Insights into actuarial university students

The Actuaries Institute accredits seven Australian universities and one New Zealand university to teach our Foundation Program and part of our Actuary Program. A survey was created to gain an understanding of the demographics and future aspirations of students currently enrolled in actuarial studies within these universities. The following article provides a summary of the results.

Methodology

The survey opened in the first week of October and closed on Friday 29 October. Each accredited university distributed the survey through their Nominated Accredited Actuary and corresponding actuarial student society bodies. In addition, the Institute circulated the survey to its internal email list of current university student subscribers with further mentions in the Institute’s Weekly Bulletin.

Kitty Chan, the Institute’s Asia Liaison Manager, also distributed the survey via social group chats hosted by Asia-based volunteers in China, Hong Kong, Malaysia, Singapore, and other parts of Asia.

Participating universities

Students from all eight accredited universities were invited to participate in the survey. Responses were received from all universities.

Survey results

There were approximately 300 responses received in total. The main themes from each question are detailed below.

Current university and year of study

Students were asked which university they were currently studying at, their current year of study and whether they were undertaking undergraduate, post graduate or PhD studies.

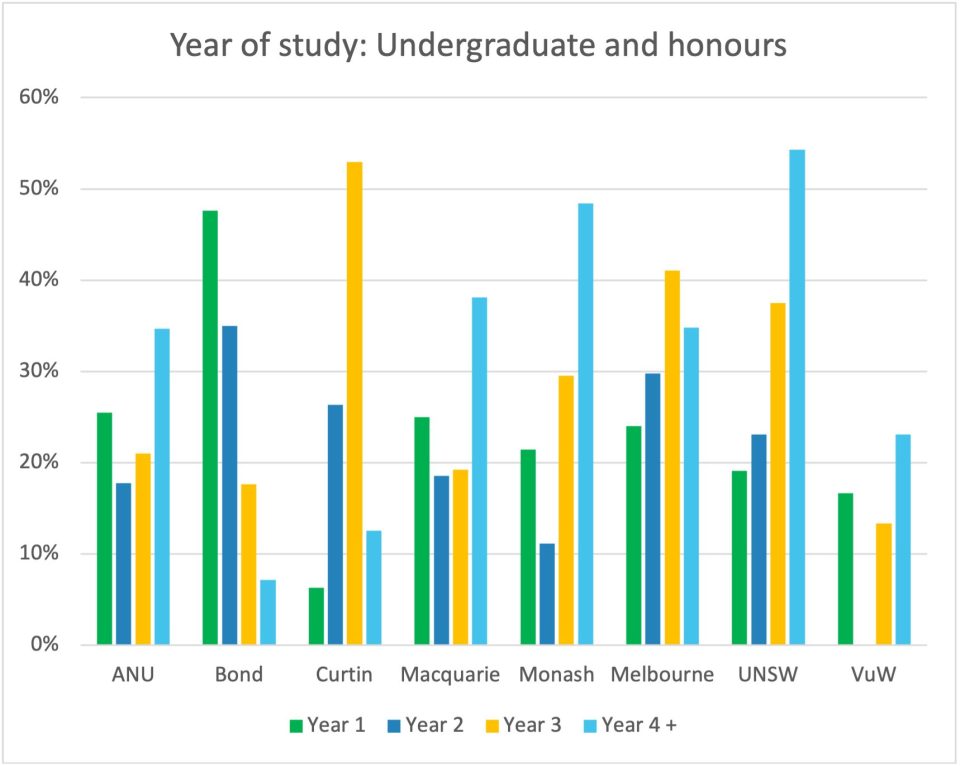

Chart 1 visually presents the number of undergraduate student responses by university and year of study.

