Returning COVID-19 claims savings back to health fund members

Private health insurers paid less in claims during the COVID-19 pandemic due to the suspension of elective surgeries and lower utilisation of extras such as dental and optical.

Some claims that didn’t occur during the pandemic are unlikely to be ‘made up’ in the future. For example, a member may have missed a dental appointment due to lockdowns and only visited the dentist once instead of twice a year. Other claims that didn’t occur may be delayed. For instance, a member scheduled for a knee replacement surgery is unable to proceed with the scheduled surgery date because elective surgeries were temporarily suspended. Once private hospitals resume business as normal, a new surgery date is set and the member can proceed at a later date.

In anticipation of pent-up demand of services, private health insurers collectively set aside billions of dollars to pay for future claims which were deferred because of the pandemic. However, it is now clear that much of the expected deferred claims are not occurring.

The private health insurance industry has made a commitment not to profit from the pandemic, and consequently, private health insurers have continued a range of initiatives to return COVID-19-related claims savings back to members. These initiatives include:

- Cashback and premium relief where cash payments are made to members (cashback) or premium payments are temporarily reduced (premium relief).

- Premium rate increase deferral, where premium rate increases which typically occur on 1 April each year, are deferred or cancelled; and

- Other initiatives including rollover of extras limits, increasing mental health benefits and financial hardship packages.

This article will provide an overview of each of these initiatives to date.

Cashback and premium relief

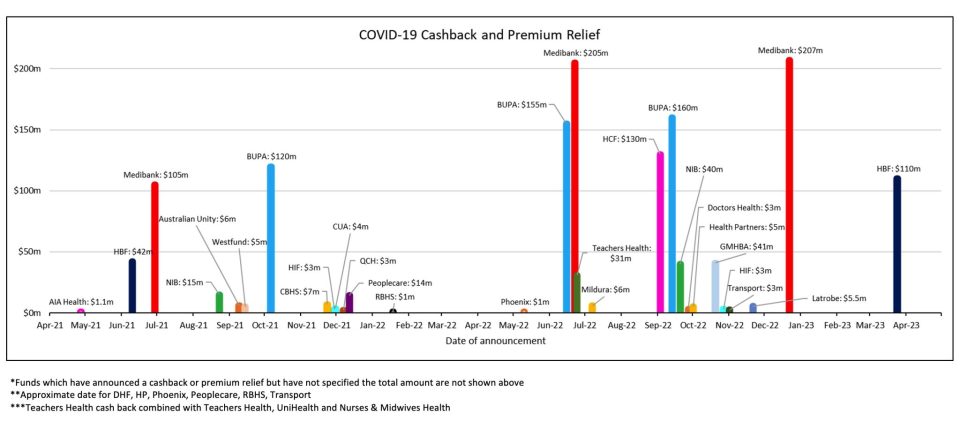

Several funds have announced a cashback through cash payments to members or premium relief where premium payments are temporarily reduced. The graph below sets out a timeline of cashback and premium relief announcements by private health insurers.

