Life insurance customer value per dollar

With numerous life insurance products available in the Australian market, choosing the right one can be overwhelming for the consumer.

The big number of life insurance products can be attributed to the number of insurers (even after recent sell-off by banks), their product variations, and the many permutations these variations have created. There are also different channels to choose from, retail (individually sold via financial advisers), direct (direct to customer) and group. For instance, in the retail life insurance channel, a given product combination, say term with TPD rider and income protection (IP), IRESSgenerates more than a hundred different offers from all insurers. If you add direct and group insurance products, the task of choosing the right product is really daunting for the customer.

The good news for retail customers is that financial advisers have significantly helped in simplifying the choice and are able to recommend a handful of top product prospects. As part of the process, financial advisers normally use research tools created by research companies (e.g., IRESS, LifeRisk Online, etc.) to ease the product selection process. Research companies provide premium estimates and product scores to advisers, which are key variables that financial advisers use to decide on the most appropriate life insurance for that particular customer. This allows financial advisers to provide a solution from a choice of potentially more than a hundred down to a few.

Research companies’ research tools normally provide a range of competitors’ products with their respective product score(s) and premium. For a potential customer, financial advisers will enter the customer’s personal circumstances for which a research company will generate available product(s) for each insurer. The adviser will then analyse the results, looking at premiums, product score, quality of service of insurer and some other variables and make a recommendation guided by the best interest duty[1] and if the product belongs to the adviser’s approved product list (An approved product list or APL is simply a governance tool and risk management device for a licensee. Essentially, it provides a curated list of researched and verified financial products which advisers can consult before providing financial product recommendations).[2]

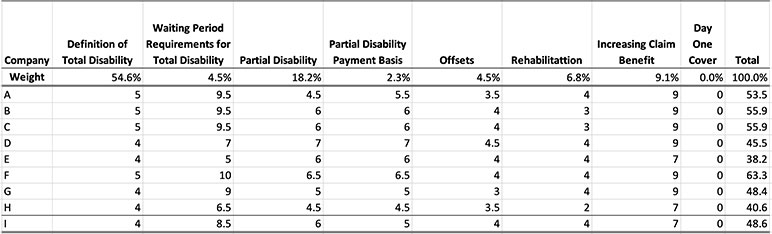

Figures 1 and 2 are sample product score outputs from LifeRisk Online and IRESS. Each has its own contrasting criteria for arriving at the product score. Figure 1 applies different percentage weightings to a number of categories to arrive at the total cover score.

Figure 1 LifeRisk Online sample rating for Income Protection Product

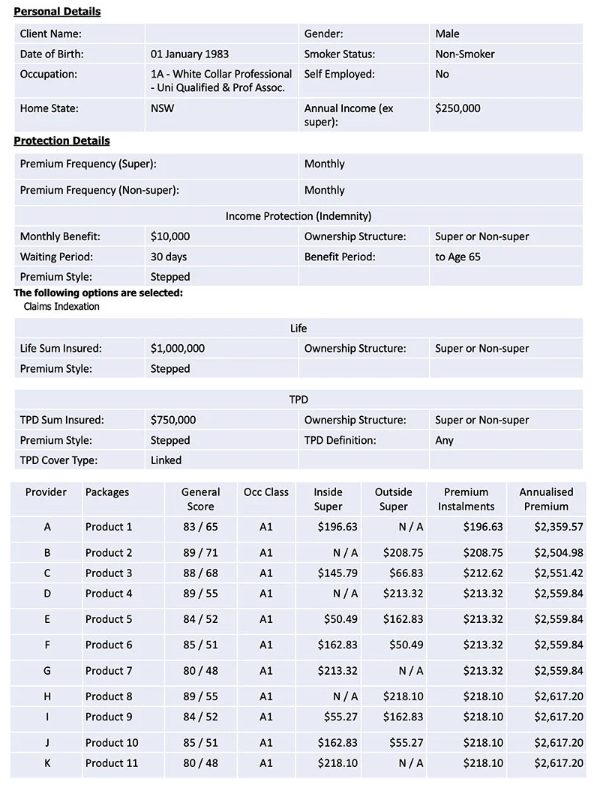

Figure 2 uses a general score, which is composed of the core score and a supplementary score. Core score, in a nutshell, is the product score for all the core provision and features of the product and the supplementary score is the product score for the supplementary provisions/features.

Figure 2 Sample IRESS Product Rating for Income Protection Product

(Source: IRESS. Reprinted with permission.)

In an XY Adviser[3]discussion, an adviser believes that the best product to be recommended is the product where the customer has the best chance of making a claim on the policy. As part of the product score and premium analysis, advisers would normally look for the highest product score[4] with the cheapest possible premium. Often, three or more may be recommended. The choice of what product is to be recommended normally depends on the adviser experience with the insurer or product and guidelines or tools that are available to them. In this process, a cheaper product with low rating will almost never be recommended over top products that have higher premiums but higher product ratings. How can we be sure that a more expensive but highly-rated product is better than a cheaper product with lesser features? What if the proposed customer can’t afford the premiums of the best-rated product? Does required coverage then suffer?