Gender mix

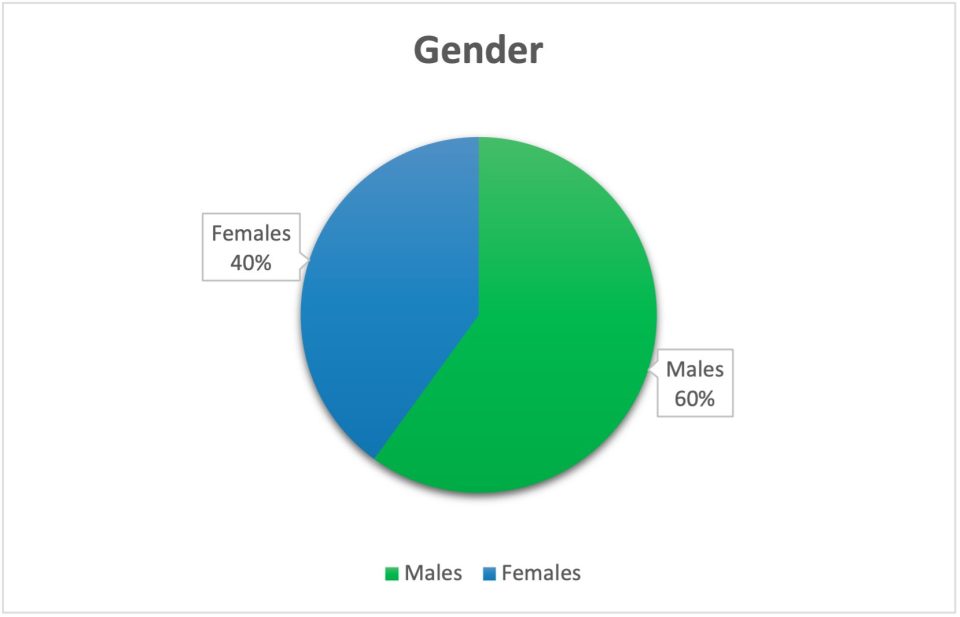

The gender mix of students who responded was approximately 60% male and 40% female as detailed in Chart 2. This may not be indicative of the actual gender mix of all students.

Enrolled degree

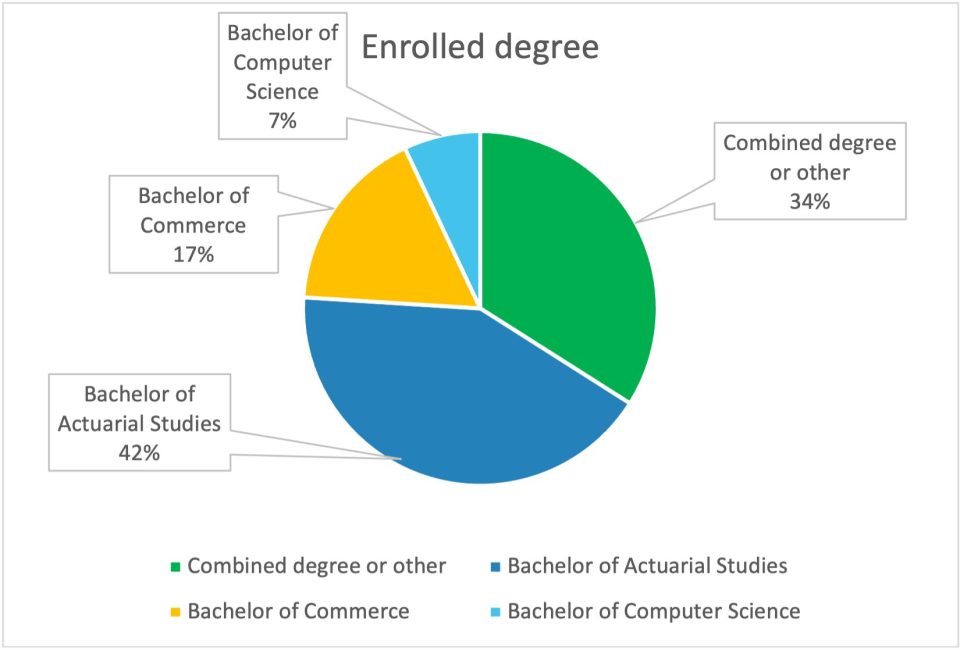

The question of which degree students were enrolled in revealed some interesting results as shown in Chart 3.

Whilst less than 50% of the students are enrolled in a Bachelor of Actuarial Studies, this reflects the fact that actuarial subjects often form a major as part of a degree. An additional 34% were enrolled in a combined/double degree. The combined degrees listed included commerce, finance, computer science, statistics, engineering, mathematical science, economics, law, applied data analytics and science (physics). This is encouraging as students with different backgrounds will help with diversity of thought in the profession.