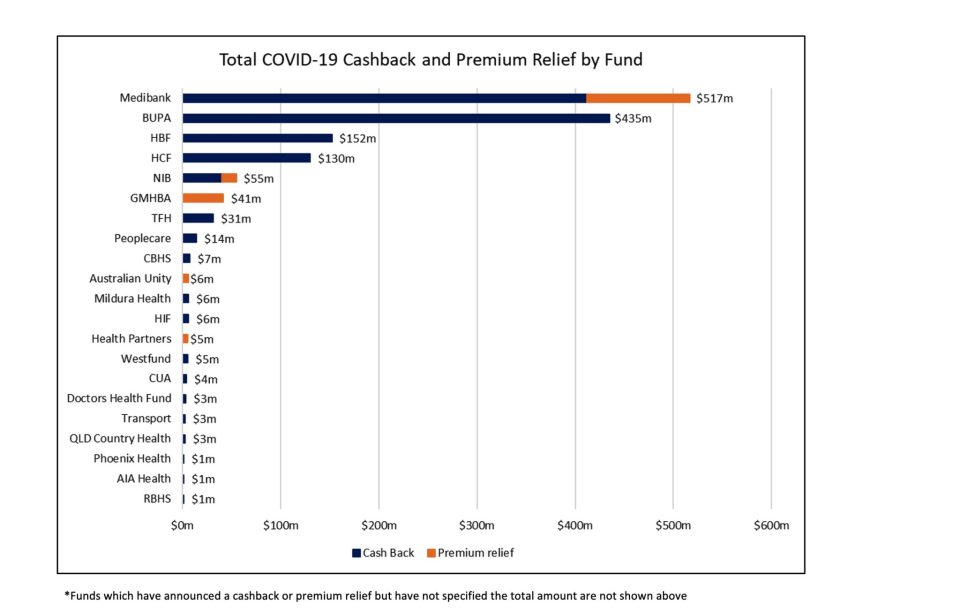

Australia’s two largest private health insurers, Bupa and Medibank, have announced the largest cash back amounts to date. The below graph shows the total cashback and premium relief announced to date by the fund.

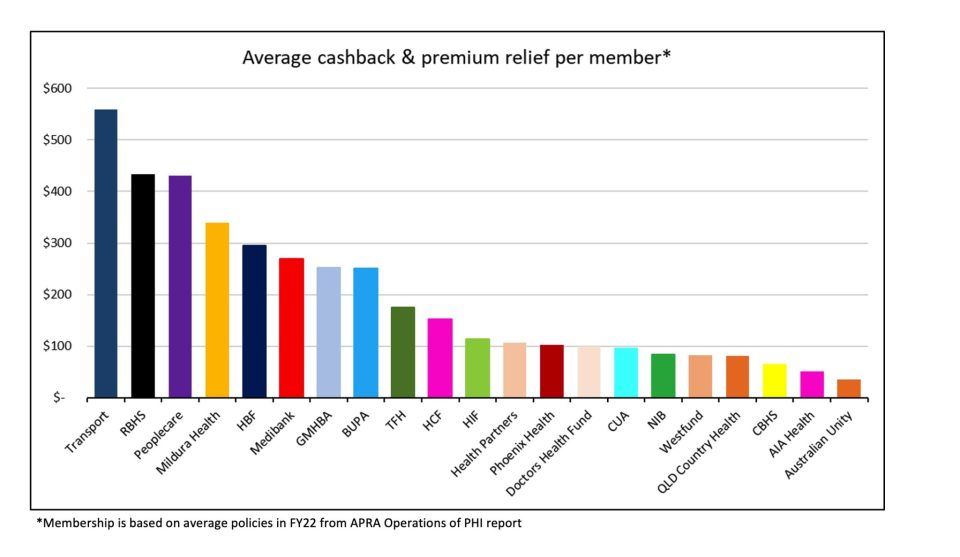

After standardising for membership, Transport Health and RBHS appear to have paid the most cashback per member. The chart below sets out the total cashback and premium relief amount per member.

The dollars returned to individual members vary as different allocation methods are used by different insurers. Some have adopted a simpler approach based on the cover at a point in time, while others have opted for a more sophisticated, approach such as an exposure-based method.

There are added complications around members who have left the insurer, suspended cover, or changed cover but were active during the pandemic-impacted periods, which some insurers have also allowed for.

As with any allocation exercise, there are advantages and flaws around fairness and the balance between simplicity and complexity for each method.

