Inclusive insurance – a different game

About 4 billion of the world’s current 9 billion population may benefit from inclusive insurance initiatives, but this may not be seen as accessible from a traditional insurance perspective.

This leaves a large group of people who can improve their lives by utilising formal inclusive insurance products – not only for recovery of losses from adverse events – but also to provide the confidence to take risks to advance their economic growth. Inclusive insurance products are relevant to economically disadvantaged groups in all countries, so it is a mistake to presume that these products are only applicable in countries with relatively low average incomes.

Many major insurance providers are now working on delivering commercially viable inclusive insurance products in many countries. There has been a steep learning curve for these providers as they have needed to understand the inherent differences between inclusive and traditional insurance provisions.

The International Actuarial Association’s (IAA) Risk Book chapter on Inclusive Insurance provides a high-level introduction to Inclusive Insurance and how this type of insurance differs from traditional insurance, as typically taught in actuarial qualification syllabuses.

The IAA Risk Book

The IAA is the global body representing the actuarial profession and its Risk Book introduces actuarial topics, in an accessible way, to a wide audience including users of actuarial services, actuarial students, the wider business and regulatory community, and actuaries. Actuarial advice to businesses, policy decision-makers, and supervisors can give them insight into the potential of future risk events by quantifying the financial impacts and supports them in making better business decisions.

The Risk Book’s Inclusive Insurance chapter, published in 2021(see IAA 2021) introduces Inclusive Insurance. Here are some highlights from it and I encourage you to read it for yourself. The full Risk Book is also available from the IAA website.

What is inclusive insurance?

The Risk Book chapter defines Inclusive Insurance as insurance products through which adults have effective access to insurance and savings products offered by insurers through formal providers. Effective access is explained as the involvement of convenient and responsible service delivery, at a cost affordable to the customer and sustainable for the provider, with results in financially unserved or underserved customers can use formal financial services rather than existing informal options.

Inclusive insurance products include all insurance products aimed at unserved or underserved markets. These markets typically are insurance markets in developing countries (from an insurance perspective) but are not restricted to such countries. Microinsurance is a subset of inclusive insurance.

It is well established that increased access to inclusive financial services, including insurance, helps to reduce poverty and improve social and economic development. It is also the case that insurance of all types not only provides protection coverage for adverse risks but also provides the confidence to undertake riskier commercial activities, playing both a positive social and economic incentive role and providing security in adverse circumstances. These supports are especially valuable to those living near the poverty line as one adverse event risks pushing them permanently below the poverty line.

