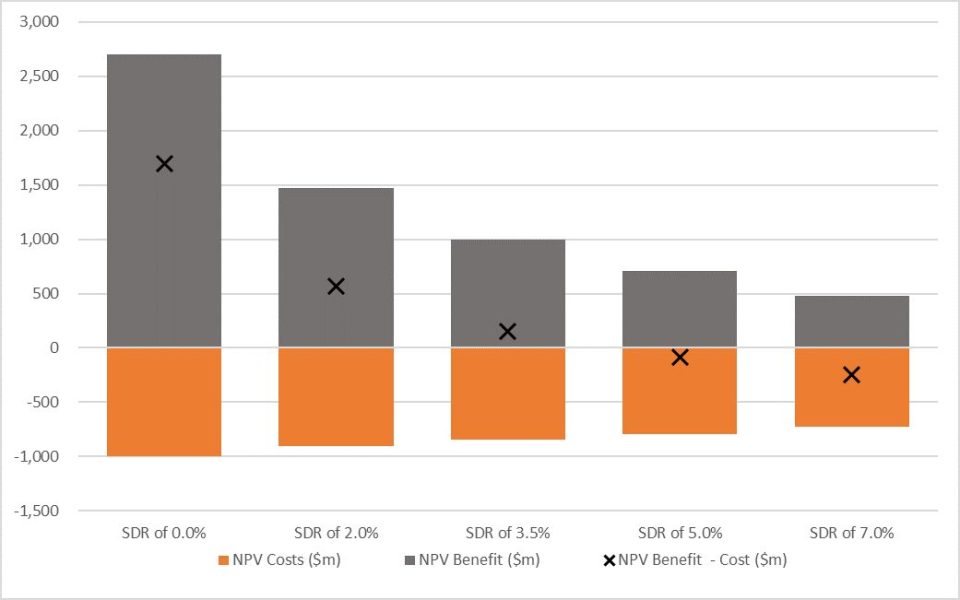

In projects with long time horizons, the discount rate chosen is critical. Consider an example of a hypothetical project requiring an outlay of $100 million in each of the first 10 years and providing benefits of $50 million per year for 55 years from the fifth year onwards. As shown in Figure 1, small changes in the discount rate have a major influence on whether such a project passes or fails a cost-benefit test. The sensitivity of the net present value (NPV) of benefits to the SDR is much higher than the sensitivity of the costs in examples where benefits are realised over the long term.

Figure 1: Illustrative effect of different SDR on cost-benefit analysis result

This example highlights the issues that can arise when high discount rates are used. Investors using discount rates over 5% would pass up opportunities captured by those using lower hurdle rates to invest in climate change adaptation and transition.

Cost-benefit analysis gives very different outcomes depending on the SDR used. If the discount rate is too high, worthy projects may be rejected. If it is too low, unworthy projects may be approved.

So is there global consensus on a social discount rate for climate adaptation projects?

There have been several studies on the economics of global warming, but there is no global consensus on the ‘right’ SDR. The use of different SDRs leads to very different conclusions on the amount of investment that should be made today to avoid future costs of climate change.

The work of William Nordhaus in the early 1990s – for which he won a Nobel Prize in 2018 – focussed on developing an ‘optimal’ pathway balancing the costs of climate change mitigation today against the costs of inaction later. Nordhaus’s original optimal pathway would lead to a rise in global average temperatures of 3.5°C by 2100. Subsequent work by the IPCC and others, however, concludes that limiting temperature increases to between 1.5°C and 2°C is an optimal strategy in welfare terms and the Paris Climate Agreement that warming should be limited to “well below 2°C”.

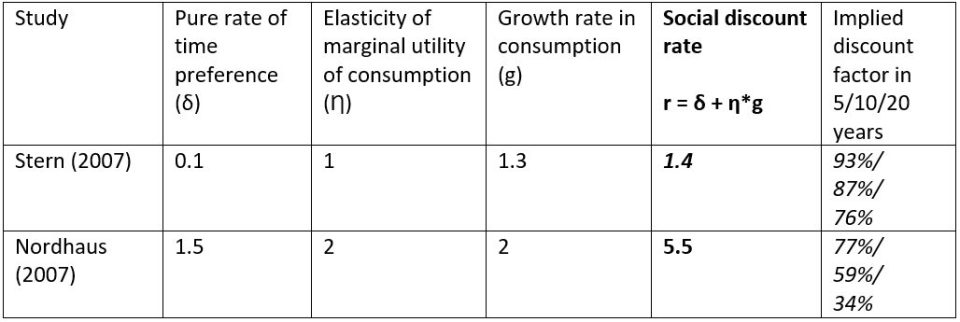

Nordhaus used a SDR of 5.5% in his modelling, which is considerably higher than that of similar studies such as the Stern Review which used 1.4%. Table 1 highlights the effect of discounting costs and/or benefits at 5.5% compared to 1.4% over 5, 10 and 20 years. A paper published by the London School of Economics last year showed that using current thinking on social discount rates, and updated climate science, brings Nordhaus’ optimal pathway in line with limits of 1.5°C to 2.0°C. This shows how the use of an inappropriately high discount rate delays the optimal timing of emissions reductions and investment in mitigation.

Table 1: Different discount rates derived from the Ramsey formula

So what social discount rates are currently being used in the public sector internationally?