Premium rate increase deferral

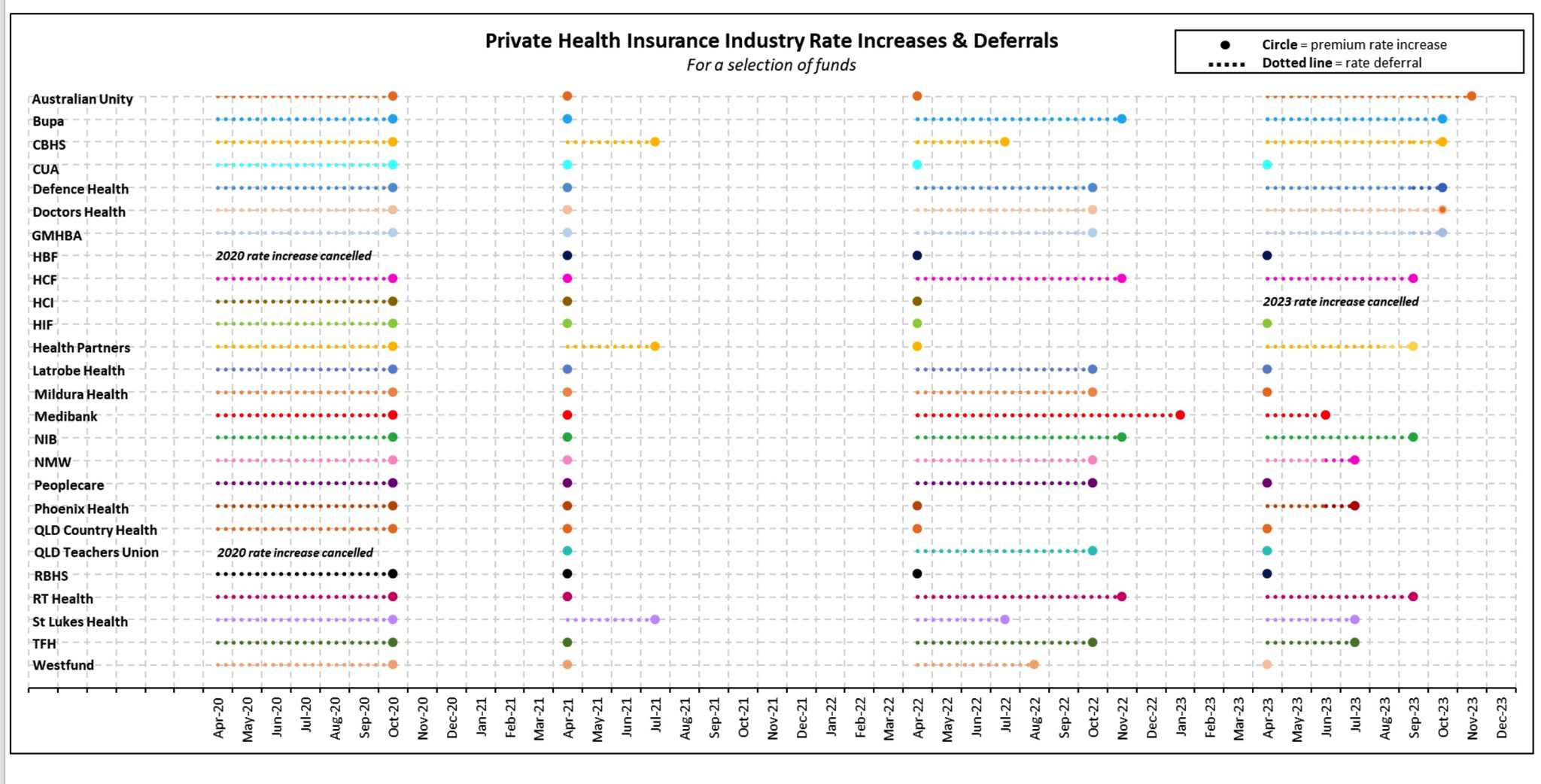

Private health insurers’ premium rate increases typically occur on 1 April each year. Since the onset of COVID-19, many funds have deferred premium rate increases from 1 April to a later date to pass pandemic-related savings to members.

The chart below illustrates premium rate deferrals for a selection of health funds.

For the 1 April 2020 rate year, HBF and QLD Teachers Union Health were the only two funds who cancelled the 2020 rate increase, while all other funds deferred the rate increase to 1 October 2020.

The deferral of rate increases was less uniform in 2021, 2022 and 2023, with some funds choosing to proceed with a 1 April rate rise while others deferred the rate increase.

The deferral of premium rate increases for a few months each year collectively costs health funds hundreds of millions of dollars. Data shows that Bupa’s rate increase deferrals in 2020, 2022, and 2023 have an associated cost of $456m.

Other initiatives to return COVID-19 claims savings to members

There are several other means beyond cash backs, premium relief, and premium rate increase deferrals by which health funds are returning COVID-19 claims savings back to members. These include rollover of extras limits as members are unable to or only have limited capacity to use extras services during the pandemic, additional mental health support, expanded coverage for COVID-19-related treatment and financial hardship packages.

