Communicating Investment Risks to Boards and Trustees

In October I presented to the iPARM Australia 2014 (Investment Performance, Attribution & Risk Management) Forum in Sydney. The focus of the conference was predominantly on how best to coax extra return out of a portfolio, measure and attribute investment performance and manage investment risks.

My experience and research with managing risk on an enterprise wide level has led me to believe that the best investment research and analysis fails to be effective if the communication of those risks is not accurate and effective in itself. Good enterprise risk management (ERM) involves understanding what are the risks and their interactions that are most important; and communicating those risks effectively.

The best investment research and analysis fails to be effective if the communication of those risks is not accurate and effective in itself.

Investment risk discussions are often dominated by asset volatility. This squeezes out wider discussion on what are the most important investment risks from a non investment professional perspective. It also misses the point that the purpose of any investment strategy is to achieve the investor’s goals, and the key risks from an investor’s perspective revolve around the goals, not the strategy.

How can we better communicate the investment risks, particularly in relation to goal achievement, so the people making strategic investment decisions can make better decisions appropriate to their investors’ circumstances?

WHAT DO WE MEAN BY INVESTMENT RISK?

I have made a wide interpretation of investment risk. It is the risk that the outcomes of an investment strategy and its execution do not meet the goals of the investor, or the person (e.g. member) on whose behalf the investments are being made.

Investment risk – the risk that the outcomes of an investment strategy and its execution do not meet the goals of the investor.

The start and key focus must be on the goals of the investor – not on the goals of the fund manager. So the assessment of risk must revolve around that. The goals the investor requires from an investment must be clear. An investor’s financial goals are not solely driven by investments – e.g. rate of contribution and time to retirement. It also requires the degree to which risk can be taken in striving for those goals to be just as clear. E.g. what time period is relevant? Is the risk that over the relevant time there is a return that is negative, less than cash, or less than wages growth or inflation plus 3%? In other words the risk appetite of the investor must be clear – clearly stated and clearly communicated. This requires two way communication:

- The risk appetite of the investor must be clear to those setting and implementing the investment strategy.

- The ‘risk’ implications of a fund manager’s strategy should be clear to the investor, so they can determine if it will help meet their goal.

WHAT IS EFFECTIVE COMMUNICATION?

Effective communication means being successful in getting the message across – it must be heard, understood and believed by the receiver. Effective includes knowing the message is understood and has been taken on board to make better decisions and achieve more appropriate and better outcomes.

Effective communication means being successful in getting the message across – it must be heard, understood and believed by the receiver.

INVESTMENT RISKS – WHICH MATTER MOST?

I’ve identified my top 10 investment risks – split into those strategically / indirectly related to the underlying investments and those directly related. The former are to my mind generally more important. All 10 are factors that affect the risk of failing to achieve the investor’s goals.

Table 1: Top 10 investment risks

| Strategic/Indirect | Direct | |

| 1 |

Failure to understand investor’s risk appetite |

Asset allocation |

| 2 | Matching risk | Market risk |

| 3 | Inflation | Stock selection |

| 4 | Operational risk | Fund manager selection |

| 5 | Liquidity | Credit risk |

The relative importance of each investment risk will vary from fund to fund with the size and nature of the fund and the environment in which it operates. Most importantly, it will vary with, and should be driven by, the ultimate investor/member’s unique position. Many of the top 10 risks are interrelated. Understanding their relativities and their aggregation is important.

From a communication perspective, communicating even one investment risk can be a challenge. Yet if you are not communicating effectively the contribution of each of these risks to the overall risk of your clients not achieving their goal, you are failing your client. Good decisions require relevant, sufficient quality information. This information goes beyond pure investment data.

One answer is to prioritise the investment risks and bring out the overlaps in discussions with the Board Trustees / investor. Concentrate on the fundamentals

- what risks are most important to the combination of your investor’s:

- particular circumstances;

- investment goal;

- time period for that goal;

- risk appetite?

Taking Table 1 as our indicator of priority, and the strategic / indirect risks as being more important to the setting of an investment strategy, consider how to communicate these for say a superannuation fund.

STRATEGIC / INDIRECT

- Failure to understand investor’s risk appetite1

Before illustrating communication around risk appetite I’ll highlight an important fundamental around risk from a non sophisticated or disinterested investor/ member. As Howard Marks2 has noted most people mean “the probability of loss” when they refer to risk. In communicating with them on investment risk and investment risk appetite, keep the concept simple – how much capital are they prepared to lose or what’s the minimum return that is acceptable to them, while potentially making or not making extra returns.

