Parametric (re)insurance solutions – a viable alternative to traditional reinsurance

In the prevailing hard reinsurance market, global reinsurance capital has shrunk (Williams, T. 2022) and traditional reinsurance protection is becoming increasingly expensive for insurers. Therefore, finding support for reinsurance protection particularly for natural catastrophe exposed portfolios is becoming increasingly challenging.

Some reinsurers are limiting their exposure to catastrophe perils and others have stopped writing business in catastrophe exposed markets, particularly after suffering losses from catastrophe events. With reduced supply of traditional reinsurance support, unfulfilled coverage and the increasing demand for reinsurance protection are influencing the traction of alternative forms of protection.

Parametric covers[1] have been in existence for a long time and are specifically designed to complement traditional reinsurance solutions rather than replace them. Recently, parametric covers are emerging as a pragmatic alternative to fill potential protection gaps left by reduced traditional reinsurance support, particularly in Asia.

In addition, parametric solutions are becoming increasingly popular due to several reasons:

- The highly customisable nature of parametric solutions can address specific coverage needs.

- Once triggered, faster and simpler claims payment compared to traditional reinsurance as payment criteria is met.

- The emergence of specialised parametric service providers offers more service provider options for customers.

- Competition among parametric service providers could benefit customers with competitive pricing.

In this article, we look at a case study to showcase how such a solution has recently helped a general insurer in Asia.

The Case Study

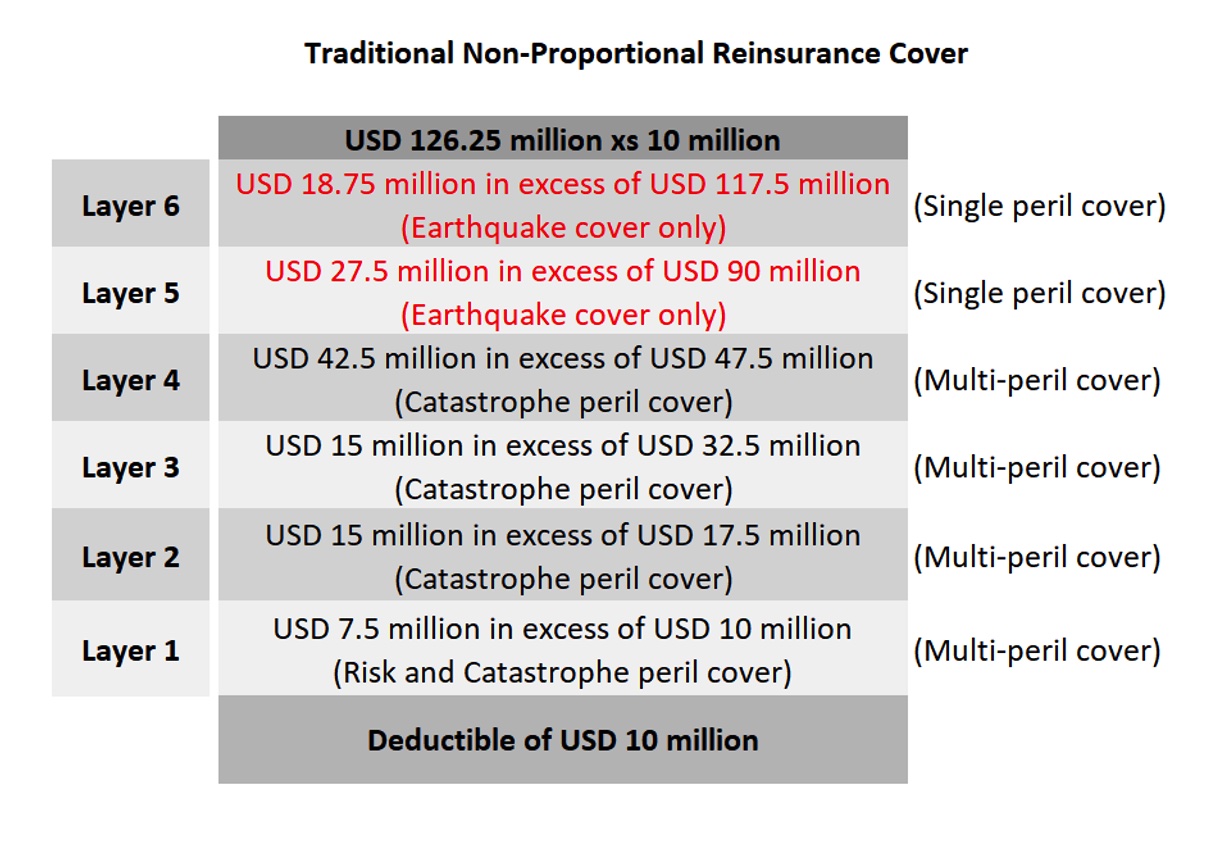

A general insurer required traditional reinsurance protection with a relatively large capacity requirement to cater for its growing catastrophe exposures. In the prevailing hard reinsurance market, finding capacity was challenging and if it could be supported, it would be at a steep price increase. The traditional reinsurance coverage requirement was a non-proportional reinsurance treaty structure as shown below in the diagram.