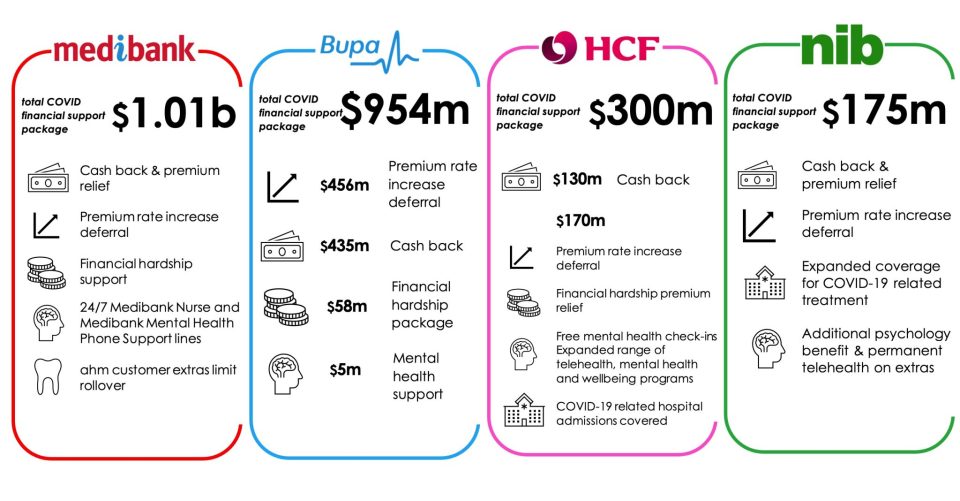

The infographic below illustrates the total COVID-19 relief packages provided by the four largest health funds.

In summary

Throughout the pandemic, private health insurers have closely monitored claims experience and continually assessed the appropriate level of funds to hold to pay for the potential future ‘catch up’ of claims while determining how best to return pandemic-related claims savings to members.

As the experience continues to emerge in future, there may be more initiatives to return COVID-19-related claims savings back to members if the ‘catch up’ of claims does not occur or is lower than originally expected.

References

- Australian Unity, 9 September 2021, Australian Unity to return about $6 million in COVID-19 savings to members, accessed 14 November 2022, < https://www.australianunity.com.au/media-centre/news-and-media/australian-unity-to-return-about-6-million-in-covid-19-savings>

- Bupa, 6 October 2021, Bupa customers to receive $120 million cash back in COVID savings, bringing total support to $315 million, accessed 14 November 2022, < https://media.bupa.com.au/bupa-customers-to-receive-120-million-cash-back-in-covid-savings-bringing-total-support-to-315-million/>

- Bupa, 15 June 2022, Bupa customers to share in biggest round of customer cashbacks as COVID-19 support tops $618m, accessed 14 November 2022, < https://media.bupa.com.au/bupa-customers-to-share-in-biggest-round-of-customer-cashbacks–as-covid-19-support-tops-618m/>

- Bupa, 13 September 2022, Bupa customers to receive $315 million in pre-Christmas cashback, accessed 14 November 2022, < https://media.bupa.com.au/bupa-customers-to-receive-315-million-in-pre-christmas-cashback/>

- CBHS, 23 November 2021, We’re giving back over $7 million to members, accessed 14 November 2022, <https://www.cbhs.com.au/mind-and-body/blog/we-re-giving-back-over-7-million-to-members>

- HBF, 30 November 2021, COVID-19 savings being returned to CUA Health members, accessed 15 November 2022, <https://www.hbf.com.au/media-releases/covid-19-savings-being-returned-to-cua-health-members>

- DHF, 27 September 2022, COVID member support and give back program, accessed 15 November 2022, <https://www.doctorshealthfund.com.au/news/giveback>

- GMHBA, 20 October 2022, GMHBA to return an additional $41 million of COVID related savings via one month premium contribution, accessed 15 November 2022, <https://www.gmhba.com.au/about/media-centre/returning-covid-19-claims-savings>

- HBF, 10 June 2021, HBF finalises COVID-19 surplus funds to be returned to members, accessed 14 November 2022, <https://www.hbf.com.au/media-releases/covid-19-surplus-funds>

