A Century of Australian Government Actuaries

A fascinating story, chronicling a century of the Australian Government Actuary (AGA), has been meticulously compiled by the current Australian Government Actuary, Guy Thorburn.

His book, A Century of Australian Government Actuaries, is not just a historical account; it’s a testament to the enduring role of actuaries in helping shape the nation’s policies and societal framework.

Before we explore the book, a bit about the author. Guy Thorburn, who has been the Australian Government Actuary since 2017, brings a wealth of diverse experiences to the table. His journey began at Colonial Mutual, where he worked in life insurance, general insurance, banking, and superannuation. His career path then led him to Mercer, allowing him to further his life insurance and superannuation experience, whilst providing broader exposure to the energy sector and international developments in superannuation. This broad spectrum of experiences has been invaluable for his work as the AGA as well as in his role of Reviewing Actuary to the National Disability Insurance Scheme (NDIS) and the Australian Reinsurance Pool Corporation.

The Genesis of the Book

Guy’s journey to authorship began with a blend of curiosity and serendipity; “I was always aware that I was the tenth AGA and had been curious about what the last nine actually got up to”. The “spark” was ignited in 2017 when he received a call from John Balmford, son of the second Commonwealth Actuary, Walter Balmford.

This call led to Guy receiving some of Walter’s books and notes, which turned out to be a fascinating account of his experiences as a WWI pilot, working at the Government Actuary’s Department in the UK, then as the Commonwealth Actuary in Australia. His story is now published as a memoir, Three Score Years and Twenty. The documents provided a treasure trove of information, inspiring Guy to delve deeper into the history of his predecessors.

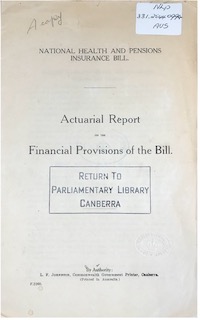

Compiling a century’s worth of history was no small feat. Guy embarked on a research process, scouring the National Library for parliamentary documents, newspapers, and other materials. He faced challenges, particularly around the 1970s, where he “hit a bit of a blank” as published material dried up in that period. However, reaching out to retired actuaries provided him with valuable insights and personal recollections over many interesting phone calls and emails, filling in the gaps of this rich history.

Significant Milestones and Evolution of the AGA

Guy’s book highlights several key milestones in the AGA’s history, from its establishment in 1924 to the recent introduction of the cyclone reinsurance pool in 2023. The role of the AGA has evolved significantly over the past century, starting with a focus on population statistics and expanding to include prudential supervision of insurance and supporting government schemes like the NDIS.

Some of the many significant moments that Guy points to in the history of the Australian Government Actuary include:

- The first Life Insurance Act in 1945: This established a legislative basis for regulating life insurance and provided the Commonwealth Actuary with a prudential regulatory role, that lasted until Sid Caffin’s retirement in 1978.

- Establishment of the Medical Indemnity Insurance Schemes in 2002: After the collapse of Australia’s largest medical indemnity provider, United Medical Protection, this scheme allowed doctors to continue helping all Australians.

- Establishment of the terrorism reinsurance pool in 2011: After the September 11 terror attack, terrorism reinsurance was withdrawn around the world. For Guy, the establishment of the pool is yet another example of the AGA supporting insurance in response to market failure.

Technological advancements and actuarial practice

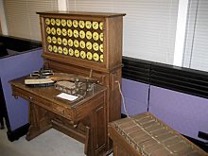

When asked how technology has transformed actuarial work, Guy uses the National Insurance Scheme as an example. Actuarial costings were completed in the 1930s

and included a 40-year actuarial projection. “Completing those calculations manually must have been a tedious task in the 1930s.”

Since then, the volume of data and the tools with which to interrogate that data have changed significantly over the last few decades. “This has allowed us to find new insights at more detailed levels than in the past,” says Guy. “Today, when we project the social security system, we undertake a detailed population projection of the expected social security utilisation of each individual, supported by a microsimulation using models developed by neural networks. That’s a massive step change from the work that was done in the 1930s.”

However, while the technology may have changed, some recurring issues remain. In writing A Century of Australian Government Actuaries, Guy says,

“my biggest surprise was seeing how enduring some issues are…A problem that is not acted upon is not solved; it seems to just re-emerge later in a slightly new guise.”

Accident compensation is one example. The Whitlam Government of the 1970s had a strong commitment to establishing something like the NZ Accident Compensation Commission but, despite much work, the scheme did not progress. About 40 years later, the underlying issues were revisited with the recommendation to implement the National Injury Insurance Scheme.

Advice for Aspiring Actuaries

For those interested in entering the field, particularly in government, Guy emphasises the importance of applying actuarial skills to new and different problems from first principles. “Don’t just learn how to replicate existing processes. Understand the underlying principles and techniques,” he says.

In addition, he stresses the need to understand the implications of actuarial advice, “especially in government service where that advice can impact everyone. Understand the implications of your advice and be prepared to explain the reasoning behind it.”

Humility also has a role to play. “Significant new programs are always going to be a team effort in which everyone both across the public service, elected representatives and even the public, play a role.”

Despite this, A Century of Australian Government Actuaries is proof of how actuaries at the AGA have contributed to helping Australia over the past century.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.