Health funds return COVID-19 claims savings back to members

Private health insurers experienced significant claim savings during COVID-19, due to the reduced utilisation associated with the suspension of elective surgeries and temporary disruption in ancillary services.

Some of the reduced or avoided services will never occur, so are ‘genuine’ claim savings (although as noted below, these savings will not be kept by insurers as profits). However, a proportion of the services are likely to have been deferred and may eventually materialise as claims. In other words, some claims will occur once procedures that were delayed due to COVID-19 are scheduled in once hospitals and ancillary service providers, such as dentists and physiotherapists, return to business as normal.

In anticipation of future deferred claims, private health insurers collectively held $1.8 billion in deferred claims liabilities (‘DCL‘) at December 2020. As 2021 progressed, it became apparent that some of the expected deferred claims would not materialise, prompting many health funds to release a portion of their DCL provision as a benefit to members.

The private health insurance industry has committed not to profit from COVID-19, and consequently, many private health insurers have released COVID-19 related profits back to members. COVID-19 has impacted insurers to varying degrees due to differences in the mix of policies by insurer. The method, timing and quantum of the return of COVID-19 related profits is up to individual insurers, with many returning COVID-19 related profits through a combination of the below:

- A ‘give back’ of COVID-19 claims savings through cash payments to members, premium relief, or deferral of the 1 April 2022 premium rate increase. This initiative will be referred to as the ‘COVID-19 give back’ throughout this article.

- Other forms of COVID-19 relief including financial hardship packages, increasing mental health benefits, deferral of the 1 April 2021 premium rate increase, expanded telehealth services and/or extras limits rollovers.

Of the $1.8 billion deferred claims liability for the industry at December 2020, some of this has been released to members to fund the above initiatives, while the remainder relates to the funding of deferred claims. Some uncertainty remains around future deferred claims, and many private health insurers continue to hold a deferred claims liability. For example, Medibank held a DCL of $224 million at 30 June 2021, and NIB held a DCL of $34 million at 30 June 2021. There may be future initiatives to return COVID-19 claim savings to members if there are less deferred claims in future than expected.

The focus of this article will be on the first of the two initiatives listed above, i.e. the COVID-19 give back initiative via cash payments to members, premium relief, or deferral of the 1 April 2022 premium rate increase.

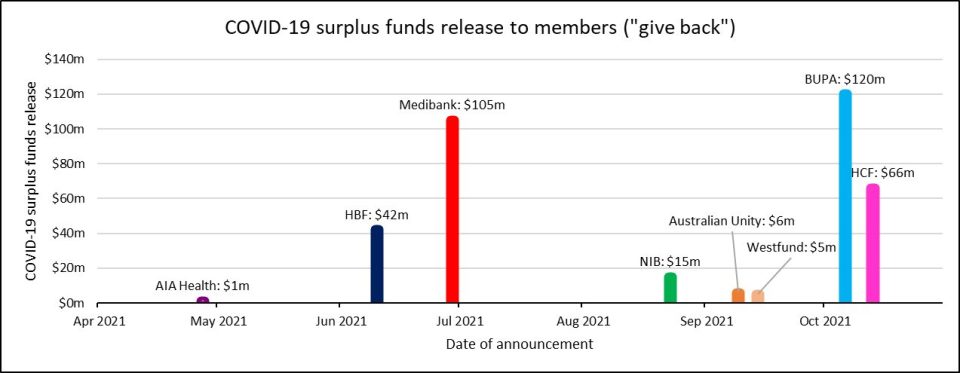

Timeline and amount being released to members

At the time of writing of this article, eight of 35 private health insurers have announced some form of COVID-19 give back to its members. The announcements from health funds began with AIA Health in April 2021, to the latest announcement (as of drafting this article) by HCF in October 2021. The graph below illustrates a timeline of press releases by health fund to date and the amount of COVID-19 give back being released to members as stated in respective insurer press releases.