- HCF, 3 September 2022, HCF to give back a further $130m in COVID savings to eligible members, accessed 14 November 2022, <https://www.hcf.com.au/about-us/media-centre/media-releases/2022/hcf-gives-back>

- HIF, 29 November 2021, HIF gives $2.8 million back to its members, accessed 15 November 2022, <https://www.hif.com.au/news/hif-news/hif-gives-2-8-million-back-to-its-members>

- HIF, 27 October 2022, HIF to give $3 million in COVID-19 claims savings back to members, accessed 15 November 2022, <https://www.hif.com.au/news/hif-news/hif-to-give-3million-in-covid-19-claims-savings-back-to-members>

- Health Partners, 2022, We’re giving back to members, accessed 15 November 2022, <https://www.healthpartners.com.au/giveback-2022>

- Mildura Health Fund, 7 July 2022, MHF returning $6 million to members, accessed 15 November 2022, <https://www.mildurahealthfund.com.au/about/news/mhf-returning-usd6-million-to-members>

- AIA, 27 April 2021, AIA health refunds over $1.1 million during tough 2020, accessed 14 November 2022, < https://www.aia.com.au/en/adviser/business-growth-hub/adviser-news/aia-health-refunds.html>

- Medibank, 29 June 2021, Medibank to return around $105 million in COVID-19 savings to customers through premium relief – with total support reaching $300 million so far, accessed 14 November 2022, <https://www.medibank.com.au/livebetter/newsroom/post/medibank-to-return-around-usd105-million-in-covid-19-savings-to-customers>

- Medibank, 22 June 2022, Medibank returning another $205m to customers bringing total COVID-19 customer give back to a record $682m, accessed 14 November 2022, <https://www.medibank.com.au/livebetter/newsroom/post/medibank-returning-another-205m-to-customers-bringing-total-covid-19>

- NIB, 23 August 2021, nib announced return of $15 million in COVID-19 claims savings to members, accessed 14 November 2022, <https://www.nib.com.au/media/2021/08/media-pages-nib-covid-19-claims-savings>

- NIB, 20 September 2022, nib to return $40 million in claims savings to members, accessed 14 November 2022, <https://www.nib.com.au/media/2022/09/media-pages-nib-to-return-40-million-in-claims-savings-to-members>

- Peoplecare, 2021, Peoplecare’s 2nd Member Giveback, accessed 15 November 2022, <https://www.peoplecare.com.au/membergiveback>

- Phoenix Health, 2022, COVID Give-Back Payments, accessed 15 November 2022, <https://phoenixhealthfund.com.au/covid-give-back-faqs/>

- Queensland Country Health, 7 December 2021, Member Giveback Relief, accessed 15 November 2022, <https://www.queenslandcountry.health/members/news/2021/member-giveback-relief/>

- RBHS, 2022, The Reserve Bank Health Society’s 2nd member giveback, accessed 15 November 2022, <https://www.myrbhs.com.au/membergiveback>

- TFH, 2022, COVID savings give-back initiative, accessed 15 November 2022, <https://www.teachershealth.com.au/about-us/news/teachers-health-group-covid-savings-give-back/>

- Transport Health, 2022, Give Back, accessed 15 November 2022, <https://transporthealth.com.au/managing-your-cover/managing-your-cover/giveback/>

- Westfund, 14 September 2021, Westfund to return $5.1m to members in extension of COVID-19 community support package, accessed 14 November 2022, <https://www.westfund.com.au/newsroom/westfund-to-return-5-1m-to-members-in-extension-of-covid-19-community-support-package/#:~:text=The%20payment%20will%20vary%20according,towards%20the%20end%20of%202021.>

- NIB, 2022, 2022 Annual Report, accessed 16 November 2022, < https://www.nib.com.au/docs/2022-annual-report>

- Medibank, 2022, 2022 Annual Report, accessed 16 November 2022, <https://www.medibank.com.au/content/dam/retail/about-assets/pdfs/investor-centre/annual-reports/Medibank_AR2022_website.pdf>

- CBHS, 17 March 2022, We’ve deferred premium increases again in 2022, accessed 15 November 2022, <https://www.cbhs.com.au/mind-and-body/blog/we-ve-deferred-premium-increases-again-in-2022>