Motivation for actuarial studies

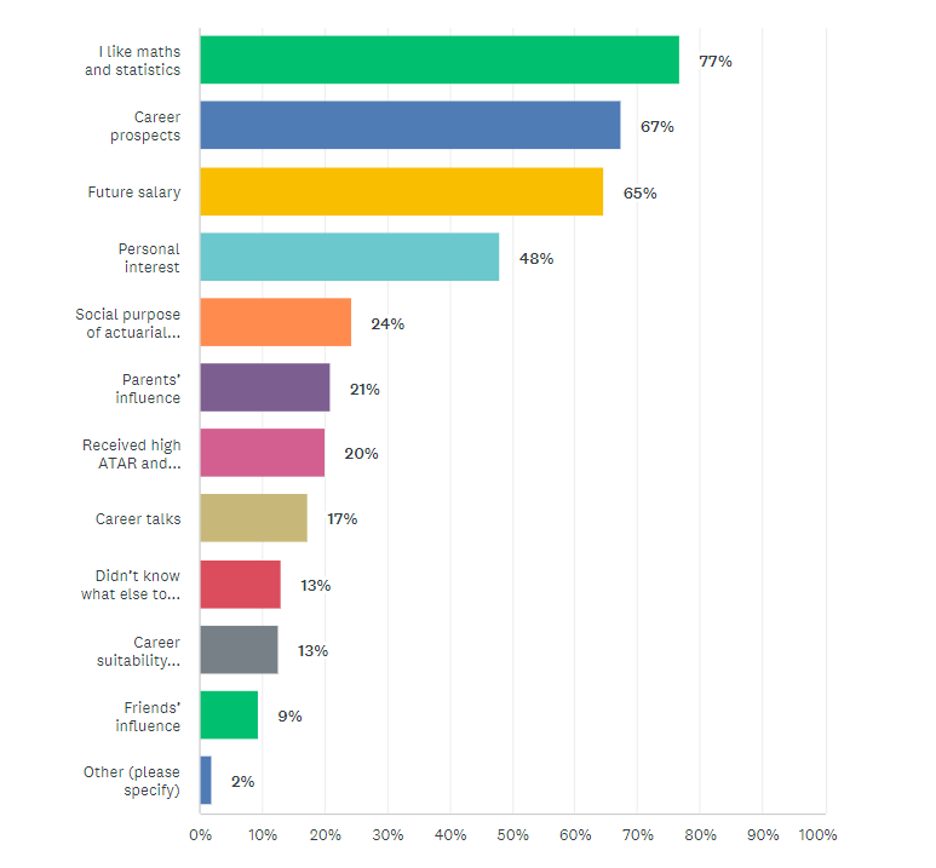

Students were asked to tick as many of the listed motivations as applied. The results revealed that the primary motivation for students enrolling in actuarial studies was their interest in math and statistics.

This motivator was closely followed by the prospects of future career and salary opportunities. Other motivations were ranked as shown in Chart 4.

Domestic and international students

Of all responses received, 225 students stated that they were domestic. Approximately 70 students stated that they were international with almost half of these from China. Other countries of origin included Indonesia, South Korea, Vietnam, India, Columbia, Malaysia, Sri Lanka, Hong Kong (SAR), New Zealand, Singapore, Japan, Zambia, Taiwan, Zimbabwe, Guatemala, Cambodia, Ireland, Kenya, Botswana, Africa and Thailand.

