Understanding the Value of the Associate Actuary

Forget what you think you know about actuaries – the image of the maths whizz, number cruncher buried in spreadsheets is about to be shaken up. A new generation of “Associate Actuaries” is proving to be indispensable, tech-forward, and passionate about using data for good. According to the latest report from the Institute’s Associates Advisory Taskforce, they may be the profession’s best-kept secret.

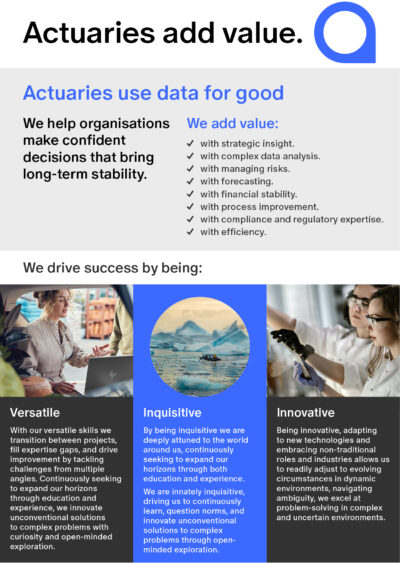

The Associate attributes

Associate Actuaries are highly skilled practitioners who bring fresh perspectives, blending traditional actuarial expertise with cutting-edge capabilities in emerging fields. They are making significant contributions not just in insurance, but also in industries where data drives decision-making and innovation. Associates make up nearly 17% of the Institute membership, and their unique blend of skills is proving invaluable. They may not always follow the traditional path to Fellowship, but their contributions are also helping businesses solve complex problems and drive growth in rapidly changing world.

Through focus groups and comprehensive data analysis, the Taskforce identified three central themes in the expectations business leaders have for Associate Actuaries:

- Long-term vision: Associates are aligned with the ambitions of business leaders who seek sustainable growth and innovation. They contribute to projects that drive credibility, build legacy, and respond to evolving customer needs, enhancing reputations and advancing customer-focused solutions.

- Strategic stability: In an environment where risk management is critical, Associate Actuaries bring invaluable support. They empower decision-makers to plan with confidence, applying detailed analysis to manage financial health, ensure compliance, and address industry regulations.

- Operational excellence: Associates help leaders overcome practical frustrations by optimizing processes, reducing inefficiencies, and fostering integrity within decision-making. They create solutions that streamline operations, enhance productivity, and adapt to change with agility.

By focusing on these critical areas, the Associate Advisory Taskforce’s work aims to elevate the profession’s impact and reputation in the business world. Associates are increasingly recognised as adaptable experts who not only analyse data but actively contribute to business strategy, risk management and operational efficiency.

Key insights from the Associate Advisory Taskforce

The taskforce’s research sheds light on how Associates are making an impact beyond the conventional actuarial path, increasingly moving into roles in technology, finance, and consulting. Key findings highlight that Associate Actuaries:

- Leverage technical skills across both traditional fields like insurance and finance and emerging sectors where they apply data science, analytics, and strategic insights to solve complex challenges.

- See themselves as adaptable and innovative professionals who are less defined by traditional actuarial paths and more by their ability to bridge data analytics, AI, and socially responsible solutions.

- Contribute to business goals by addressing core needs of executives, including long-term stability, risk mitigation, and operational efficiency.

The Actuaries Institute has already taken great strides to keep our Associates engaged and supported:

- Communicating the Brand: Built out a guide (see below) to assist Associates with communicating their brand and value proposition to employers within and outside actuarial-heavy industries.

- A Powerful Role Model: Jan Swinhoe, a non-Executive Director, made history as the first Associate to be named Actuary of the Year. Her diverse accomplishments, recognised in 2024, showcase the remarkable potential of Associates and the significant impact they can have on the profession.

- Continuous Development: Actively inviting Associates to make a difference through volunteering on Practice Committees, Taskforces and Working Groups.

- Expanding to Data Analytics: Encouraging Associates to undertake the Data Science microcredential which is important as the field grows and changes.

The Taskforce has proposed several recommendations to ensure Associates can continue to thrive in today’s talent-driven economy, including:

- A bigger voice for Associates: Ensuring Associates have a stronger presence and more influence in the Institute’s decision making and overall direction of the profession.

- Tailored CPD: Offering learning opportunities to help Associates continue developing their skills in line with industry needs. Particularly for those outside of the insurance.

- Financial incentive: Associates who haven’t studied with the Institute for two or more years can take advantage of a 25% discount on their next Fellowship subject for Semester 1, 2025.

We extend our gratitude to the Taskforce for its dedication and vision in highlighting the strengths of Associates. Their work plays an important role in supporting members’ career trajectories, fostering innovation within the profession, and ensuring Associate Actuaries are positioned as a vital part of our industry’s future.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.