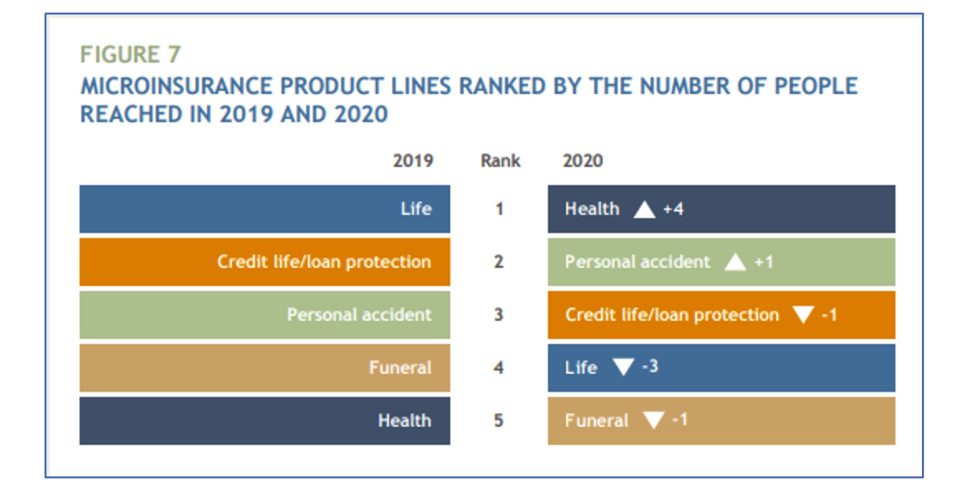

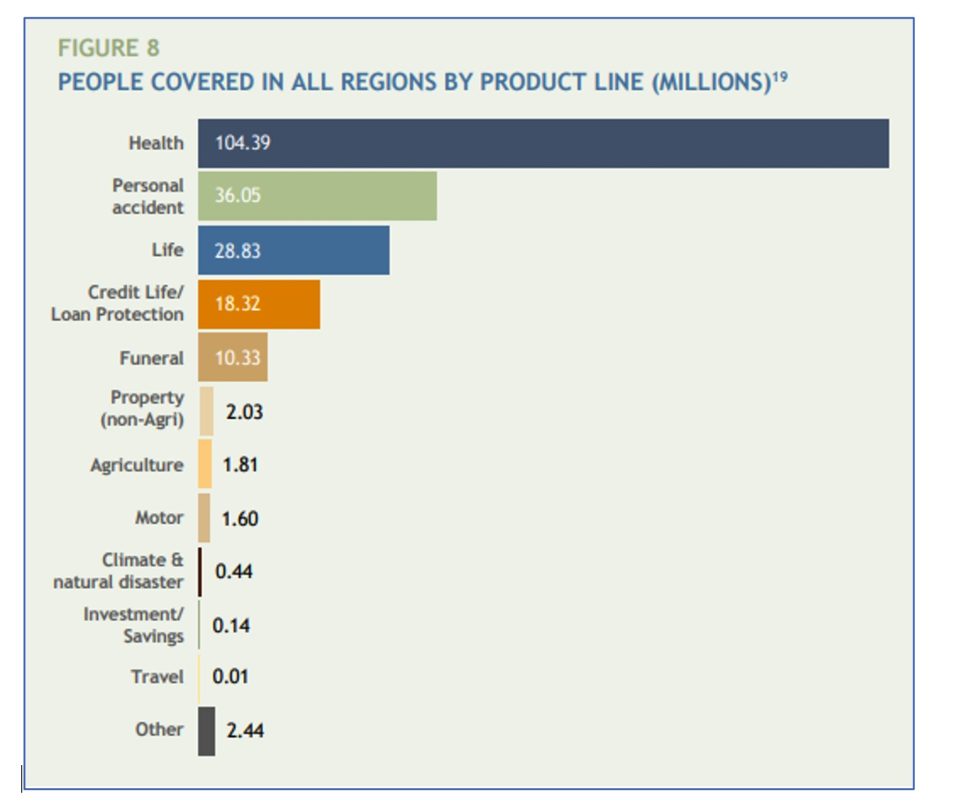

The inclusive insurance landscape is evolving rapidly. A recent global survey, see MIN 2021, reinforces this point as illustrated by the following two diagrams.

The increased prominence of health insurance in product lines, with its ranking moving from 5 to 1, is notable and a change to the historical dominance of life and credit life insurance.

