What’s True Level Premium?

The Australian Prudential Regulation Authority (APRA) and the Australian Securities and Investments Commission (ASIC) published their second joint letter to life insurers in December 2023, in response to recent reviews of past premium increases and disclosure materials.

In the first of a two-part series, this article summaries the joint letter and provides an overview of the implications from risk management perspective.

Premium increase in life insurance products has been a topic of industry focus since APRA and ASIC issued a joint letter on 8 December 2022. It outlined regulators’ concerns with premium setting practices, after complaints from the public on stability and premium setting transparency, as well as reportable situations from several insurers.

More specifically, three life companies discovered instances where they increased premiums without a clear right to do so. An additional 10 life companies found possible problems or areas for improvement with regards to disclosure, marketing and communication materials for premium increases.

Several actions have been taken by life companies, including reviewing pricing practices and product design, improving the clarity of disclosure materials, and remediating impacted customers.

How has this impacted policyholders?

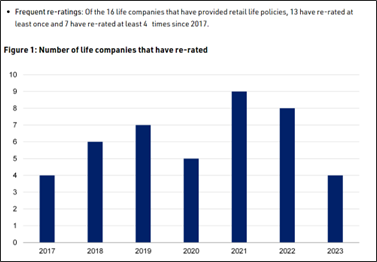

As shown in the chart below from APRA/ASIC’s letter, premium re-rates have been common practice as insurers perform experience reviews regularly and may restore profitability through premium adjustments.

However, policyholders do not necessarily understand or have visibility as to the drivers behind such premium increase decisions. For some customers holding “level premium products”, they may have formed an expectation that premiums would not increase in the future due to potentially misleading or unclear disclosure information in marketing material in the past.

Regulatory expectations

In response to these circumstances, APRA/ASIC listed in their letter several regulatory expectations that the industry should consider and act upon.

- Premium stability and governance

A well-functioning market should have products designed with sustainability and affordability in mind.

This is particularly relevant to products labelled with a “level premium” structure. Policyholders with those products generally have a great need for premium stability. However, APRA/ASIC observed that only one insurer consciously kept level-premium products increased at a lower rate than their stepped-premium products.

- Customers’ reasonable expectations and suitability

Insurance products are expected to be designed and priced with a consumer-centric approach.

Consumers choose the premium structure based on their objectives, financial circumstances and needs. Also, from an affordability perspective, consumers expect insurers to reasonably limit/restrict premium increases. Sudden increases in premiums can cause financial stress and result in lapses that are detrimental to a consumer’s financial well-being. Moreover, consumers expect to hold life insurance products on a long-term basis. Hence, premium stability and long-term affordability should be a key product feature of life insurance policies.

- Clarity in communication

The importance of supplying clear communication to consumers was highlighted by the regulators. To achieve this, insurers need to avoid wording, labelling and graphs that are potentially misleading.

For example, some insurers illustrated “level premiums” as a flat line contrasted with stepped premiums rising. This potentially misled consumers by providing an impression that premiums would not increase, which resulted in complaints.

APRA/ASIC also expect clear communication on an ongoing basis (e.g., at every policy anniversary), in addition to the disclosure materials provided at the point of sale. This also gives insurers the opportunity to explain the rationale behind any premium increases.

- Transparency & fairness

Premium increases should be transparent and fair to consumers. Insurers need to have a good grasp of the drivers of premium increases and provide clarity to policyholders.

For example, it was noted that duration-based pricing is common in the industry and premiums are expected to increase. Insurers are encouraged to illustrate the expected premium increase so that the longer-term premium level can be better understood.

The regulators also mentioned unilateral variation clauses as a potential issue of fairness since many insurers use them to re-rate – these clauses might be seen as “unfair” under the law that regulates unfair contract terms. Insurers should explicitly state their right to change premium, but only to the extent required to keep their business sustainable while being fair to consumers.

Moving forward

The Council of Life Insurers (CALI) is developing a new set of premium labels and guidance to address the concern over clarity in communication with policyholders. Some insurers may make changes sooner by, for example, removing products with “level” premium features.

The insurance sector should take lessons from this event and avoid similar problems from arising in other field of work, in particular for customer-facing areas such as product marketing, underwriting and claim management. More robust and comprehensive risk management practices that are aligned with evolving consumer expectations and regulatory standards should be developed and adopted.

Author’s Note

A special thanks to the Risk Management Practice Committee (RMPC) for their contribution and support in reviewing this article. You can learn more about the RMPC here.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.