The top two layers of the structure were designed to be single peril coverage for high severity earthquake losses. Since these layers are single peril cover and typically parametric covers are based on a single peril, it made sense to consider a parametric cover as an alternative.

Challenges

Typically, parametric covers have basis risk[2]. Even in the above case, the primary challenge was to minimise the basis risk arising from replacing the top two layers with a parametric cover. In order to reduce the basis risk, we followed the process described below.

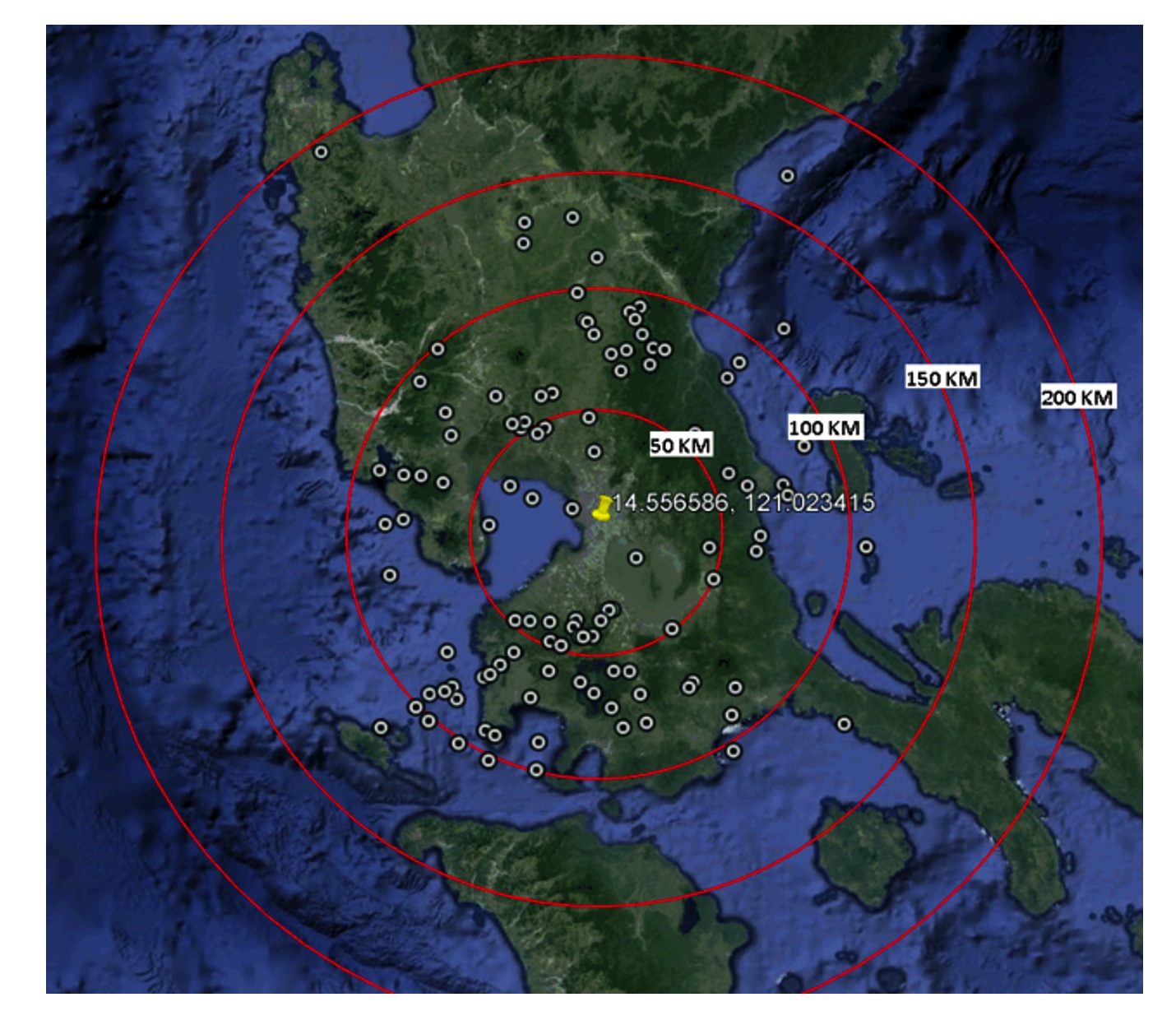

From earthquake catastrophe risk modelling results for this particular portfolio, we identified earthquake events that resulted in claim recoveries from the top two layers, determined their magnitudes and located their epicentres. Event magnitudes ranged from 6.5 to 8.37 in Richter Scale with an average of 7.04 and a median of 6.93. Therefore, for the parametric cover, magnitude 6.8 or above events were selected as the trigger point to have a wider inclusion of events.

