I am an Actuary: April Edition

In the latest edition of ‘I am an Actuary’ we speak to four actuaries whose journey spans from pragmatic beginnings to self-taught innovation, strategic shifts and familial influence turned passion, to get their perspectives on the ever-evolving landscape of actuarial excellence.

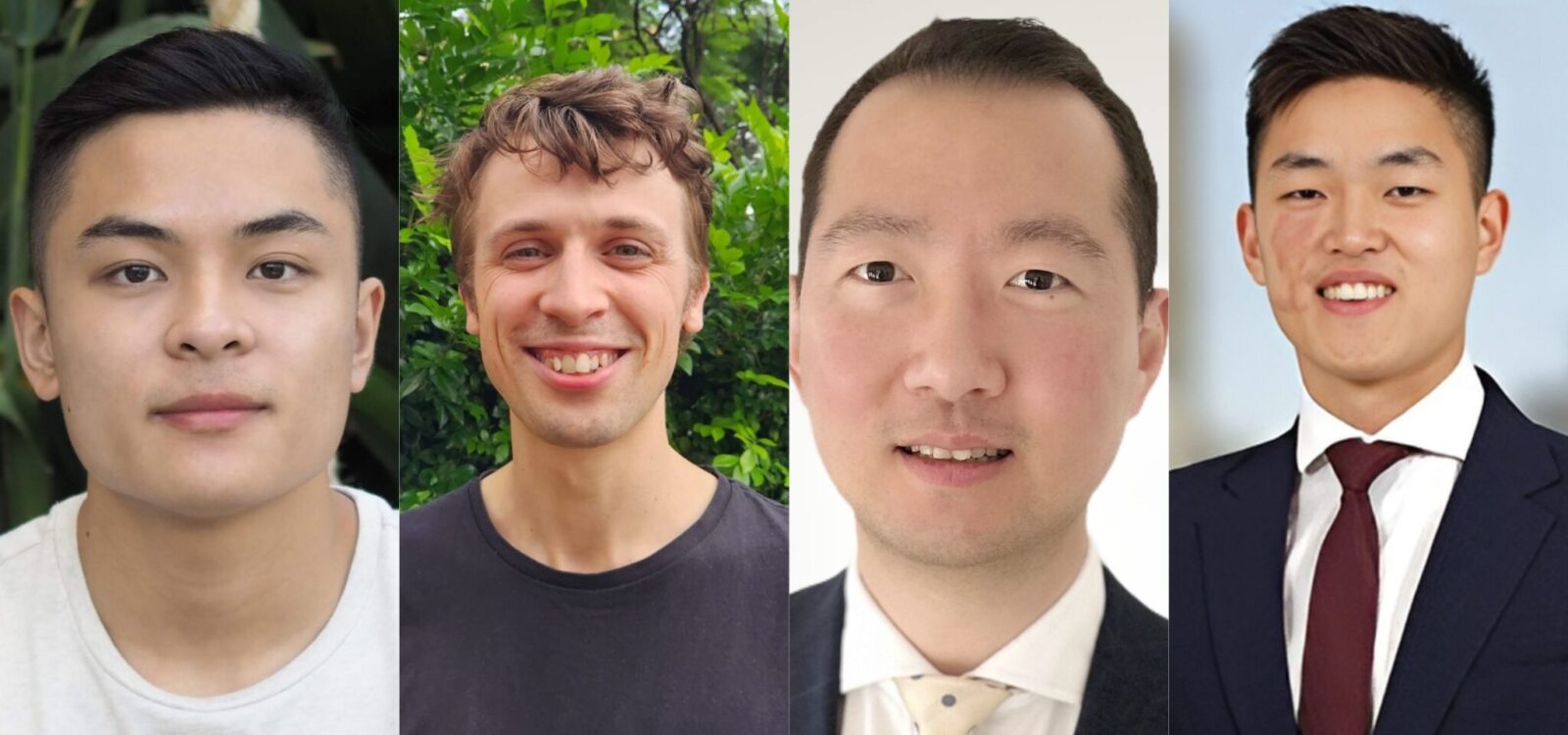

Andy Nguyen

Andy Nguyen

My journey into becoming an Actuary began with a practical consideration: economic stability.

As a high school student navigating the complex landscape of career options and having recently learnt in economics about the correlation between recessions and unemployment rates, the potential volatility of the job market was a concern. After a Google search for “the most stable jobs during an economic downturn”, I was taken down a path that converged my interest in mathematics and economics – the actuarial profession.

I studied at UNSW and completed my bachelor’s degree in Actuarial Studies and Economics. After graduating, I secured my first actuarial job at IAG and immersed myself in diverse teams like Natural Perils Technical Pricing, Commercial Insurance Pricing, and CTP Reserving and Pricing. These experiences laid the foundation for my actuarial growth, solidifying my technical skills and knowledge in valuations, pricing, capital, and reinsurance.