Customer Value per Dollar (CV/D)

This article proposes a customer value per dollar (CV/D) analysis methodology. Its objective is to clearly guide the customer and adviser to the most suitable product given the number of products available to a customer and strike a balance between features, cost, and affordability.

Simply put, CV/D is the ratio of the overall rating (OR) to the premium of interest (POI). CV/D tries to unitise the value of a given product offer (benefits provided by the product) to premiums that customers pay. It can be considered as the value a customer gets for every dollar or dollar unit (e.g., per $1,000) a customer pays.

In this case, OR represents the total value that a customer can get from the product. For our purposes in this paper, we will be using IRESS’s General Score to represent OR.[5] There is obviously a big reliance on OR to be as accurate as possible for this analysis to be successful. IRESS was chosen for illustration because of its share of business and experience in the Australian life insurance market.

POI on the other hand, represents customer cost. There can be many ways to measure this which includes (1) first year premium, (2) sum of first five/ten/twenty years of premium (or however many years), or (3) present value of premiums for x number of years (x can be any number capped at the maximum number of years in which premiums are payable). Using premiums for ten or more years is desirable to capture the impact of durational discounts and shape of the premium rate curve being employed by insurers.

Table 1 shows premiums from different insurers for term, TPD and IP in the market. Columns 2, 3 and 4 are total annual premiums for the first year, first five years and first ten years. If we turn our attention to products F and J, product J has a slightly higher premium in the first year. However, as you lengthen the duration of comparison, product J shows much lower premium. The choice of length of comparison is left to the customer and/or adviser on what is best for the customer.[6]

Table 1 Premiums for Term, TPD and IP

The Devil is in the Details

We start the analysis by using product scores. Table 2 shows an abridged version of product information from IRESS. Column 3 provides the general score which is composed of core and supplementary scores. Again, core score is the overall score for core product features while the supplementary score corresponds to the supplementary features (as described in Figure 2 above). The table also provides premium instalments and cumulative premiums until age 65. As alluded to earlier, capturing multi-year premiums is important because of the prevalence of entry discounts for several insurers and variation or premium rate curves between insurers. In a comprehensive version of the table, there would be more insurers and all their different products with the corresponding general scores, premiums, and cumulative premiums. The table shows four products offered for this proposed insured.

Table 2 Sample IRESS Premium Estimate

The general score is the input to OR. For the purposes of this analysis, OR is equal to the core score plus 50% of the supplementary score. Combining the two scores simplifies the analysis with 50% as a rough estimate of how supplementary scores impact the overall rating.[7] OR should be considered as the total benefit or value that a customer can get out of the product.

On the other hand, cumulative premium to age 65 is the key input to POI.[8] However, for our purposes, we will define POI to be cumulative premium over ten years and this value is divided by $1,000 (This just aims to make results more comparable). POI can be the first-year premium, sum of the premiums for 5/10/20 years or it can even be the present value over a specific period to account for timing differences in each life insurer’s premium rate curve.

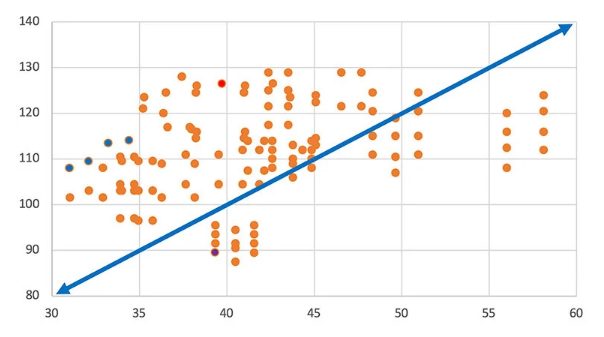

CV/D uses the product score and premium analysis matrix. Figure 3 illustrates the different term, TPD and IP packages available in the market for the selected sum insureds in Table 2. On the Y axis is the OR and on the x-axis is the POI. The line is the equilibrium line—an arbitrary line that divides the chart into two equal triangles. The objective is to separate the products such that products above the line are high value products with reasonable premium and products below are products to avoid. To illustrate what this means, consider the red dot above the line and the purple dot below. The red dot has OR of 126.5 and POI of 39.73 which translates to 3.182 CV/D. (One can think of 3.18 as the “number of benefits” that a customer gets for every $1,000 of premium paid over 10 years.) The purple dot on the other hand with an OR of 89.5 and 39.4 POI has CV/D of 2.27 Based on this analysis, the product represented by the red dot should be recommended over the purple dot. However, there are still a lot of dots above the equilibrium to choose from. Which are the top choices?

