Legal Complexities

Two barristers, Jessica Tat and Elizabeth Esber from Edmund Barton Chambers, highlight some important legal considerations for actuaries designing policies in general insurance.

Actuaries Digital has already covered the potential for wide ranging effects on the insurance industry resulting from COVID-19. Estelle Pearson’s COVID-19 blog on 17 March 2020 touched on the direct, indirect, and economic areas of impact for general insurers. Clearly there is still much uncertainty around the virus, how it will progress through populations across the globe, government responses, and ultimately the impact on businesses and individuals.

Insurers will inevitably draw on the expertise of their actuaries as they navigate the financial uncertainties. In this article, we draw the reader’s attention to the legal complexities that insurance professionals will likely encounter when considering the financial impacts of COVID-19.

Uncertain policy wording

This has been raised previously, but it will nonetheless be one of the main areas of concern. Having reviewed a number of policies across different insurance products, it is not uncommon to find policies with terms that are either not sufficiently precise and clear, or use terminology susceptible to more than one meaning.

Although the COVID-19 challenges have moved beyond merely travel insurance, it still serves as a good example of the potential problems when the exclusions are applied to COVID-19. In addition to travel insurance, uncertain terms also appear in income protection and business interruption to varying degrees.

Injury or illness, loss or damage arising from pandemic/epidemic events are generally excluded in travel insurance. For example, it is common for standard exclusion terms to consists of the following:

To the extent permissible by law, the policy will not respond if it:

- arises from;

- is related to, or

- is associated with:

- an actual;

- or likely

epidemic or pandemic events; or the threat of an epidemic or pandemic.

An exclusion term with similarly broad parameters would be difficult to apply because there is no clear point in time where the exclusion is triggered. The language is also vague, which would give rise to different interpretations. For example, what constitutes a “likely” epidemic or pandemic and, who determines this status? Further, what is considered a ‘threat’ of epidemic or pandemic and, who determines that this threat exists at any point in time?

Additionally, on what material will an insurer seek to rely upon in determining whether these factors are made out? For example, will the declarations of governments or bodies such as the World Health Organisation (the WHO) be determinative factors or merely informative?

In the context of travel restrictions, how will a WHO declaration of pandemic be weighted in an insurer’s assessment when some governments had already implemented travel restrictions and bans weeks or months prior to the WHO declaring pandemic status?

If these questions remain unsolved by the operation of the policy, then they may present points of dispute between policyholders and insurers.

While exclusions are a necessary component of any insurance policy to identify the risks that the insurer agrees to cover, the clause also needs to provide the necessary information to inform the insured under what circumstances they will not be covered, otherwise it would be unfair to the policyholder if applied. The sample clause, in our view, is too broad resulting in a lot of uncertainty on how it should be applied.

The Courts will attempt to interpret the policy by applying legal rules and principles, with the added requirements of the Hayne Royal Commission. However, it will be difficult for insurers to successfully rely on exclusion terms that are not clear, specific and, fair.

Planning for claims will lead to better outcomes

The progress of COVID-19 through Australia is well documented. Insurers that are likely to receive claims would be better served by being on the front foot. This means identifying the contributing factors that are important to deciding the claim and collecting this information near the time the claim is lodged. This will save later effort in establishing the timeline and establishing the facts. Announcements like travel warnings applicable at certain points in time are easier to collect at the time they are made.

Similarly, questions put to potential claimants should help to establish the facts surrounding the claim rather than reliance on the retrospective piecing together of facts. This will simplify the work that claims professionals and their solicitors will have to do later, and therefore lowers costs and speed processing.

Further, it is also a useful process to identify the areas of dispute that might arise in claims later, which will start to distil down the uncertainties for actuaries who are attempting to estimate the cost of COVID-19 to their organisations.

For example, NSW workers compensation legislation requires that employment must be the main contributing factor, or words to similar effect. In addition to matters canvased in section 9A(2) of the Workers Compensation Act 1987 (NSW), circumstances specific to COVID-19 should be considered and may include:

- Work related travel to an area with a known COVID-19 outbreak.

- Work related activities that include engagement or interaction with people who have contracted COVID-19.

- Any interaction with family or friends who have contracted COVID-19, i.e. living with someone or attended gatherings with people who has been tested positive.

- Travel history two weeks prior (number of weeks prior subject to medical advice) to the date of the claimed event.

Fairness in dispute resolution

There are varying challenges between stakeholders, the sentiment being expressed by the government, insurers and regulators is one of compassion for policyholders, and rightly so.

As infections continue to increase worldwide and an estimate of one million Australians face losing their jobs overnight, a lot of people are suffering. However, compassion for the policyholder needs to also consider the challenges that financial institutions and insurers will face from the unprecedented magnitude and impact of COVID-19.

AFCA has identified the severe financial impacts of COVID-19 on both the insureds and insurers in their revamped approach to dispute resolution for COVID-19 related claims. AFCA announced that it will take into consideration the unprecedented circumstances that financial firms and policyholders are currently facing, as well as any revised regulatory standards or guidance.