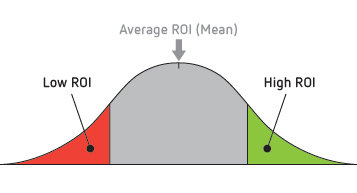

This requires firstly that the investor or fund is helped to express their risk appetite. This two way meeting of minds could be achieved by the investor or fund (for a given demographic/population segment and risk tolerance level) being provided with graphs illustrating a distribution of returns which could then be clearly delineated by the investor as bands from unacceptable (too low), acceptable (in target range) and unnecessary (higher than high target). Figure 1 illustrates this as red, grey and green.

The risk appetite is determined by the investor as: (a) less than a stated investment return with an agreed low A% probability (the red zone) over the relevant investment time horizon, (b) a high B% probability that the investment return will be in the grey zone and (c) a low C% probability that the return will be in the green zone. A,B,C might be 10%, 85%, 5% respectively.

An important aspect of the communication around investment risk appetite is to communicate positively and not scare. Framing the question positively can in itself lead to a more informed dialogue and assessment which in turn should then lead to a better outcome3.

- Matching risk

In the big picture, the nature and timing / duration of the investment assets should match the needs (goal) of the investor (the future liabilities) being future retirement income streams at a level to preserve current lifestyle so a need to increase at future wage rates.

Communication of this risk can be achieved by scenarios illustrating ‘what ifs’ for demographic segments in the past and best estimate into the future.

- Inflation risk

Given the very long timescales in superannuation as people live longer– in the long term the biggest risk from a member prospective is that their savings fail to keep up with wages/lifestyle inflation.

Communicating this risk requires the illustration of past actual and future potential realistic scenarios showing how inflation erodes value over time and how e.g. growth investments have in the past at many times and might in the future return more of an inflation linked outcome, thus decreasing this investment risk.

- Operational risk

I identified poor execution of the investment strategy as part of my definition of investment risk. From the investor perspective there can be considerable operational risk – losses from failed processes, people and systems or from external events. Conflicts of interest, poor advice, inefficient, ineffective or costly investment administration systems and processes, poor governance and fraud all come to mind. When an investor pays higher fees than necessary, they are bearing relative losses from this investment risk. Less than optimal fees can make a huge difference to members’ retirement outcomes. This investment risk can be reduced by clarity and transparency on fees, and by setting fees in $ terms rather than as % of funds under management which rise disproportionately when as happens more often than not, asset values increase at greater rates than wages.

TAILOR TO YOUR TARGET AUDIENCE

Your communication strategy needs to be as tailored as your investment strategy. Within superannuation alone, the scale at a Trustee level is from a $200,000 SMSF to over $50bn for the largest public offer funds reflecting wide variety in scale and the nature of the fund or organisation.

Boards of directors are made up of people with a range of skills and expertise. You need to get your messages across to all of them not just the accountants or those with a finance background. You need to explain your investment and related risk messages in a way that relates to their organisation and its strategic intent so they can make appropriate decisions.

You will need to consider the level of investment risk awareness and expertise of the Trustees, investment committee members and senior management making investment recommendations, and how this communication of risk might be used to inform a fund’s members in their myriad of circumstances.

Is the message different for not for profits e.g. charitable trusts, profit for members such as industry super funds or shareholder for profit institutions? Yes, if these organisations have a different level of risk appetite, reflecting their capital reserves and degree of conservatism and prudence, which might be accentuated by different levels of skills and numeracy.

REGULATORY REQUIREMENTS

In superannuation APRA‘s introduction of Superannuation Prudential Standard SPS 530 Investment Governance outlines prudent practices in relation to corresponding investment risk management arrangements with sections on investment risk management and stress testing. It focuses on a narrower definition of investment risk than I have – it defines investment risk in superannuation as the risk of an RSE (Registrable Superannuation Entity) licensee failing to meet its investment objectives due to adverse or inadequate investment performance. APRA expects assessment of the investment risks that might arise from factors such as:

Table 2: APRA identified investment risk factors

| Investment Risk Factor (SPG 530 #128) | |

| (a) volatility | (e) tail risk |

| (b) maximum drawdown | (f) correlation risk |

| (c) sequencing risk | (g) liquidity risk |

| (d) inflation risk | |

WHAT TO COMMUNICATE

So what do you need to communicate to your client / investor?

Firstly that you understand their specific circumstances, time frames, goals and risk appetite. Interface with this, information and discussion that helps them understand their unique investment risk appetite and its related tolerance for losses or return shortfalls.

Consider which risks matter most to them and why. Explain the implications of risk versus return trade-off for them. A key part of this is communication of historical and potential future price volatility and variability of returns by asset class and by investment option. Helpful quantitative measures to show are:

- the standard deviation of returns by asset class and investment option, and

- the Sharpe Ratio value which measures risk adjusted return defined as actual return in excess of the risk free rate of return divided by the standard deviation of returns.