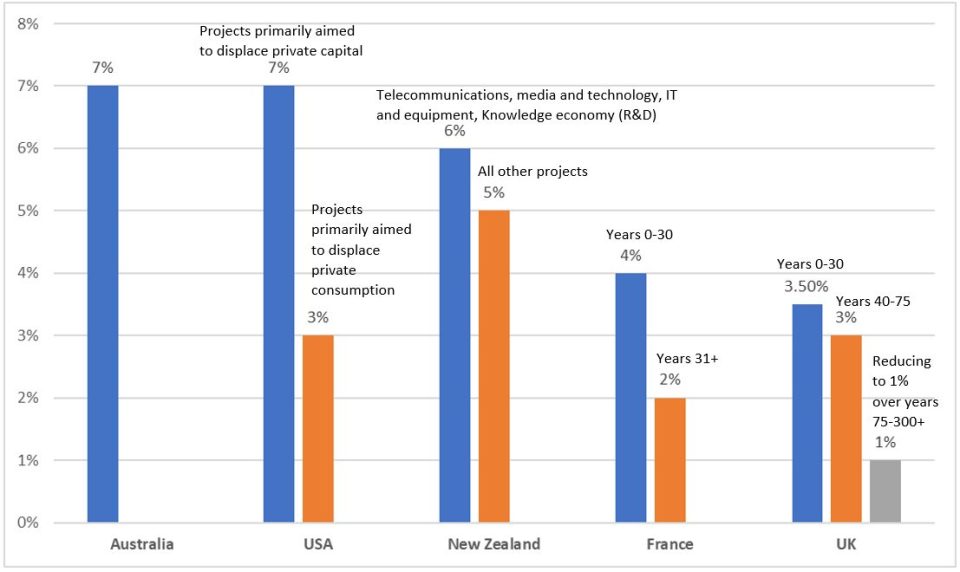

Public sector discount rates (used in projects spanning several generations) vary significantly across the world. As shown in Figure 2, a 7% SDR is at the top end of the range.

Figure 2: Public sector discount rates in a range of developed countries

While most governments use a time-constant SDR, but the United Kingdom and France adopt time-declining discounting schemes. The disadvantage of using a time-constant SDR is that, even with moderate discount rates, large future costs have almost no effect on current decisions. Declining discount rates alleviate this problem by discounting the far future at a lower rate. Declining discount rates are also broadly consistent with how people think about the future and are more appealing from an intergenerational equity perspective[3].

Is Australia’s use of 7% reasonable?

Australia’s SDR of 7% is high compared to other governments and not aligned to keeping warming well below 2 degrees. Federal and State Governments in Australia commonly use a discount rate of 7% to assess public investment. The use of 7% by many government agencies has occurred since at least 1988[4] [5] at a time when yields on Australian Government 10-year bonds were above 13% (see Figure 3). Although sensitivity analyses for government projects may be carried out using a range of discount rates between 3% and 10%, is this still appropriate for evaluating climate risk related projects?

Figure 3: Australian Government and NSW Treasury 10 year bond yields

A 2018 Grattan Institute paper considered discount rates for cost-benefit analyses of transport infrastructure projects (using a SOC approach) which, like climate risk related projects, also have time horizons spanning more than one generation. This took account of the considerable falls in interest rates over the last 30 years since the Australian Government’s discount rate was set and put forward a recommended discount rate for infrastructure projects of:

- 5% where there is low systematic risk[6] (e.g. bus, urban road, and urban passenger rail projects)

- 3.5% where systematic risk is higher (e.g. ferry and freight rail projects).

As shown in Figure 2, New Zealand also recommends using a higher SDR for projects where the opportunity cost of capital is higher due to systematic risk e.g. telecommunications, media and technology, IT investments have a higher recommended SDR than buildings. Similar thinking could be applied to different types of climate investments.

Conclusions

A 7% SDR might have been appropriate when interest rates and intergenerational equity were higher. But it is much harder to justify today – with interest rates at historic lows and growing inequity in the average wealth and wellbeing of young versus older Australians. The Australian government discount rate of 7% also seems out of step with other governments who are using considerably lower hurdle rates to invest in climate change adaptation and transition.

The Climate Risk Working Group (CRWG) is exploring the range of factors that influence investment in adaptation to climate change. The climate risks and opportunities draw focus to investment in opportunities to reduce greenhouse house gas emissions and transition to the future net zero economy. However, it is critical to also invest in a stronger and more resilient built environment. The 2021 IPCC report highlights the foreseeable warming pathway and the associated physical risks; unfortunately Australia will be significantly impacted. Investment today in a more resilient built environment will benefit current and future generations, and dampen the growing cost and disruption of natural disasters to our lives, livelihoods and the financial stability of our economy.

Please refer to the Actuaries Institute Climate Risk Resource Centre if you are interested in climate risk or recent work completed by the CRWG. A fulsome paper on a framework for analysing climate risk projects can be found in this 2020 Society of Actuaries paper.

|

[1] https://www.gfanzero.com/press/amount-of-finance-committed-to-achieving-1-5c-now-at-scale-needed-to-deliver-the-transition/

[2] Where there is higher intergenerational equity, the disparity in the wealth and wellbeing of younger and older generations is smaller. [3] https://www.lse.ac.uk/GranthamInstitute/wp-content/uploads/2014/02/discount-rates-climate-change-policy.pdf and https://onlinelibrary.wiley.com/doi/full/10.1111/jpet.12497 [4] p.3-6 https://www.australasiantransportresearchforum.org.au/sites/default/files/2013_douglas_brooker.pdf |

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.