Differences between Inclusive and traditional insurance

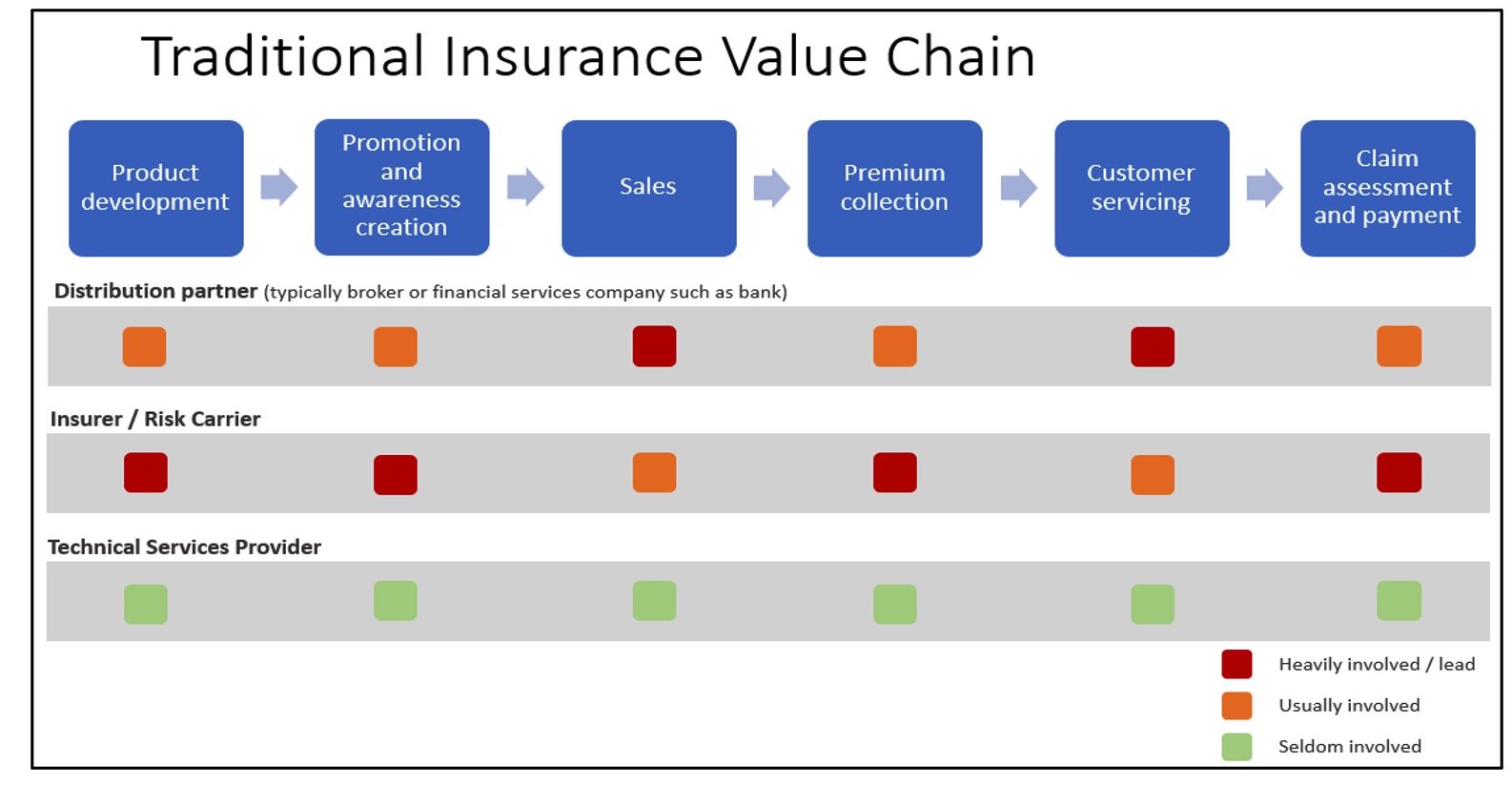

At a high level, there are three key roles in the insurance value chain:

- Distribution partner: Any player that has a role in the distribution of insurance. There may be several distribution partners working together or sequentially to distribute insurance to the customer.

- Insurer or risk carrier: Any party that accepts financial risk in return for payment of the insurance premium.

- Technical services provider (TSP): Provides technical services to a distribution partner, insurer, or any other party in the insurance value chain. These services can include actuarial services, technology and data services, international development services or country and market-specific knowledge on how to reach a type of consumer. TSPs are often the “glue” that holds the multiple partners of an inclusive insurance initiative together.