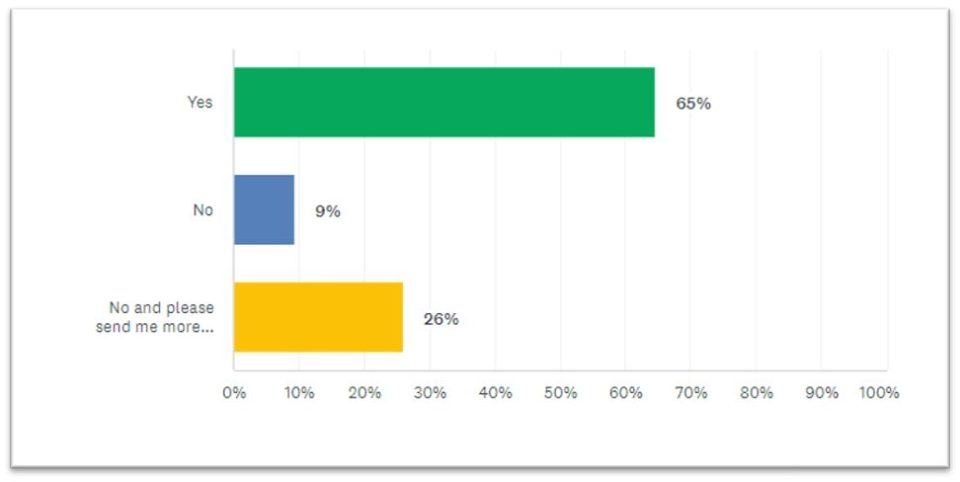

General awareness of how to become an actuary

Chart 5 reveals that most students, (65%) were aware of how to become an actuary through the Institute following completion of their university studies.

Whilst 35% of students stated that they did not have any awareness, nearly 75% of these students provided an email address and the Institute is preparing relevant information to be sent through.

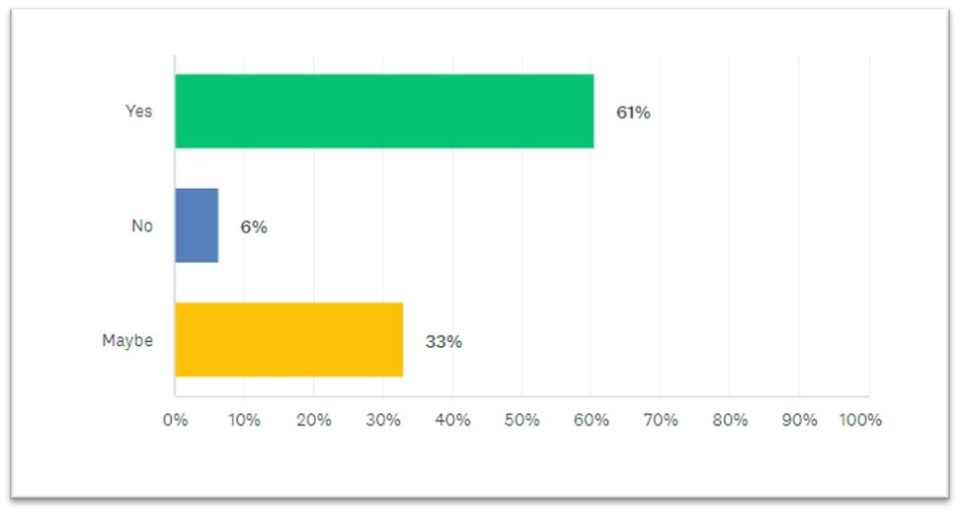

Future intentions of becoming a Fellow

Chart 6 shows that most students (61%) indicated that they had a future intention of becoming a Fellow of the Institute. Reasons given for this intention were to enhance their career prospects, promotional and employment opportunities, increased salary, personal interest, always wanting to aim to be the best and a personal drive to achieve.

Six percent of responding students stated that they did not intend to continue studying to becoming a Fellow.

Thirty-three percent of responding students were not certain of their intention to continue their studies. Reasons given for this were broadly stated as dependant on whether the Fellow designation was a necessary job requirement, whether employers would subsidise the cost of study, a desire to understand more about the profession first, a lack of enjoyment and/or interest in actuarial studies, the absence of a desire to continue studying, unsupportive families and questions around whether they may be too time poor when working full time plus a lack of understanding around what the study would entail.

