9 things I learned after becoming an actuary

Actuaries Digital Editor Kirsten Flynn reflects on nine things she’s discovered since starting her actuarial career.

I was recently asked to give a presentation to high school students on actuarial career opportunities. To prepare for this, I thought about what I knew about actuaries then and what I know now (eight or so years later).

Here are nine things I’ve discovered since starting my actuarial career:

- There is nothing more irritating than finding a hard-coded number where it doesn’t belong

Just thinking about hard-coded numbers makes my blood boil! Who hasn’t spent hours tracing back through twenty or more spreadsheets to work out how a number was calculated only to find a part of the calculation was hard-coded with no explanation?

- Actuaries do much more than insurance

I’ve been guilty of spreading this misnomer as I used to explain what an Actuary is by giving examples of the work I did in life insurance. When speaking to students I still use examples but extend these to include non-traditional fields like banking, environment, health and investment.

- People don’t understand what an Actuary does (no matter how many times you explain it)

If you asked 10 different people what an Actuary does, you’d probably get 10 different answers (one of which would be “an actor”)! To be fair, how can you expect someone else to explain what you do if you can’t really explain it yourself?

- Words are just as (if not) more important than numbers

There is a big misperception that actuaries are simply number crunchers. But the truth is, if you can’t use words to explain why the numbers matter, they won’t matter. In my opinion, communication skills are just as important as technical skills for actuaries!

- Actuaries are always wrong (and openly admit it)

Actuaries are commonly required to make assumptions about the future. But no-one can really know the future with certainty. The only thing that seems certain is that our assumptions will be wrong. And Actuaries make sure you know this! How often have you heard an Actuary use phrases like “past performance is not a reliable indicator of future performance” or “deviations are normal and are to be expected”?

- You never stop learning (though you may stop studying)

Many recently qualified Actuaries will tell you they have no plans to study ever again (the pain of sitting exams is too fresh). But as the world continues to change and our personal and professional lives develop, we will continue to learn. And you may even enjoy it! Last year I took Spanish classes and learnt to Salsa (I had to do something with all the free time I acquired post qualification).

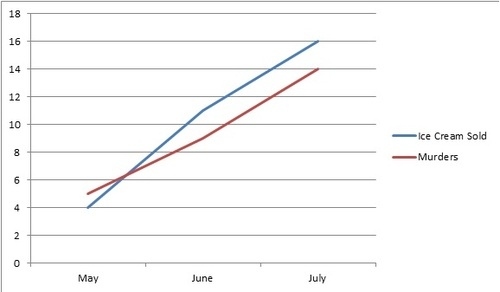

- Correlation does not imply causation

Does ice cream consumption lead to murder? Probably not. The two might be correlated (see this Buzzfeed article) but this does not mean one causes the other.

The lesson here? You always have to apply judgement when you’re analysing data and results.

- Being an Actuary doesn’t make you good at poker

I’ve observed a high correlation between being an Actuary and being good at poker. But this does not mean being an Actuary makes you good at poker. I learnt this the hard way. This is a perfect example of correlation vs. causation.

- I love being an Actuary

And I’m not the only one – ‘Actuary’ was rated the number 1 job in a survey from a US job-search site in 2015!

CPD: Actuaries Institute Members can claim two CPD points for every hour of reading articles on Actuaries Digital.