COVID-19 – Emerging impacts for Business Insurance

As Australia continues its efforts to ‘flatten the curve’, there are more economic impacts that are emerging. Estelle Pearson returns to the COVID-19 blog in this article about business insurance and some issues actuaries should consider in their roles.

By 21 April 2020 Australia had over 6,600 confirmed COVID-19 cases and over 70 deaths. New cases peaked at an average of 375 per day between 23 and 29 March and have averaged under 40 per day for the last week. Discussion has turned to how long the current shutdown lasts and how restrictions will be eased. It is likely that there will be a certain level of restriction around social distancing, travel and borders for some time and restrictions are likely to increase and decrease depending on case numbers.

The economic consequences of COVID-19 are already massive. An estimated 700,000 Australians have lost their jobs and the Commonwealth Government has announced over $200 billion of fiscal stimulus packages including the JobKeeper and Jobseeker allowances. There is significant uncertainty about the medium and longer term economic impacts of COVID-19 for Australia, with the IMF estimating a 6.7% contraction in the Australian economy this year and the worst global recession since the Great Depression.

In this context, this article looks at the impact that COVID-19 is having on Business Insurance in Australia and provides some thoughts on how actuaries can assist insurers in this sector.

Impact on businesses

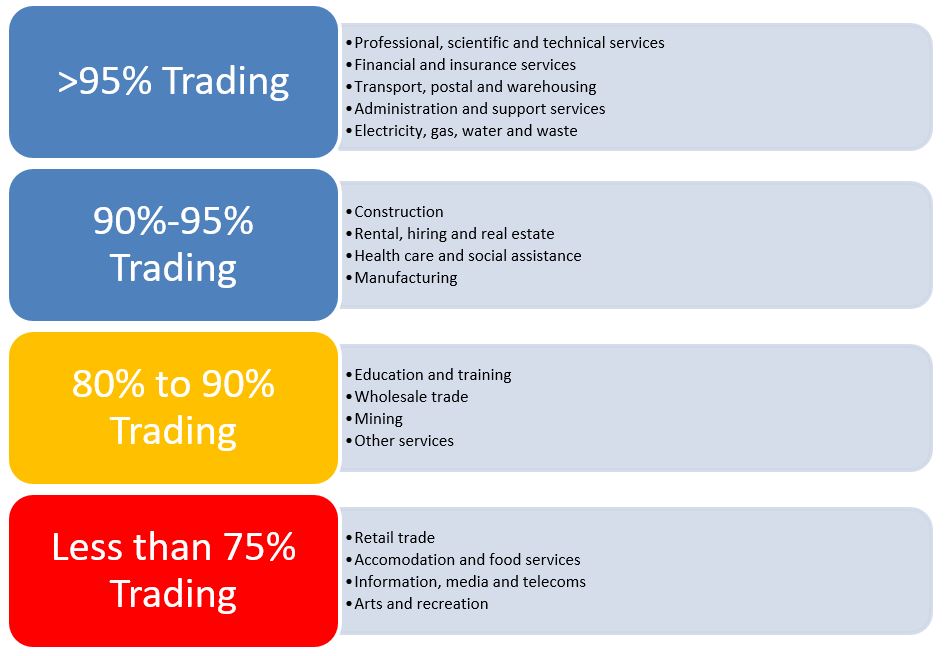

The ABS survey on the COVID-19 impacts on businesses for the week commencing 30 March 2020, found that 10% of businesses were not trading, and that in 70% of these cases it was due to the impact of COVID-19, mainly the Government restrictions on operations. By sector the proportions of businesses currently trading varied from 96% for areas like financial and insurance services and utilities to under 50% for arts and recreation. Retail trade, accommodation and food services and information, media and telecommunications also had more than 25% of businesses reporting that they were not trading. Small businesses have been hit harder than larger businesses, but all sectors and businesses have been impacted in some way.

The survey also reported that two thirds of businesses had seen a reduction in turnover/demand. In most sectors at least half of all businesses reported a reduction in demand; in accommodation and food services 95% of businesses reported a reduction. Only Mining and Utilities had less than 50% of businesses reporting a reduction in demand.