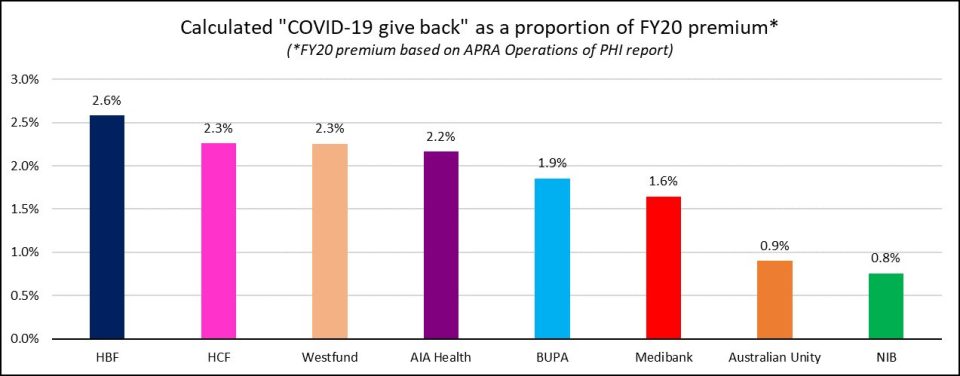

Australia’s largest two private health insurers, Bupa and Medibank, announced the largest dollar give back amounts of $120 million and $105 million respectively. When expressed as a proportion of FY20 revenue, health fund HBF returned the largest COVID-19 give back of 2.6% of FY20 premium revenue. The COVID-19 give back as a proportion of FY20 premium revenue is shown below.