- CBHS, 31 August 2021, 2020 CBHS Corporate delayed premium review FAQs, accessed 15 November 2022, <https://www.cbhs.com.au/mind-and-body/blog/cbhscorp-rate-review-faq-2020>

- CUA, 26 May 2021, CUA Health delays premium increase as part of COVID-19 support package, accessed 15 November 2022, <https://www.cuahealth.com.au/news/2020/march/cua-health-delays-premium-increase-as-part-of-covid-19-support-package>

- HBF, 26 March 2020, HBF cancels 2020 premium increases, accessed 14 November 2022, <https://www.hbf.com.au/media-releases/hbf-cancels-2020-premium-increases>

- HCI, 25 February 2022, COVID-19 support for HCI members, accessed 15 November 2022, <https://www.hciltd.com.au/2022/02/covid-19-support-for-hci-members/>

- Latrobe Health, 1 April 2020, Latrobe Health commits $8m in support of its members throughout the COVID-19 crisis, accessed 15 November 2022, < https://www.latrobehealth.com.au/news/2020/latrobe-health-commits-$8m-in-support-of-its-members-throughout-the-covid-19-crisis/>

- Latrobe Health, 21 February 2022, Latrobe Health Services’ six-month rate freeze, accessed 15 November 2022, <https://www.latrobehealth.com.au/news/2022/latrobe-health-services-six-month-rate-freeze/>

- Medibank, 2022, Premiums to change 16 January, accessed 15 November 2022, <https://www.medibank.com.au/premium-review/>

- NIB, 30 March 2020, nib postponed premium increase to provide relief to members, accessed 14 November 2022, <https://www.nib.com.au/media/2020/03/nib-postpones-premium-increase-to-provide-relief-to-members-during-covid-pandemic>

- NMW, 22 June 2022, COVID-19 member support and resources, accessed 15 November 2022, <https://www.nmhealth.com.au/covid-19/>

- Peoplecare, 2022, 1 October 2022 Premium FAQs, accessed 15 November 2022, <https://www.peoplecare.com.au/help-centre/frequently-asked-questions-faqs/>

- QCH, 30 March 2020, Premium Increases Delayed for Six Months, accessed 15 November 2022, <https://www.queenslandcountry.health/members/news/2020/premium-increases-delayed-for-six-months/>

- QTUH, 15 February 2022, We’re putting members first by freezing premiums again for our members, accessed 15 November 2022, <https://tuh.com.au/news/putting-you-first-freezing-premiums-again>

- RBHS, 2022, Premium Rise 1 April 2022, accessed 15 November 2022, <https://www.myrbhs.com.au/help-centre/frequently-asked-questions-faqs/premium-rise/>

- RT Health, 2022, rt health returns savings from COVID-19 to members via premium increase freeze, accessed 15 November 2022, <https://rthealthfund.com.au/about-us/latest-news/rt-health-returns-savings-from-covid-19-to-members/>

- St Lukes, 8 March 2022, A health insurer that supports members through the pandemix? Well, well, well!, accessed 15 November 2022, <https://stlukes.com.au/about-st-lukeshealth/news/we-re-freezing-our-premiums#:~:text=We’re%20freezing%20premium%20increases,19%2C%20not%20benefit%20from%20it.)

- St Lukes, 11 March 2021, Well, well, well… St Lukes Health gives back to its members, accessed 15 November 2022, <https://stlukes.com.au/about-st-lukeshealth/news/well,-well,-well-%E2%80%A6-st-lukeshealth-gives-back-to-it>

- St Lukes, 30 March 2020, April 1 premium increase postponed, new support measures, accessed 15 November 2022, <https://stlukes.com.au/about-st-lukeshealth/news/st-lukeshealth-postpones-april-1-premium-increase,>

- Westfund, 2022, Westfund Health Insurance steps up again to support members, accessed 15 November 2022, <https://www.westfund.com.au/newsroom/westfund-health-insurance-steps-up-again-to-support-members/>

- Teachers Health, 2022, Teachers Health’s average increase lower than industry average, accessed 15 November 2022, <https://www.teachershealth.com.au/about-us/news/2022-premiums/>