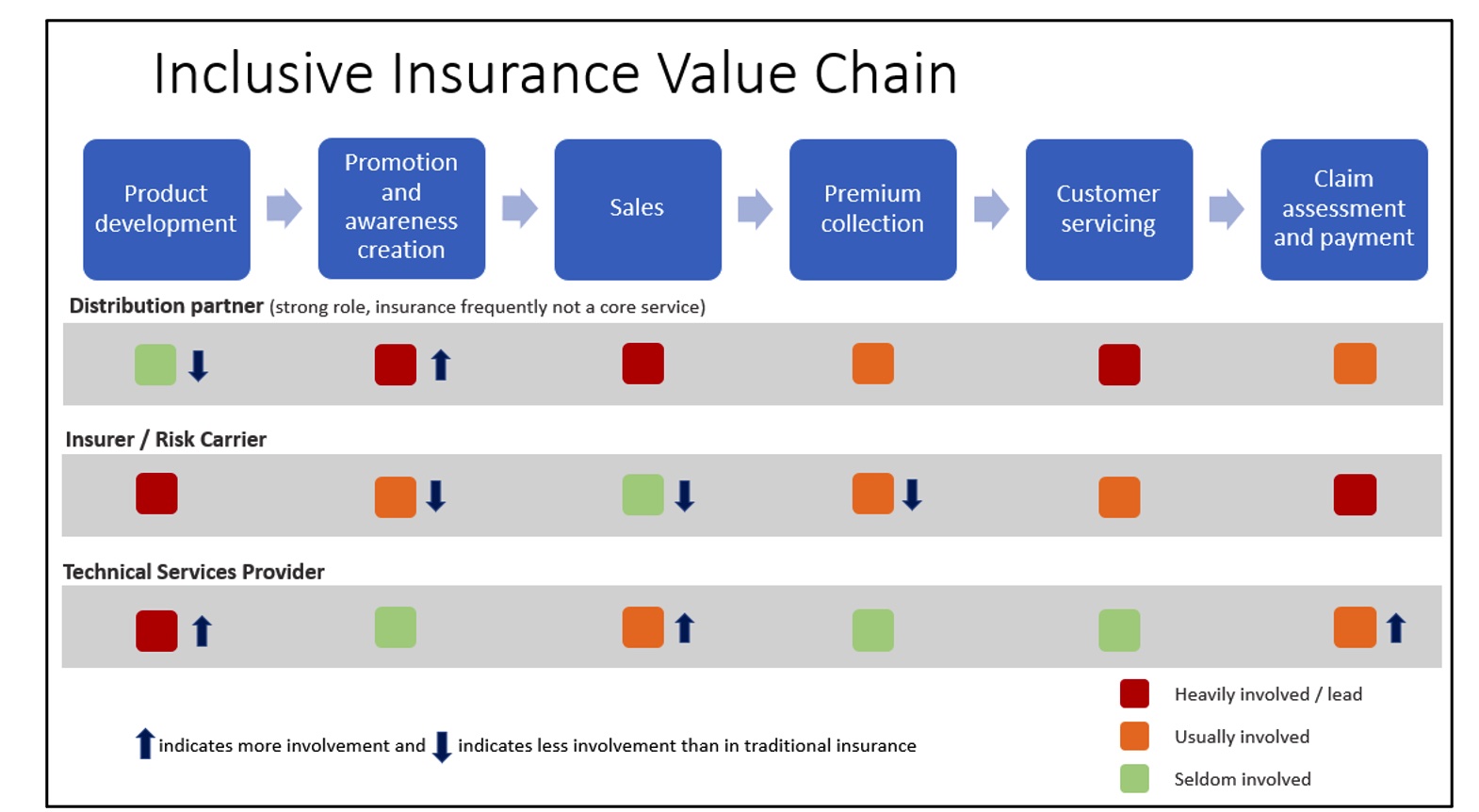

The following diagrams, taken from IAA 2021, summarise the significant differences between traditional and inclusive insurance. As these value chains are indicative there will be variations in practice reflecting local conditions. The differences and the changes in the importance of various players are highlighted by the arrows in Diagram 2.

Diagram 1: The value chain for traditional insurance

(Inclusive Insurance Risk Book 2021 Page 20)

Diagram 2: The value chain for inclusive insurance

(Inclusive Insurance Risk Book 2021 Page 21)

TSPs typically play a significantly stronger role in inclusive insurance than in traditional insurance, bringing to inclusive insurance skills and experience that more traditional insurers and distributors may not have. Multiple stakeholders are often involved in delivering key aspects of inclusive insurance, and some of these stakeholders (such as telcos) may be outside the insurance industry, something that differentiates inclusive and traditional insurance and often complicates effective inclusive insurance delivery.

