Inflating and deflating – the real value of money

After a decade of averaging less than 2% p.a., inflation shot up to 6.1% for the year to June 2022.

This is the highest annual increase since March 1990 (excluding the one-off increase after the introduction of the GST). The Reserve Bank of Australia (RBA) is expecting inflation to peak at 7% by year-end.

Rising inflation hits people’s hip pockets. Cost of living concerns are more prevalent, with prices increasing but wages barely moving. The average worker is worse off than a year ago – the real value of their income has decreased.

Inflation is also a concern for investors. Investors want to ensure that their money maintains (or grows) its real purchasing power over time. However, even before the recent increases in the RBA cash rate, the real risk-free return was currently negative. With inflation over 5% and some interest rates still close to 1%, investors in cash are seeing the real value of their assets decrease.

The release of the Australian Securities and Investments Commission’s (ASIC) RG276 Superannuation forecasts: Calculators and retirement estimates highlights the importance of allowing for inflation in retirement forecasts.

For a retiree, protecting the real value of their income stream is as important as protecting their capital from the effects of inflation. A dollar of income buys a lot less than it did ten or twenty years ago. Even in the recent low inflation environment, a retiree would need $121 today to buy the same goods as $100 bought in 2010.

Inflation also impacts future projections. While $1 million might provide a very comfortable retirement today, in 20 or 30 years that same amount won’t go nearly so far. ASIC’s recent consultation regarding superannuation forecasts[1] recognises this importance of explaining the effect of inflation to consumers:

|

“We think that most members do not have a strong understanding of inflation rates or the impact they can have on long-term forecasts… We think superannuation forecasts are most useful for superannuation fund members when they show how much income the member would have available in retirement.”

|

Adjusting for inflation

Adjusting for inflation is a well-recognised principle by actuaries and many others within the industry. ASIC RG276 requires that estimates produced by superannuation and retirement calculators are adjusted for inflation. The Institute’s Practice Guideline 499.02 expresses a similar preference.

ASIC sets default inflation rates at 4% p.a. while the member is in the accumulation phase (reflecting wage inflation) and 2.5% p.a. while the member is in the retirement phase (reflecting consumer price inflation).

ASIC does not prevent a superannuation calculator from modelling a range of inflation assumptions, nor prevent users from inputting their own alternative inflation rate assumptions in a superannuation calculator or interactive retirement estimate.