It aims to provide early communication with stakeholders and more streamlined and expedited process for the resolution of COVID-19 related claims. It would be reasonable of AFCA to expect that insurers similarly take a balanced, reasonable and honest approach in the way COVID-19 related claims are managed and determined.

What should we do?

Insurers undoubtedly will already have teams devoted to their pandemic response, focusing on their own business continuity and impact of claims. For those considering the claims aspects, it’s clear that the complexities with COVID-19, the many unforeseen circumstances, and the continuously evolving landscape mean that a team with expertise across actuarial, claims and legal, customer and executive leadership needs to proactively plan for eventual claims

– lets call it the Pandemic Claims Response Strategy (PCRS).

The PCRS

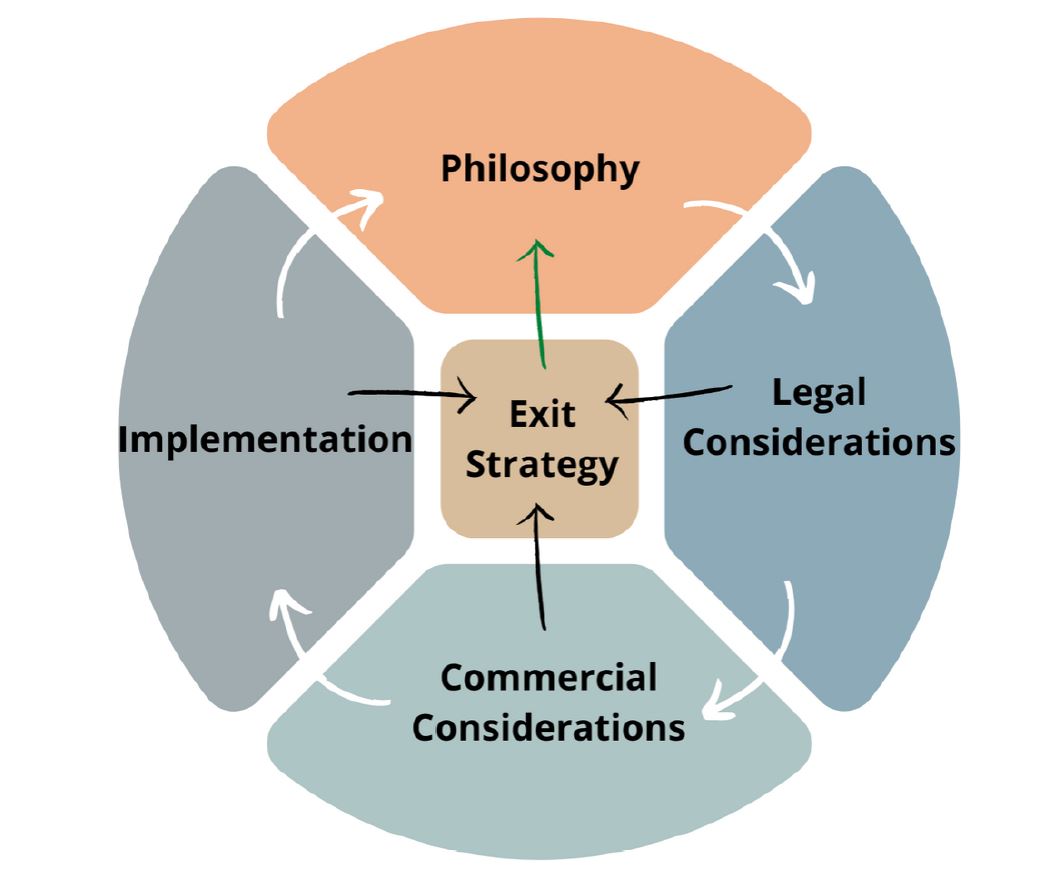

The PCRS is based on legal principles including recommendations by the Hayne Royal Commission as well as characteristics of the CPS 220 Risk Management framework. It requires the collaboration between different experts such as actuaries, lawyers, claims, underwriting and CROs to develop a strategy that is legally sound, commercially viable and importantly, adaptable to the rapid changes presented by COVID-19.

The PCRS provides the strategy on which decisions are based, and it is also a guideline for claims assessors, to facilitate consistency in the management of claims and outcomes.

The ability to adapt is key to managing a pandemic such as COVID-19. We must be prepared for the unexpected, claims and circumstances, and respond accordingly.

As COVID-19 evolves, so should the process and an exit strategy that anticipates change is essential. The “exit strategy” allows insurers to reassess and re-tailor the procedures accordingly, which will require regular engagement with all relevant stakeholders and experts.

COVID-19 has already set many records, perhaps it could also present an opportunity for insurance experts to come together and work towards a solution that is viable for all stakeholders.

Liability limited by a scheme approved under Professional Standards legislation. The contents of this paper (including any attachments, charts, and info-graphics) are privileged and confidential. Any unauthorised disclosure or use of its contents is expressly prohibited.

If you are interested in discussing further with the authors, contact details are below in the bio section of this article

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.