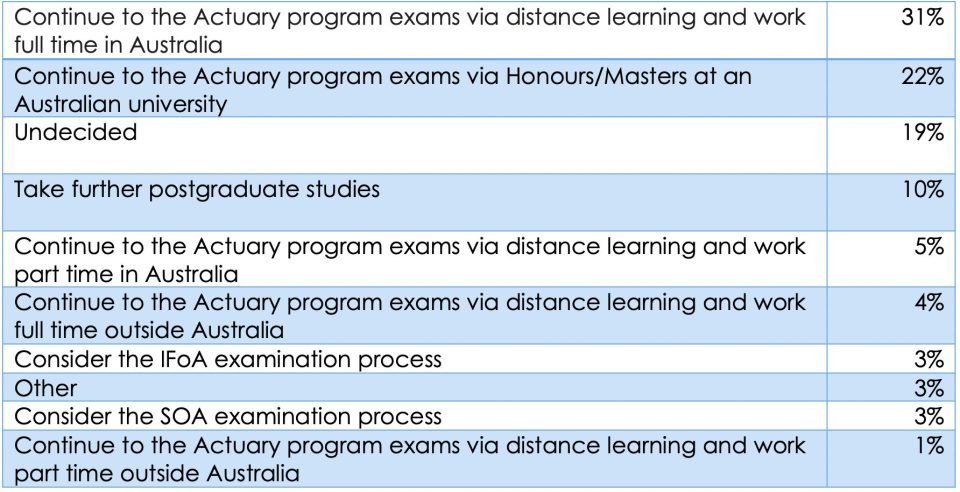

Student plans following completion of undergraduate degree

Table 1 details what students planned to do following the completion of their undergraduate degree:

The ‘Other’ category of responses included having secured a role in a non-actuary related field, the desire to work full time first and the intention to continue with post graduate studies.

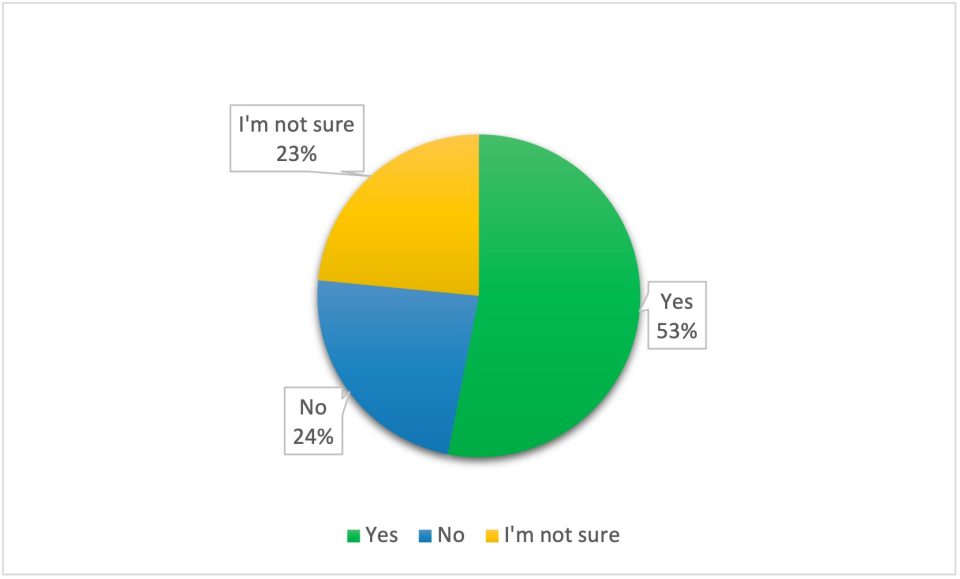

University subscriber membership and knowledge

The Institute offers university students a free subscription with various benefits via registration on the Institute website. The benefits include complimentary attendance at Insights sessions, career and other information delivered via an App called ‘Sprint’.

Students were asked whether they were current subscriber members, with the results detailed in Chart 8.

Fifty-three percent of students stated they were current subscriber members.

A total of 47% however indicated that they either were not subscribers or unsure if they were.

This presents an opportunity for the Institute to increase subscription awareness and take up. Students were also asked if they would like to receive more information about how to become a subscriber, with 18% providing their email address for that purpose.