Be clear on costs charged for specific investment management and related reporting services.

HOW YOU SAY IT

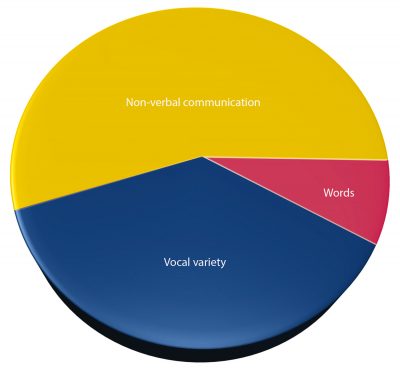

We’ve all heard that what we say is just a small part of effective communication. That is the ‘7 38 55 rule’ illustrated in Figure 2. It’s partly true and partly a myth. Mehrabian has been a pioneer in understanding communications for decades. His research on understanding body language and non- verbal communications found that only 7% of message pertaining to feelings and attitudes is in the words that are spoken, 38% in the way that the words are said, and 55% in facial expression. But Mehrabian himself stressed it only applies when there is inconsistency between the content, tone and body language – at which point our “like / don’t like” takes control.

So what you say is extremely important and the greater clarity here the better as you need that as the foundation for understanding and trust. How you say it is also very important and needs to be consistent with what you say. Finally to gain trust, and have your message accepted, you must believe in what you have communicated so that there is consistency in the message, delivery and interaction.

HOW TO COMMUNICATE WITH BOARDS ON INVESTMENT RISKS

Successful communicating with a Board is primarily about developing a trusted adviser relationship. This means tailoring your information and advice to the organisation starting with an understanding of its vision, mission and its strategic objectives, and what drives the organisation. Tailor your communication to each of the individual Board members recognising that each has a different set of skills and experience and only one or two at most will have the depth of investment knowledge you have.

Keep explanations simple, clear, relevant and be consistent over time. Set reasonable expectations for what can be communicated in the limited amounts of time Board members have to read Board papers and interact with you at Board and committee meetings.

Communicating matters on risk is always a challenge as risk means uncertainty and ambiguity4 not indisputable facts. With investment risk these probabilities are quantitatively around distributions of investment return outcomes over time and qualitatively around people’s comfort with understanding their current position, goals and needs, and their likely future behaviour as events emerge, particularly their reaction to losses. So that the best decisions can be made.

Scenarios past and future including stress testing and reverse stress testing are excellent ways of communicating. Encourage an interactive discussion on those to draw out the areas needing extra explanation.

Given the variety of backgrounds on a Board some communication is more akin to education but no less important. Share examples of good practice you’ve observed or know work from other Boards’ experience. Draw analogies to non investment risk where you can – e.g. car insurance, life insurance, betting – where the people you are communicating with already have a base understanding of risk and uncertainty.

Keep it relatively simple means using pictures and colour rather than words, or to supplement words, where possible. Graphs which deal with a limited number of variables, ideally 2 but 3 at most at a time, help a lot. Put a lot of your time into deciding how best to get your core message(s) across and be ready with the why and how answers.

CONCLUSIONS AND RECOMMENDATIONS

|

1 Start by assisting the Board/investor to clarify and understand their investment goal(s) and risk appetite. |

|

2 Communication of investment risk is as important as identifying and managing it. |

|

3 Pay extra attention to the strategic / indirect risks and in doing so show how control over the ‘direct’ risks by the investment manager contains risk within appetite. |

|

4 Tailor to your audience remembering a Board will have a range of numerate and not naturally numerate members. |

|

5 Use pictures and words, analogies from familiar household risk and insurance, scenarios past and future and interact in discussion where possible. |

|

6 Put the necessary communication preparation time in to maximise the effective use of Board members’ limited time. |

Thanks to John Reid for his input and support for this article. All errors are mine.

Successful communicating with a Board is primarily about developing a trusted adviser relationship. This means tailoring your information and advice to the organisation.

1See John Reid’s presentation at Risk Insights Session on ‘Superannuation – Risk Culture and Risky Communication’– Melbourne 24 July 2014

2Howard Marks on Risk and How to Handle It Today – Cuffelinks June 2013

3Applying the techniques of Nobel Laureate in Economics Daniel Kahneman author of Thinking Fast and Slow.

4See Risk insights discussion in Sydney on 16 September 2014 ‘Understanding and Communicating the Uncertainty and Ambiguity of Risk’ and forthcoming discussion in Melbourne on 4 December 2014.

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.