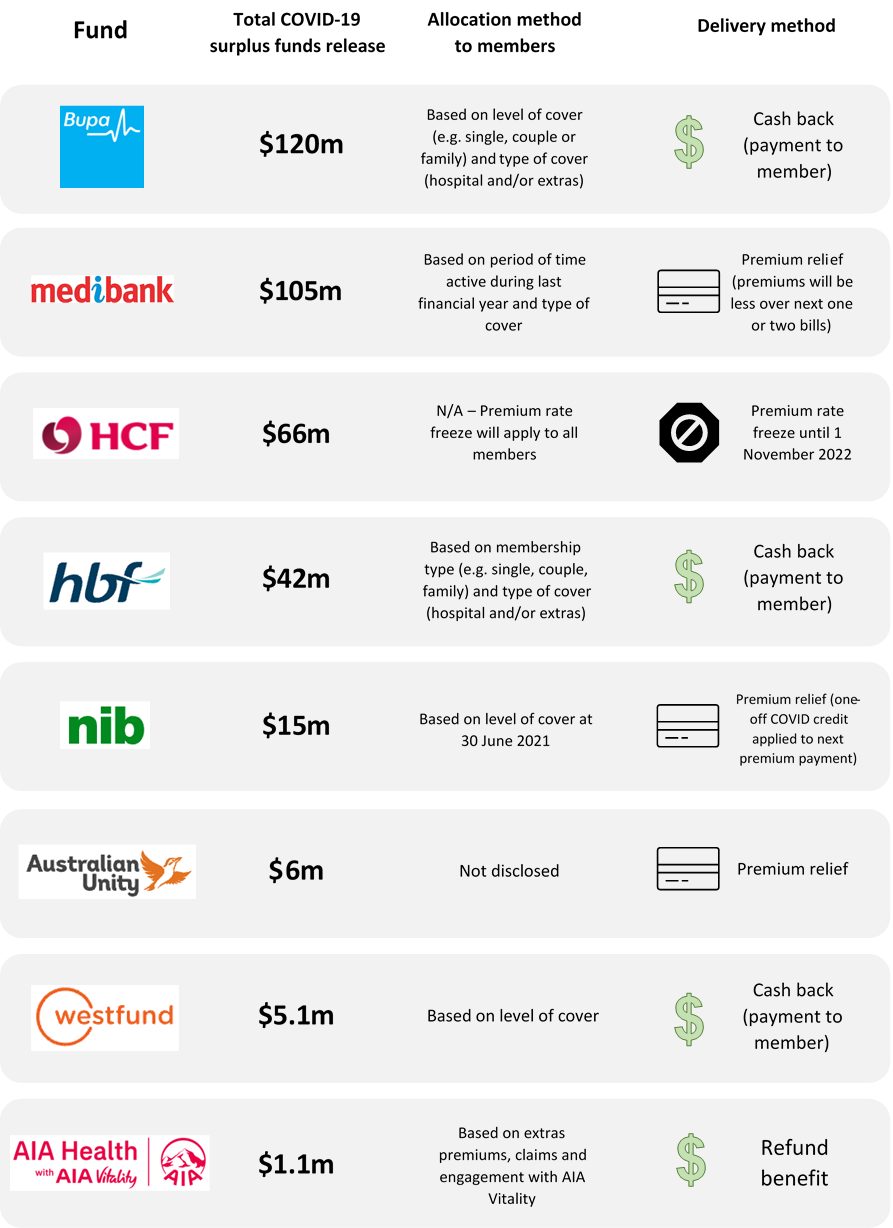

Allocation method and delivery of COVID-19 give back

The allocation of the total COVID-19 give back to individual members differs by insurer. Some insurers have opted for a simple approach based on the level of cover at a point in time, whilst others have adopted a more sophisticated approach, such as an exposure-based method. Similarly, the delivery of the give back to members varies with different insurers returning the surplus through cash payments to members, premium relief or 1 April 2022 premium rate freeze.

The infographic below summarises the calculation method and delivery of the COVID-19 give back by fund.

Impact to individual members

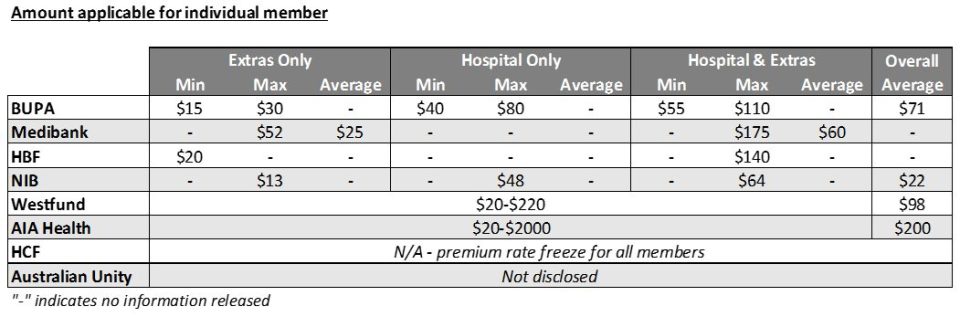

The dollar returned to individual members from the give back initiative is based on the calculation methodology adopted by individual funds. However, press releases provide an indication of the benefit amount a member could expect to receive. Based on this information, members have received or can expect to receive a range of surplus funds, from a few dollars to around $100-$200.

There is no consistency in the figures that health funds choose to release, with most generally quoting a minimum, maximum and/or average amount per member. Where available, these are displayed in the table below. The dollar amounts quoted in the table below are based directly from press releases and/or insurer websites and no numbers were calculated.

The total COVID-19 give back announced through cash payments to members, premium relief, or deferral of the 1 April 2022 premium rate increase amounts to around $360m to date and there may be more to come in future months. The $360m COVID-19 give back initiative discussed in this article represents a subset of the much larger total COVID-19 support package provided by private health insurers which includes other initiatives such as the 1 April 2021 premium rate deferral, financial hardship packages and expansion of mental health and telehealth services.

The total COVID-19 give back announced through cash payments to members, premium relief, or deferral of the 1 April 2022 premium rate increase amounts to around $360m to date and there may be more to come in future months. The $360m COVID-19 give back initiative discussed in this article represents a subset of the much larger total COVID-19 support package provided by private health insurers which includes other initiatives such as the 1 April 2021 premium rate deferral, financial hardship packages and expansion of mental health and telehealth services.

As future experience emerges, the DCL provision held by private health insurers will gradually be released either through the funding of future deferred claims or through other forms of release, for example, through further premium relief that benefits members.

References

|

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.