Impact on Business Insurance- Premium

For insurance the impacts being felt by businesses will be seen most obviously in lower premium revenue. A number of insurers have announced support for SME customers in the form of deferred premium payments for those in financial hardship. However even with this, it is to be expected that a number of businesses will cancel or reduce cover or be unable to pay premiums once the deferment period ends. Insurers are also likely to reassess or put on hold rate increases. Up until the end of 2019, the commercial insurance market had been hardening with some significant increases in rates for property and more recently liability – while the impetus for these increases remains (especially for property) more difficult market conditions especially in the SME sector may make it hard to achieve meaningful rate increases.

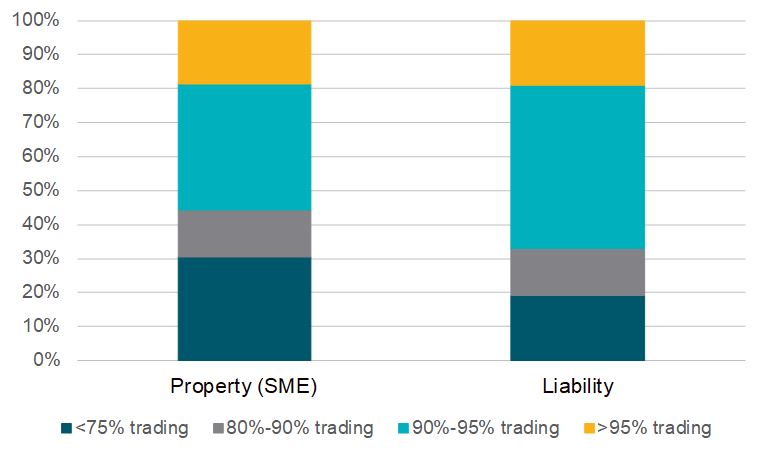

The following graph shows the distribution of property premium for package business and liability premiums by the proportion of businesses that were trading in the week commencing 30 March 2020. The information on property premiums has been estimated from information on 80% of the market collected by Insurance Statistics Australia. The information on liability premium has been estimated from APRA’s National Claims and Policy Database.

For property around 30% of premium is from industries where less than 75% of businesses were trading in the week commencing 30 March 2020. These same industries represent around 20% of liability premiums. A further 15% of premium for both property and liability is from industries where 80% to 90% of businesses were trading in the week commencing 30 March 2020. Only around 20% of premiums are from industries where more than 95% of businesses were still trading.

Impact on Business Insurance – Claims

From a claims perspective there has been much written about Business Interruption cover both in Australia and overseas given so many businesses have been unable to continue to operate due to Government restrictions. Generally in Australia, business interruption cover is only triggered by physical damage or loss to the underlying property. Even where extensions exist, there is normally an exclusion for diseases declared under the Quarantine Act 1908 (replaced by the Biosecurity Act 2015) – the industry having generally moved to such exclusions following the 2003 SARS outbreak. Successful business interruption claims might therefore be expected to be the exception rather than the rule. Arguments that BI cover should respond more generally to COVID-19 are ultimately unrealistic. This risk has not been included in premiums and is not covered by insurers’ capital reserves. To put this in context, the monthly turnover of Australian businesses is around $250 billion. The total capital base of Australian regulated direct insurers is around $24 billion (and this is already needed to ensure that insurers can meet all claims actually covered by existing insurance policies).

One possible insurance claim impact in the medium term is an increase in fire claims. Giving evidence to the Select Committee on Fire Protection in 1867, the Secretary to the Sun Insurance Office noted “When there is a depression in any particular trade then the fires in that particular trade commence” (according to A History of the Sun Insurance Office 1710-1960, discovered recently in a second hand bookshop). Investigating the possibility of arson for some claims will be a sensitive issue for insurers during a prolonged economic downturn.

For liability, while restrictions are in place, the level of ‘slip and trip’ exposure will reduce dramatically. At the same time the increased use of contractors in some areas might increase W2W exposures. There will be class actions arising from COVID-19 relating to breach of duty of care, but these are likely to be confined to specific exposures – such as cruise line operators or operators of aged care or other facilities.

How can actuaries assist?

A key aspect of the current environment is the level of uncertainty. It is uncertain how long the current shutdown will last, how long it will take for Australia to come out of shutdown, the level of economic contraction and the length of the recovery. And these uncertainties are then repeated for the rest of the world which will also impact the economic situation in Australia. On the basis that Business Insurance will not suffer a large level of COVID-19 related claims impacting solvency, one of the major issues faced by insurers is the uncertainty of the prospective outlook for premium and profit.

The key is to be nimble and adapt models as the situation evolves.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.