Interview with Andy Cohen: General insurance industry outlook for 2019

To kick start the new year for fellow general insurance actuaries with a sneak peek of what’s to come in 2019, Kitty Ho interviewed Andy Cohen, Principal at Finity Consulting and the chief editor of Optima.

2018 could somewhat be described as an eventful year for the general insurance industry – early experiences of the NSW CTP scheme reform (and the subsequent review by the NSW Legislative Council’s Standing Committee on Law and Justice), Royal Commission into Financial Services, ACCC’s Northern Australia Insurance Inquiry, dwindling profitability of short tail commercial lines.

For full details on how the industry performed in 2018, I refer you to Finity’s annual publication “Optima – General Insurance insights 2018”.

But what will be in store for the industry in 2019? What’s the outlook ahead?

What are the three key macro level trends that will drive the industry in FY19?

“For 2019, the three key trends that any general insurance actuaries should pay attention to are:

- Premium growth – which will continue for most lines of business due to rate increases, particularly in Commercial Lines. In FY18 premium volume increased due principally to rate increases. You would have thought this would have been positive for the industry’s insurance margins. While this was the case in Personal Lines, surprisingly in Commercial Lines the Combined Operating Ratios didn’t change much at all. This suggests the upside to rate increases in Commercial Lines is still to come through. While recent rate increases have obviously been useful, it is Finity’s view that further rate increases across most Commercial Lines are still needed if insurers are to achieve target Returns on Capital;

- Reserve releases have been a strong feature for a while now, with CTP being the major contributor – $1 billion releases three years in a row. Going forward, capacity for releases may not be at as high a level as in the past. The NSW CTP scheme changes will impact profit margins in the post-reform business. So, going forward, while the “back book” may still deliver good releases, this may be more challenging for the “front book”; and

- Claims inflation – after a number of years of strong inflation in Motor, a key theme in FY18 was a return to more normal inflation levels (2%). Is this a one off or will inflation levels remain under control going forward? More generally claims inflation levels have, for the most part, been relatively benign for a number of years but there are increasing pressures in a couple of classes that actuaries may want to keep their eye on.”

What does this mean for industry profitability? Will the industry deliver adequate returns in FY19?

“FY18 was a pretty good year for industry, it reported a 15% return on capital – this good result was driven by benign weather well below average levels, reserve releases in long tail classes and rate increases in personal lines. For FY19, the interacting dynamics of the three macro level trends outlined earlier will drive the industry’s performance. It’s hard to say and a lot depends on weather outcomes also … but I think upsides coming from rate increases will be offset by pressures from lower reserve releases, claims inflation in some classes and weather/cat claims costs at higher levels than in FY18. Overall, we estimate it will still be a good year for the industry – returns on capital still in the 10 to 15% range – but perhaps we will look back and say FY18 was the peak.”

What else should general insurance actuaries watch out for in 2019?

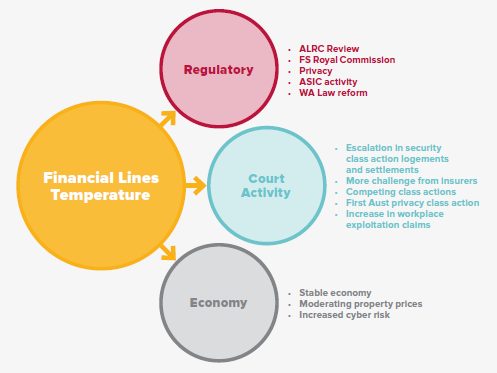

Andy highlighted the ‘Tort Temperature’ – a measure of the extent to which the claims environment is more favourable for claimants or more favourable for insurers. We are seeing the temperature going up (bad for insurers) in the Financial Lines classes of business. The diagram below, drawn from Optima, highlights the many areas of claims pressure in this class and explains why we now assess the tort temperature as having moved from warm to hot.

“The headwinds in Financial Lines include increased regulatory focus, escalation in security class actions, increase in workplace exploitation claims and increased cyber risk. Not all insurer portfolios are equally exposed to these issues. But actuaries will want to understand their clients’/insurers’ exposure and carefully consider all these factors in pricing and reserving.”

And for the Liability lines of business?

“Liability lines have run well since 2003 as a result of the tort reforms at the time. Initially, loss ratio levels of 30-40% were not unheard of in this class back in the early 2000s. This resulted in returns on capital well above target. However, over a number of years, competition has diluted profit margins and we estimate the Liability class is now running in line with, rather than above, target.”

While returns are currently on target, Andy alluded to a warming of the claims environment that may indicate risks to maintaining profitability at current levels. These include a High Court judgement that expanded the scope of common law damages to include superannuation, increased regulatory focus on the treatment of claimants, Royal Commission impacts more generally, increasing frequency and size of mental harm claims, the potential for Child Sexual Abuse Redress Scheme claim impacts to spill over to insurance policies and class actions. Pricing and reserving actuaries will no doubt want to keep an eye on these areas.

While only an anecdotal indication of the current environment, Andy also mentioned an article he had seen showing the most expensive keywords in Australia for online searches that are “purchased” from Google. In 2016/17, the most expensive word was “lawyer”, which was double the next closest – “workers compensation” and “insurance”. While not directly indicative of tort temperature this suggests that law firms are advertising, it is competitive, and law firms believe that this is financially worthwhile.

Some final comments

On wrapping up the interview, we discussed the topical Opal Tower incident and wondered which insurance lines of business will be impacted? Professional Indemnity, across a number of professions (certifiers, engineers)? Liability? Or perhaps all of these? Regardless, Andy made a bleak comment that up to now, the premium pool for Financial Lines is low relative to its susceptibility to high profile cases such as this one with its propensity to trigger large losses.

Post-interview, I walked away with the feeling that Andy had a cautiously optimistic view of the industry’s profitability for FY19 (returns on capital lower than FY18 but still in the 10 to 15% range), but there were a few headwinds for actuaries to consider in their daily work.

What’s your view and feelings on the general insurance industry’s outlook?

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.