Juggling studying while working full-time presented a challenging yet rewarding journey for me as this balancing act required dedication and perseverance, but the practical experience I gained within the industry proved invaluable, particularly in the exams. After a few years at IAG, I sought a new challenge and joined a consulting firm.

Today, I am a manager within the General Insurance Team at EY. My day-to-day presents me with an array of projects, each requiring me to analyse client issues from various perspectives.

Recently, I’ve delved deeper into capital management, focusing on areas such as governance, capital adequacy, recovery plans, and scenario testing. This exciting area allows me to contribute to the critical role actuaries play in strengthening insurer capital management.

If I were to sum up my actuarial journey, I would say it has been a continuous pursuit of knowledge and professional growth. While the journey demands dedication and hard work, the satisfaction of utilising my expertise to make a positive impact is truly rewarding.

Daniel van de Vorstenbosch

Daniel van de Vorstenbosch

I am an Actuary. I am the Numbers Guy, the Analytics Guy, the Innovation and Ideas Guy. I am also the Doesn’t Get Follow Up Questions When Asked About His Job Guy. After all the effort put into our studies, it’s a cruel injustice that no one wants to learn about risk assessment at parties.

My pathway into the profession was less prestigious than many of my peers. My university mindset was “Ps get degrees” and I spent my uni days focused on student groups and wooing my now-wife. Ps got me degrees but didn’t get me an actuarial job; my corporate career began as an underwriter for two years and a non-actuarial analyst for another two.

In this time, I’d begun sitting exams, essentially starting from scratch. More importantly, I taught myself VBA, R and SQL to automate my processes. After automating myself down to a part-time job and completing some exams I gained actuarial employment four years after graduation.

On the back of my newly developed coding skills, four years ago I started actuarial work at TAL, finding joy in their Experience Investigation and Group Pricing departments – setting assumptions for valuation and pricing purposes.

Being an actuarial code monkey is incredible: a developer can undertake ambitious projects at an even faster pace than in Excel, which allows them to cycle through projects, rapidly learning and growing to unexpected heights along the way – new contexts, models, languages, and algorithms.

This is the essence of being an Actuary: being the Learning Guy.

Jason Yu

Jason Yu

My journey into the world of actuarial science began with a simple statement during an early high school career advisory session: “I really enjoy problem-solving.”

Little did I know that this would set the course for a career marked by a fervent dedication to leveraging data-driven insights to navigate complex challenges.

Over the past decade, I’ve amassed a wealth of experience and knowledge in Pricing, Data Analytics and, most recently, Risk Management.

As a business leader, I’ve cultivated a reputation for simplifying the most intricate of problems. With each challenge encountered, I honed my skillsets to empower risk-based decision-making through data-driven insights.

My decision to venture outside of traditional pricing stemmed from my interest in the strategic operations of a company. The move into risk management provided me with the opportunity to be part of a senior leadership team, influencing and driving the strategic goals and needs of the company. The transition wouldn’t have been possible without the years of volunteering with the Institute’s Risk Management Education Faculty and Risk Management Practice Committee.

Today, as an Actuary, I find myself at the intersection of traditional versus non-traditional paths, navigating the complexities of traditional industries with forward-thinking risk views.

My ability to view challenges through the lens of different stakeholders enables me to bridge the gap between emerging risks and practical implementation, ensuring that I influence and drive a positive risk culture across the teams. With each passing day, I am always reminded of the power of problem-solving and the transformative impact of data-driven insights.

Justin Han

Justin Han

Born into a family where both parents were already entrenched in the world of numbers and equations, it seemed almost inevitable that I would follow in the footsteps of my predecessors. Further, with an older brother already carving his path as an Actuary, the path ahead seemed laid out and easy to follow.

So, my venture into the realm of actuarial science began, initially, more out of familial influence than personal conviction.

However, what started as a family tradition soon became a genuine passion. Delving into the intricate web of actuarial studies, I discovered a profound fascination for the mathematical underpinnings of Part 1s. The challenge of solving equations that had more Greek letters than numbers ignited a spark within me, transforming what initially seemed like a predetermined career choice into a fulfilling journey of intellectual exploration!

Fast forward to today, I have proudly attained the title of Fellow and am working primarily in the general insurance space within Deloitte.

Here, the fast-paced nature of consulting fuels my passion for problem-solving, pushing me to continually innovate and adapt. Each day brings new opportunities to apply my actuarial expertise in diverse contexts, from performing liability valuation work to large-scale remediations for recent ASIC issues.

My journey as an Actuary may have started for the wrong reasons but, now, I am excited to be here to make an impact. I look forward to the future of the profession and how we can harness the exponential developments in technology and its uses in the industry.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.