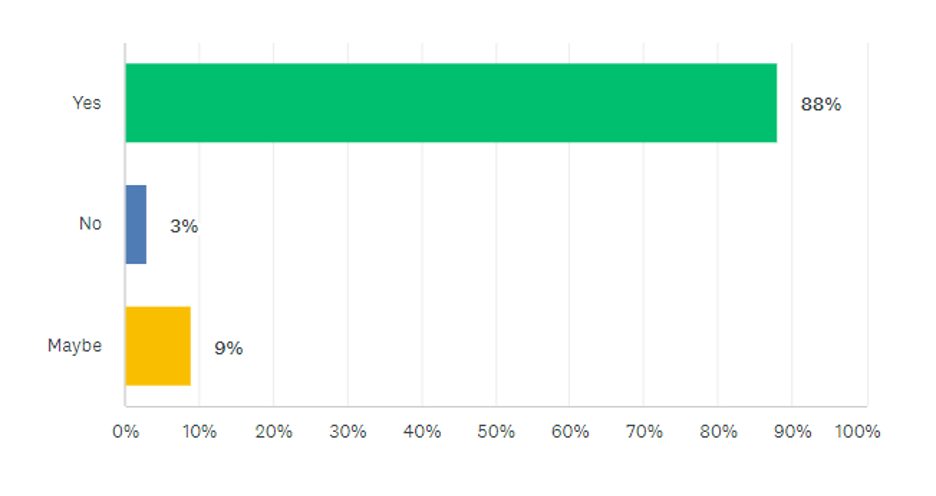

Interest in remaining connected to the Actuaries Institute

Students were asked if they were interested in remaining connected to the Institute. A large majority (88%) stated that they would like to do so, as may be seen in Chart 9.

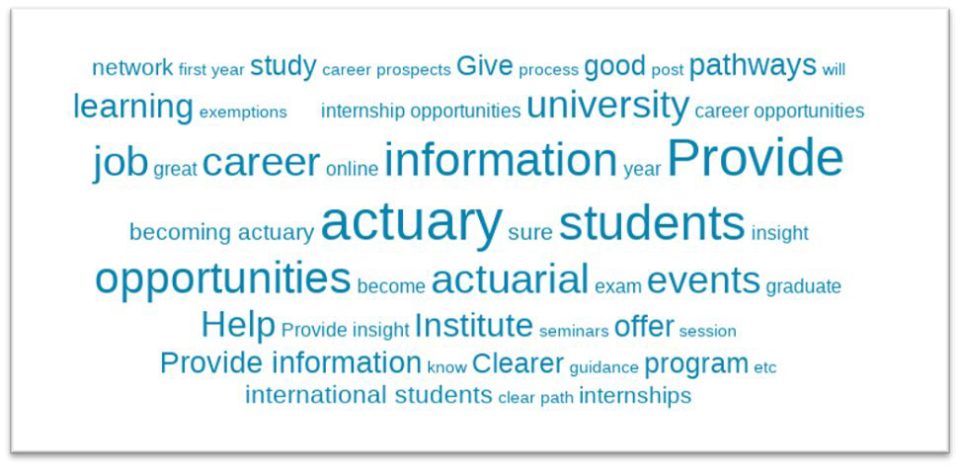

How can the Actuaries Institute help students more?

Students were asked how the Institute might be able to help them more.

The below word cloud visually represents the responses received, with words in larger font representing the most stated answers.

A broad summary of the common themes from the open text responses to this question included students seeking more information on how to become an actuary, exemptions and entry requirements, insights into career pathways, provision of social events, networking, internship and mentoring opportunities and salary surveys.

Any other feedback students would like to give

The last question of the survey asked students if they had any other feedback for the Institute. The majority said they did not and a variety of positive comments such as the below were also received:

“Keep doing the stellar work, all of the students really appreciate it!”

“Not really, the institute have provided amazing help whether it’s resources, books, showcasing opportunities to learn and work, etc.”

“I really like the actuaries digital. Insightful and interesting to see what people are up to in the actuary field.”

Conclusion

Overall, the survey provided useful insights into the current demographics, views and opinions of students enrolled in actuarial studies at Australia and New Zealand’s accredited universities. The Institute will continue to focus on further engagement with all students in the future. It is intended that this survey is an annual activity each October.

The Institutes thanks all students for their participation.

Acknowledgments

We would like to acknowledge the Nominated Accredited Actuaries from all accredited universities:

- Australian National University

- Bond University

- Curtin University

- Macquarie University

- Monash University

- University of Melbourne

- University of New South Wales

- Victoria University of Wellington

Furthermore, we would like to acknowledge the actuarial student societies who assisted in distributing the survey to students.

- ANU Actuarial Society (ASOC)

- Bond Actuarial Students’ Society (BASS)

- Curtin University Student Actuarial Society

- Actuarial Students Society at Macquarie (ASOC)

- Actuarial Students Society at the University of Melbourne

- Monash Actuarial Students Society (MASS)

- Actuarial Society of UNSW (ASOC)

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.