Price or wage inflation

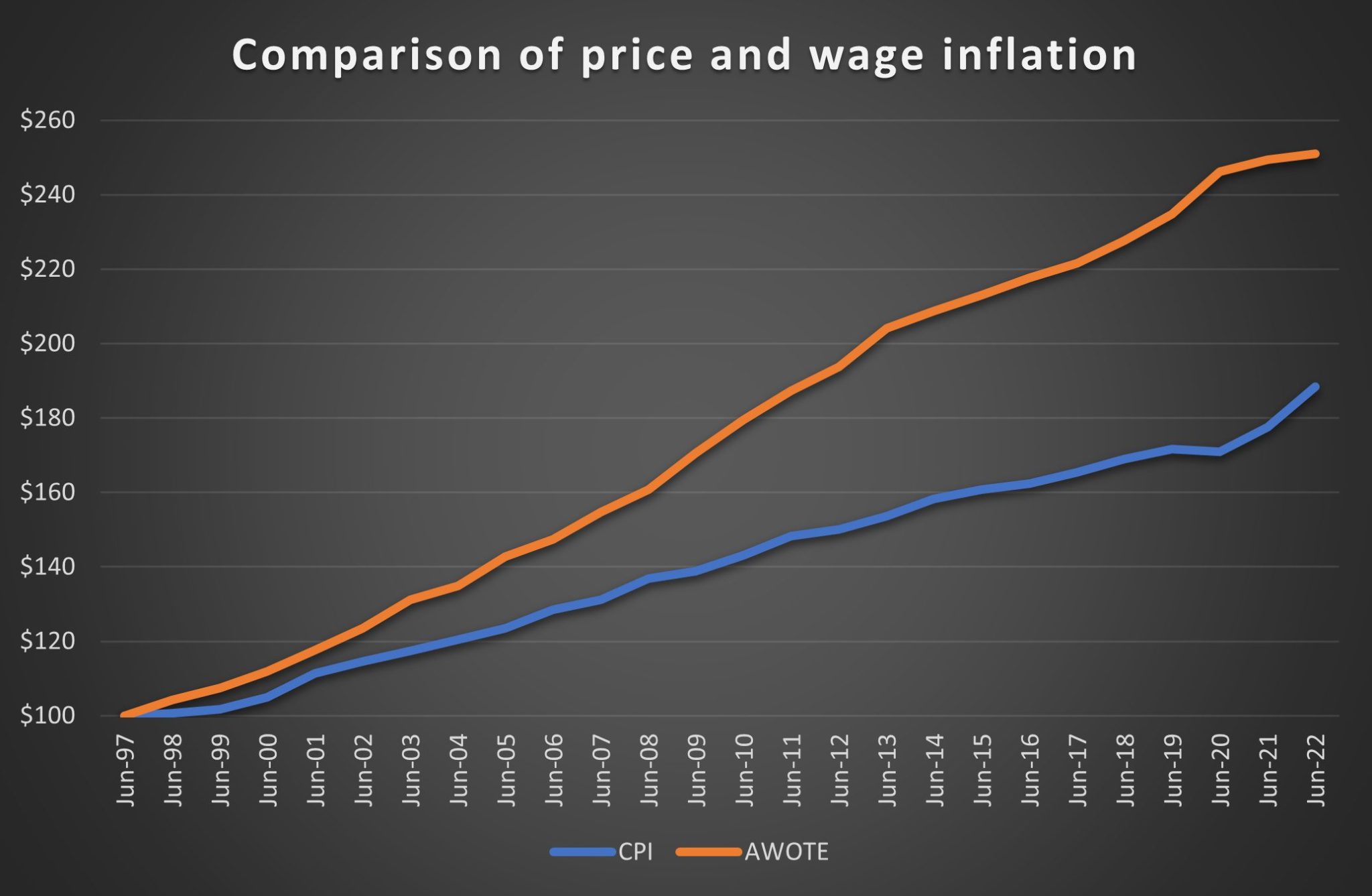

The choice between wage and price inflation can have a significant impact on projection results. Over most periods, wage inflation increases at a faster rate than prices, as shown in the chart below. Simplistically, prices increase by the rate of price inflation plus productivity (or ‘standard of living’) improvements.

Over the last 25 years, the average wage has increased by 3.8% p.a. whilst prices have increased by 2.5% p.a. – $100 in 1997 would now be worth $250 if adjusted for wage inflation but only $190 if adjusted for price inflation. Over the last 50 years, the average wage has increased by 6.3% p.a. whilst prices have increased by 5.0% p.a.

ASIC’s default inflation rate for the accumulation phase is a forecast of wage inflation (i.e. long-term nominal wage growth) while the default inflation rate for the retirement phase is a forecast of long-term consumer price inflation. This is consistent with Treasury modelling used in the 2021 Intergenerational report and in the Retirement Income Review.

Conversely, Australian social security payments are increased by price inflation before retirement (e.g. JobSeeker) and by the greater of wage and price inflation after retirement (e.g. Age Pension). As a result, the Age Pension has risen from $168 per week in 1995 to $450 per week in 2022[2] while the unemployment rate has only increased from $155 to $320 over the same time.

The Age Pension increases serve two purposes. It is the increase that a current pensioner gets. It is also the increase for the next ‘generation’ of new pensioners. For the latter group, standard of living (wage) increases is seen as appropriate. For the former group, arguably price inflation is only necessary. Since it is difficult to have different rates for new and in-force pensioners, its kept at (effectively) wage inflation.

Other measures of inflation

Consumer Price Index (CPI) is generally considered the more appropriate measure for the increase in retirement income payments. It is the rate typically used for increasing pension payments, by Commonwealth Super Scheme (CSS) and UniSuper defined benefit pensioners and by Challenger for their annuities.

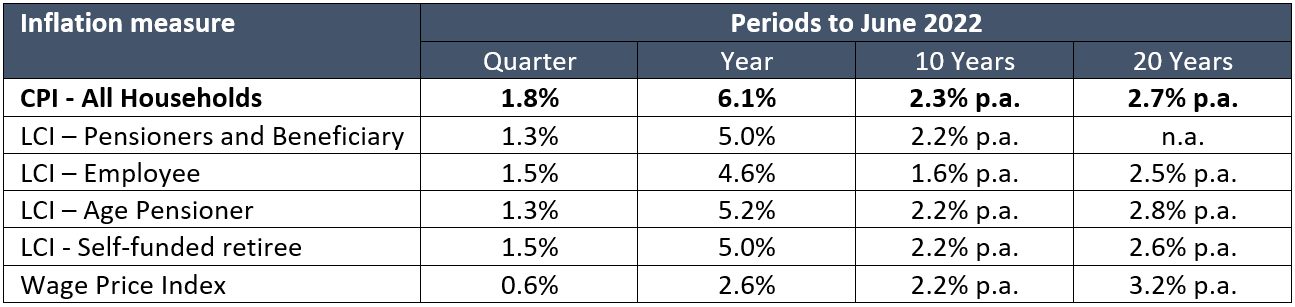

However, the Australian Bureau of Statistics produces a few other cost-of-living indices – Employee, Age pensioner, Other government transfer recipient, Self-funded retiree and Pensioner and beneficiary. These indices reflect the different spending patterns of different households.