- Teachers Health, 2021, Changes to your cover April 2021, accessed 15 November 2022, <https://www.teachershealth.com.au/2021changes/>

- APRA, 26 October 2022, Operations of Private Health Insurers annual report, accessed 29 November 2022, <https://www.apra.gov.au/operations-of-private-health-insurers-annual-report>

- Medibank, 22 December 2022, Medibank returning a further $207m to customers, bringing total COVID-19 support package to a record $950m, accessed 7 April 2023, <https://www.medibank.com.au/livebetter/newsroom/post/medibank-returning-a-further-usd207m-to-customers-bringing-total-covid-19>

- Medibank, 2023, COVID-19 giveback, accessed 7 April 2023, <https://www.medibank.com.au/health-insurance/info/coronavirus-update/covid-19-giveback/>

- Bupa, 6 March 2023, Bupa delays premium increase until October, accessed 7 April 2023, https://media.bupa.com.au/bupa-delays-premium-increase-until-october/>

- NIB, 7 February 2023, nib postpones 2.72% premium rate increase five months to September 2023, accessed 7 April 2023, <https://www.nib.com.au/media/2023/02/article-nib-postpones-2-72-premium-rise-five-months-to-september-2023>

- HCF, 7 February 2023, HCF defers premium rate increases for the third time, accessed 7 April 2023, <https://www.hcf.com.au/about-us/media-centre/media-releases/2023/hcf-defers-premium-increases-for-a-third-time>

- HBF, 24 March 2023, HBF members to receive $110 million cash back in COVID-19 savings, accessed 7 April 2023, <https://www.hbf.com.au/media-releases/hbf-members-to-receive-$110-million-cash-back-in-covid-19-savings>

- Australian Unity, 2023, Freezing our premium rate increases to save you money, accessed 7 April 2023, <https://www.australianunity.com.au/health-insurance/premium-freeze>

- CBHS, 2023, We’re deferring premium rate increases for 6 months, accessed 7 April 2023, <https://www.cbhs.com.au/we-re-deferring-premium-increases-for-six-months>

- Defence Health, 2023, Good news! Premium freeze until 1 October 2023, accessed 7 April 2023, <https://www.defencehealth.com.au/news/good-news-premium-freeze-until-1-october-2023/>

- DHF, 2023, Premium rise deferral 2023 & increased extras benefits, accessed 7 April 2023, <https://www.doctorshealthfund.com.au/ratedeferral2023>

- GMHBA, 8 February 2023, GMHBA to increase total COVID support to members to over $80 million via another 6-month premium increase freeze, accessed 7 April 2023, <https://www.gmhba.com.au/about/media-centre/gmhba-to-increase-total-covid-support-to-members-to-over-$80-million-via-another-6-month-premium-increase-freeze>

- HCI, 7 February 2023, Great news for HCI members – no premium increase in 2023!, accessed 7 April 2023, <https://www.hciltd.com.au/2023/02/no-premium-increase-hci-2023/>

- Latrobe Health, 21 November 2022, COVID savings give back, accessed 7 April 2023, <https://www.latrobehealth.com.au/news/2022/member-give-back/>

- Nurses & Midwives Health, 2023, Changes to your cover from 1 July 2023, accessed 7 April 2023, <https://www.nmhealth.com.au/2023-changes/>

- Phoenix Health, 2023, 2023 Pricing Adjustment – Postponed for 3 months, accessed 7 April 2023, <https://phoenixhealthfund.com.au/2023-premium-adjustment-postponement/>

- Teachers Health, 2023, Changes to your cover from 1 July 2023, accessed 7 April 2023, <https://www.teachershealth.com.au/2023-changes/>

- St Lukes, 7 February 2023, Private health rate rise deferred for St.Luke’s members, accessed 7 April 2023, <https://stlukes.com.au/private-health-rate-rise-deferred#:~:text=LukesHealth%2C%20has%20deferred%20passing%20on,at%20an%20average%20of%202.9%25.>

- Choice, 5 April 2023, How to avoid insurance price hikes, accessed 7 April 2023, <https://www.choice.com.au/money/insurance/health/articles/how-to-avoid-health-insurance-premium-hikes>

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.