Based on the largest concentration of catastrophe exposures of the portfolio and the epicentre of majority of identified events, a location was selected as the centre (centroid) around which parametric cover to be provided. Concentric circles of 50km, 100km, 150km and 200km around this location were selected to ensure adequate coverage. These circles are called a “Cat-in-a-Circle”, within which the occurrence of an event could trigger the parametric cover. The following map shows the location selected and the epicentre of some of the events above magnitude 6.8 around it.

Pay-out structure for parametric cover

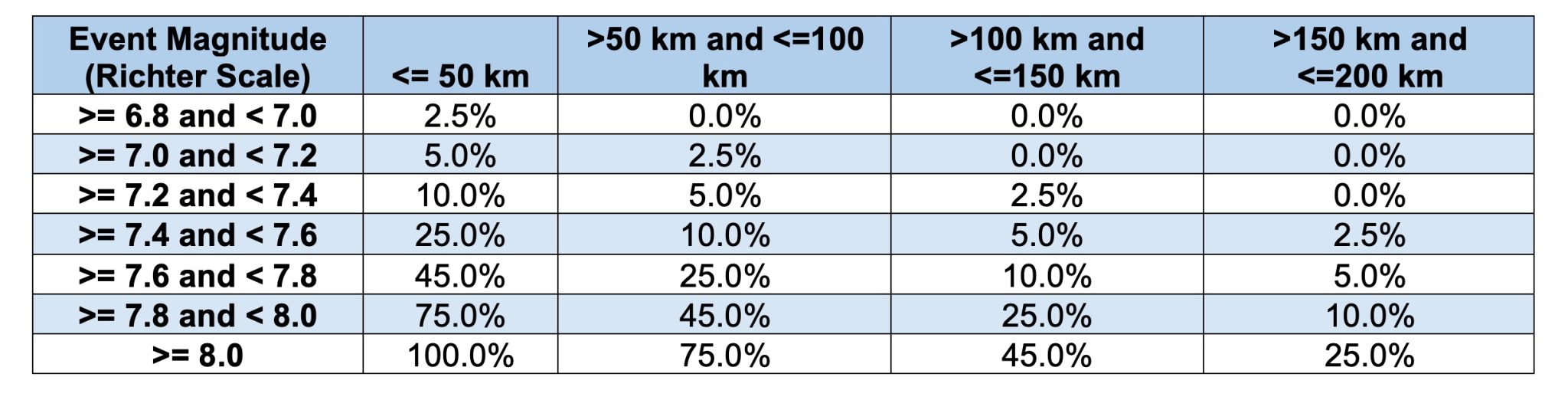

The pay-out structure specifies how claims are paid in case the parametric cover is triggered. It consists of the magnitude of an earthquake event, coverage breakdown by event’s magnitude and distance to the epicentre of the event from the selected location. The maximum pay-out is set to the limit of top two layers from the traditional reinsurance structure (i.e. USD 46.25 million). The following table shows the pay-out structure of parametric cover.

For example, if an earthquake event of magnitude 7.2 was to occur within 50km of the selected location, based on the pay-out structure, the insurer could claim USD 4.625 million (total limit x applicable percentage -> USD 46.25 million x 10%) from the parametric cover.

The pricing of parametric cover is mainly driven by the probability of occurrence of a trigger event. In the example considered, the pricing of the parametric cover was competitive. In fact, it was 10% to 15% cheaper than the cost of two layers combined from the traditional cover, making it a viable alternative to be considered by the insurer.

Compared to parametric covers, typically, traditional reinsurance covers have a larger exposure base and are less restrictive on events covered. Yet, there tends to be a misconception that parametric covers are more expensive than traditional reinsurance. Based on conditions set on the trigger, pricing for parametric covers could be competitive as we have seen with this case study.

Concluding Thoughts

Parametric solutions are emerging as a serious alternative to fill possible protection gaps left by reduced traditional reinsurance support in the prevailing hard reinsurance market. Unlike traditional reinsurance, parametric covers are highly customisable to user needs, fast in claim payments once triggered and could be price competitive. In addition, if triggered, there is the possibility to provide coverage for losses retained by the insurers below the deductible of traditional reinsurance cover, thus acting as an additional cover. However, there can be residual basis risk and exposure to losses if an event occurs outside the areas specified by the parametric cover.

Special Note: The author would like to thank Mudit Gupta (FIAA) for reviewing the article and providing invaluable feedback.

Footnotes

[1] https://corporatesolutions.swissre.com/insights/knowledge/what_is_parametric_insurance.html

[2] The difference between pay-out from parametric reinsurance and underlying loss. For more detail see https://www.indexinsuranceforum.org/faq/what-basis-risk

References

Traditional Reinsurance Capital Declining: https://www.iii.org/insuranceindustryblog/report-traditional-reinsurance-capital-declining/?utm_source=rss&utm_medium=rss&utm_campaign=report-traditional-reinsurance-capital-declining

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.