The impact of price changes on household living costs can vary between household groups due to the different average spending patterns of household groups, as shown by the various Living Cost Indexes (LCIs):

Source: Australian Bureau of Statistics

The differences in retirees’ spending do not lead to large differences in the increases in the cost of living for each group. It should be kept in mind that each ‘group’ contains many individuals. What might be appropriate on average for each group, may not be appropriate for segments or for all individuals within that group. Further, even if it is ‘appropriate’ for a segment or an individual it may not be desired by some individuals.

Implications

Discounting post-retirement income at price inflation rather than wage inflation results in a higher deflated value. A natural result of this is that a person will need to save less for retirement than they otherwise would if a wage deflator were used.

This ‘argument’ was central to the debate of the appropriate level of Superannuation Guarantee contributions. A lower SG rate is required to achieve an adequate retirement income if a price deflator is used instead of a wage deflator.

Within this debate, it was important to remember the deflator has no impact on the amount of money available in retirement. Using a price deflator and a lower SG rate means the retiree will have less money in retirement.

The Actuaries Institute’s PGG 499.02 notes that for the period between the date of the Illustration and the projected retirement date, it is preferable for future benefits to be deflated using a wage-based deflator to allow plan members to assess their purchasing power at retirement relative to their salary at retirement.

Similarly, ASIC thinks using wage inflation is an appropriate way to adjust for the increasing cost of living during a person’s working life to help them decide if their future retirement income is likely to be adequate compared to their current standard of living while they are working.

For Illustrations covering the post-retirement period, PGG 499.02 notes it is acceptable to use either a price or wage-based deflator. The Institute’s submission to CP351 Superannuation forecasts accepted that it was appropriate to use price inflation during the retirement phase. Actuaries should consider which is more appropriate, considering the nature of the Illustration.

ASIC thinks deflating using consumer price inflation is better than deflating by wage inflation for helping consumers to compare the purchasing power of their income through retirement.

The use of price inflation rather than wage inflation during retirement implies that it is appropriate for retirees’ income to not keep pace with community living standards.

Retiree spending patterns

The choice of deflator also affects the level of income a retirement lump sum can provide. Compared to a price deflator, using a wage deflator will result in a lower initial income with higher nominal payments at older ages. A retiree will spend more of their balance in later years if a wage deflator is used instead of a price deflator.

Most retirement research assumes that retirees will seek to maintain a ‘real’ inflation-adjusted standard of living throughout their retirement. However, despite the simplicity of this assumption, more recent research has increasingly shown that retirees generally experience a decline in real spending through their retirement. This reflects that in their passive retirement years, retirees’ discretionary spending tends to decline.

Research in the US[3] shows retiree spending generally decreases slowly in the early years, more in the middle years, and then less slowly in the final years, in a path that looks less like a slow and steady decline and more like a ‘retirement spending smile’ instead. An increasing level of health care expenses explains the uptick in later years – something less applicable to Australian retirees where the government meets a much higher proportion of health care costs for the elderly.

The Association of Superannuation Funds of Australia (ASFA), in calculating their retirement standard, recognise that as people age, their spending requirements change – they are often unable to engage in the same types of activities and require a higher level of care and support. ASFA produce a separate retirement standard for retirees over the age of 85 – approximately 6% lower than the standard for retirees aged 65.

Conclusion

ASIC, with its release of RG276, has institutionalised the use of wage inflation as the default during accumulation and price inflation during retirement. This will result in a higher deflated value than if wage inflation were used throughout. As a result, a lower contribution rate is needed to achieve an ‘adequate’ retirement.

The regulatory guidance allows providers and individuals to use additional/alternative inflation rates. In determining whether to use other deflators, providers should consider their retirement design. If the product design incorporates CPI increases, then a price deflator is appropriate. If the design has wage price increases, then a wage deflator is more appropriate. If the design is silent on inflation increases, then perhaps that needs to be addressed first!

|

References

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.