Actuarial preconditions

From an actuarial perspective, the differences noted above reflect the context of actuarial work. In traditional insurance markets, a number of pre-conditions are typically presumed:

- A ready supply of actuaries, the availability of actuarial education and the presence of robust professional standards;

- The availability of relevant, timely and appropriate data;

- Access to systems through which data can be collected and analysed by providers, the industry and at the national level; and

- A regulatory framework that is reasonably well developed and understood by market participants.

In inclusive insurance markets, the reality may well be different and traditional pre-conditions are frequently not met:

- The supply of actuaries and the actuarial profession may be limited or non-existent. The same applies to other insurance skills;

- Data may not be available or not readily collectable (this could, for instance, lead to a lack of insurance mortality and morbidity tables);

- Systems for collecting and analysing data may not be well-developed or integrated;

- Customer understanding of insurance may be limited, especially for first-time customers of inclusive insurance;

- Trust in insurance may be lacking; and

- Regulation that is appropriate for inclusive insurance may not be in place, or conversely existing regulation may act as a barrier to inclusive insurance.

These issues are discussed further in IAA 2014, and some examples of how these issues could be addressed are given in Blacker 2015.

There is a risk that standard actuarial tools and approaches may not be appropriate in inclusive insurance markets, and that their application may lead to unintended outcomes, such as inappropriate premiums or claims processing.

For more information on the Risk Book Inclusive Insurance chapter, you can review the chapter itself (see IAA 2021) or you can watch two webinars, delivered in February 2023, where the IAA reflects on the findings from this chapter( see IAA 2023 reference).

Globally, there is a great need for inclusive insurance products. Actuaries can play an important role in the efficient, effective, and sustainable delivery of these products. To achieve this, actuaries need to be aware of the differences between traditional and inclusive insurance products, reflecting their environment and their consumers. The challenge for actuaries is how to take traditional actuarial knowledge and transfer it into an environment in which traditionally expected pre-conditions, actuarial and more broadly, are not met. This will require flexibility and resilience from actuaries and the capacity to apply underlying principles, as distinct from standardised, ’textbook’, traditional practices. This challenge is compounded by the need to reflect the specific circumstances in specific countries.

References

Blacker 2015: Blacker, J. (editor), Actuaries in Microinsurance: Managing Risk for the Underserved, ACTEX Publications, Winsted, CT, 2015.

IAA 2023, ‘IAA Webinar: The inclusive insurance risk book chapter, Sessions 1 and 2’, See https://www.youtube.com/watch?v=l_j2bK-AdEI and https://www.youtube.com/watch?v=YTr3n7wPVS

IAA 2021, ‘Inclusive Insurance’, Risk Book Chapter, International Actuarial Association, 2021. See https://www.actuaries.org/IAA/Documents/Publications/RiskBook/IAARiskBook_InclusiveInsurance_2021-12.pdf.

IAA 2017, ’Assessing Risk and Proportionate Actuarial Services in Inclusive Insurance Markets — An Educational Paper and Toolkit ’, International Actuarial Association, 2018. See https://www.actuaries.org/iaa/IAA/Publications/Papers/Inclusive_Insurance/IAA/Publications/Inclusive_Insurance.aspx?hkey=20718186-6e51-457d-abde-cb1f7181a865.

IAA 2014, ‘Addressing the Gap in Actuarial Services in Inclusive Insurance Markets , International Actuarial Association, 2014. See https://www.actuaries.org/iaa/IAA/Publications/Papers/Inclusive_Insurance/IAA/Publications/Inclusive_Insurance.aspx?hkey=20718186-6e51-457d-abde-cb1f7181a865.

MIN 2021, ‘The Landscape of Microinsurance 2021’, Micro Insurance Network 2021. See https://www.ada-microfinance.org/sites/default/files/inline-files/Landscape%20of%20Microinsurance%202021_Report.pdf.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.