Figure 3 Customer Value/Dollar Equilibrium Chart

The final input required is the insured’s capacity to pay. Younger customers or those that just started a family might afford products within the $30K–$35K POI range, while a more mature family might afford products in the $45K–$50K POI range. For proposed insureds in the $30K–$35K POI capacity to pay, the top choices would be the upper blue dots. Calculating the CV/D for each, the third dot has a 4.10 CV/D. Note that although this product has a higher CV/D than the red dot product, the latter has way more overall customer value.

CV/D makes the product selection process very convenient and at the same time puts the customer choice front and centre. The choice now boils down to the customer’s capacity to pay as the key driver to select a product.

Why is the CV/D concept beneficial?

The key benefits of CV/D are that it (1) provides transparency for both customers and advisers, (2) addresses customer affordability issues and (3) allows the expansion of the product portfolio with simplified or entry products.

The main benefit of CV/D is increased transparency between customers and advisers. It gives a clear picture of all possible products available in the market and where they are positioned in the equilibrium chart. The customer is then provided a straightforward set of recommendations from the adviser based on his/her capacity to pay and the customer value per dollar he/she will be paying. The final choice will then be truly the customer’s. As a result, the adviser would have more confidence in his recommendation which could expedite the advisory process leading to decreased number of meetings with each customer.

In the process of recommending the best product to customers, the cover amount sometimes tend to reduce or be lower than what customer would have desired because having cover for the desired amount is unaffordable. CV/D can help with affordability issues in relation to purchasing a new policy or retaining an existing one.[9] The equilibrium chart provides a wide range of product choices. The financial adviser then aligns this with the customer’s capacity to pay and makes a recommendation based on the desired amount. This can be done when the customer is being set up for a new policy. This is particularly helpful for customers in the low-income segment who have a smaller budget for insurance.

Insurers have developed entry products with the objective of providing a cheaper option, e.g., cancer -only trauma products. However, best interest duty seems to create a barrier for these products to be recommended because the justification for their recommendation does not seem to have a strong basis. CV/D provides a sound rationale for justifying why these entry products can be reasonable recommendations if they are above the equilibrium line. This, can in turn, encourages insurers to create simplified retail product options to those who have affordability issues or for cases where insurers are targeting a low-income group to provide affordable, relevant coverage.[10]

Insurers change products from time to time. Old products may not be available and so goes for their product rating. Research houses may have changed their processes and/or criteria for product rating. It is understood that this can be a challenge for existing products that have closed to new business.

What can be done better and what’s the way Forward with CV/D?

If we review the formula, there is too much dependence on the use of product scoring that any imperfection can distort the CV/D results. The good thing that research companies do is that they have constant discussions and clarifications with insurers on product scoring criteria and benchmarks, and they listen to feedback consistently.

There might be too much focus on the CV/D result that the recommended product is not what the customer wants. As a theoretical example, take a young person with no history of cancer, who is not after a cancer cover. Based on the CV/D results, a three-event trauma cover (covers for coronary artery bypass surgery, heart attack and stroke) has a higher CV/D result and is in the affordability range. It is important not to lose sight of what the customer wants.

Other life insurance products are available through group insurance or direct to customer channels. These other channels don’t have OR (product rating) that is available at this stage. However, if OR is made available, it can be easily extended. In fact, CV/D can be applied to any product available if a rating is available (even for your car, air conditioning, television, laptop, etc). CV/D analysis hopes to contribute to a more customer-centric transparent and expedited recommendation process for advisers. Additionally, we hope to see more simplified and affordable products be developed by insurers.

The CV/D concept at this stage is theoretical, having not been tested, but one can see its benefits. As mentioned earlier, the concept is flexible in that there can be different inputs for OR and POI which can be customised on what is available to its users. It is expected that this analysis will be a supplementary tool not only to advisers but to customers as well.

Statements of fact and opinions expressed herein are those of the individual authors and are not necessarily those of the Actuaries Institute, the editors, or the respective authors’ employers.

References

[1] Future of Financial Advice: Best interests duty and related obligations (asic.gov.au)

[2] AFSL Fundamentals: Approved Product Lists — Assured Support

[3] XY Podcast. “The New Normal for Income Protection.”

[4] Product Score is a scoring system that research companies use to rate products based on its features where more generous features are given higher product score and vice-versa. Each research company has their unique scoring system.

[5] Other research companies have different labels. LifeRisk Online for instance uses “product research score.”

[6] One thing that might affect this is APRA’s pending introduction of renewability of contract which is expected to take effect later this year. This is not discussed in this paper.

[7] This is based on IRESS classification. There are other comparators in the market and a different figure can be assigned.

[8] For the purposes of analysis here, sum insured indexation was disregarded for simplicity. Sum insured indexation can have an effect on the recommendation, depending on the rate curve of the product and length of premium paying period used for POI.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.